Who’s Affected?

- Progressive motorcycle and RV insurance policy holders

- Progressive Florida motorcycle insurance and RV policyholders may see a slight increase in premium on their current policies. While some may see an increase, others premiums may stay the same.

What’s Happening?

- Motorcycle and RV insurance Rates are Increasing.

- Progressive insurance is always ensuring the best products, with competitive pricing. With the economy the way it is now, Progressive must adjust their insurance rates like many other companies.

When Is the Change Happening?

- The rate change became effective April 22, 2022 for new business customers.

- For customers that already have an active policy, or are in the middle of their current term, the rate change became effective June 7, 2022.

What State Is this Happening In?

- Motorcycle and RV Insurance rates will be increasing in the State of Florida. But insurance companies are increasing their rates all over the country. So even if you don’t have Progressive motorcycle insurance in Florida, contact one of our agents now to see if you are affected.

Why Are Rates Increasing?

- Given the current state of the economy, insurance companies need to adjust their prices as well.

How Can You Still Keep Rates Low?

There are several things you can do to keep your insurance prices low and affordable.

- For Progressive Florida motorcycle Insurance policyholders and RV policyholders, safe drivers without accidents/tickets can save up to 37% on their insurance policies.

- Customer’s should consider bundling their policies with one insurance provider to get the bundle discounts.

- If considering purchasing an RV, customers who are the original owners can save an additional 20% on their RV policy.

- Policyholders can adjust their deductibles on their insurance policies, which will generally lead to cheaper insurance prices.

Why Should I Call You?

We are an insurance brokerage! Insurance brokers are here to help the insurance buyer, even though many people are unsure of the work they do.

They are your very own personal shoppers for insurance.

They know exactly what information to gather from you when it comes to finding the best car insurance or homeowners policy.

A broker can compare the benefits and costs of multiple insurance policies and help you decide which insurance plan is best for you.

Insurance agents can work for a specific insurer and help clients find the right plan from those offered by that provider.

They can also work as independent insurance agents who deal with many different insurers so you can get the best deal possible. We save you time and we help you save money. What’s not to love?

Q1: What does Progressive motorcycle insurance in Florida cover?

A1: Progressive motorcycle insurance in Florida typically provides coverage for bodily injury and property damage liability, medical payments, uninsured/underinsured motorist coverage, comprehensive and collision coverage, as well as optional add-ons such as roadside assistance and accessories coverage.

Q2: How can I get a quote for Progressive motorcycle insurance in Florida?

A2: To get a quote for Progressive motorcycle insurance in Florida, you can contact us at 1.888.445.2793 or visit our website to request a free quote online. Our experienced agents will assist you in finding the right coverage at competitive rates.

Q3: Are there any discounts available for Progressive motorcycle insurance in Florida?

A3: Yes, Progressive often offers discounts for motorcycle insurance in Florida. These discounts may include safe driver discounts, multi-policy discounts, and discounts for completing a motorcycle safety course. Contact us to explore available discounts and save on your motorcycle insurance.

Q4: Is Progressive a good choice for motorcycle insurance in Florida?

A4: Progressive is a reputable choice for motorcycle insurance in Florida. With a range of coverage options and potential discounts, they can provide quality protection for your motorcycle. Contact us to discuss whether Progressive is the right fit for your specific needs.

What We Do at A Plus Insurance

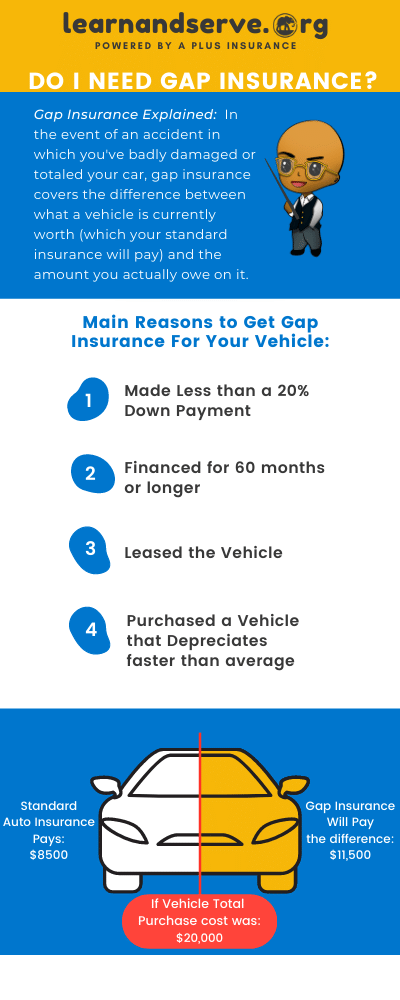

Gap Insurance Explained

gap insurance Cheat Sheet: 7 Frequently Asked Questions Answered Now! Cheat Sheet: Get Your Free…

15 Ways a DUI Will Cost You BIG Time

Hail damage car

Does “Hail Damage Car Insurance” Exist? Talk to a Live Agent Get Quote Via Text…

Last Updated on by Marlon Moss