- Arizona Insurance: Finding the Most Affordable Rates

- How Tickets/Violations will impact Insurance rates in Arizona

- Most Affordable Liability Only Arizona Insurance

- Coverage Options for Arizona Insurance

- Least Expensive Full Coverage Rates for Arizona Auto Insurance

- How much does SR-22 Insurance cost in Arizona? And is it affordable?

- Arizona Insurance – What is SR-22 Insurance?

- Arizona Insurance – Least Expensive Insurance Rates For Young Arizona Drivers

- Best Arizona Car Rates With a Bundle/Homeowners Discount

- How much is Renters Insurance in Arizona?

- Cheapest Arizona Auto Insurance Rates

- With Bad or Poor Credit

- Affordable Arizona Auto Insurance Rates

- With DUIs, Accidents, and Violations

- Average cost for Car Insurance in Arizona cities

- Least Expensive Arizona Auto Insurance Rates for Male Drivers

- Frequently Asked Questions about Arizona Insurance

- Comprehensive Guide to Arizona Insurance

New A Plus Insurance Customers in Arizona Save on Average $606…that’s almost 5420 Eggs

How Tickets/Violations will impact Insurance rates in Arizona

Not only are you responsible for paying the initial fine, if any, the result of a ticket or major violation will continue to impact your insurance rates for 3-5 years. How can you keep your Insurance cheap and affordable? Always practice safe driving, and consider taking a safety education course for additional insurance discounts.

| Violation | Average Insurance rate Annually After Violation | % Average Insurance Rate Increase | $ Insurance Rate Increase |

| DUI | $2,996 | %125 | $1701 |

| Reckless Driving | $2,314 | %75 | $955 |

| At Fault Accident | $1,879 | %50 | $689 |

| Hit and Run | $3,189 | %140 | $1,915 |

| Racing | $3,098 | %140 | $1,805 |

| Driving with Suspended License | $2195 | %60 | $798 |

Most Affordable Liability Only Arizona Insurance

In the search for the Cheapest Arizona Auto Insurance you may start with Liability Only. These minimum limits consist of $25,000 bodily injury liability per person and $50,000 per accident as well as $15,000 for property damage liability to others.

United, these coverages help pay for the injuries that you are responsible for, like vehicle repair, replacement, and the other person’s medical expenses (Up to the amount listed above as a minimum). If you do wish to have more than the state minimum, those limits are always available to you so that way you are not liable for out of pocket expenses for the other party involved.

Average Monthly Rates Liability Only

| Car Insurance Company | Average Monthly Payment |

|---|---|

| The General | $97 |

| Mendota | $100 |

| National General | $105 |

| 21st Century | $107 |

| Nationwide | $112 |

Coverage Options for Arizona Insurance

Auto Insurance in Arizona is very customizable, meaning not all policies will be the same. The be legal on Arizona roads, you must at least carry the State Minimum Required Liability limits which is $25,000 per person BI, up to $50,000 per accident BI, and $15,000 PD. Additional coverages that are offered by most insurance providers include:

Comprehensive

Collision

Loan/Lease Payoff

Medical Payments

Uninsured Motorist Bodily Injury Protection

Roadside Assistance

Rental Reimbursement

Least Expensive Full Coverage Rates for Arizona Auto Insurance

The Grand Canyon is older than the dinosaurs! And if your car is just as old as you, may only need the State Minimum liability insurance. But what if you cant afford to repair or replace your car after an accident?

Add Comprehensive and Collision insurance to cover the repairs! Though not mandatory for Arizona Insurance, it may just save you a big pay out. Typically with comprehensive and collision, you will have a deductible that you will have to pay, and the insurance company will pick up the rest of the Actual Cash Value of the Vehicle.

We also do have a company that will allow you to just add Comprehensive to your policy to help prevent against, wind, fire, hail and theft towards the vehicle. Even impact with an animal. This way you have some coverage, but not a full coverage policy and paying for the price.

Call us! An A Plus Agent will shop around for you and help any questions you might have.

Average Monthly Rates Full Coverage

| Car Insurance Company | Average Monthly Payment |

|---|---|

| Progressive | $138 |

| Travelers | $140 |

| Allstate | $145 |

| Nationwide | $146 |

| National General | $151 |

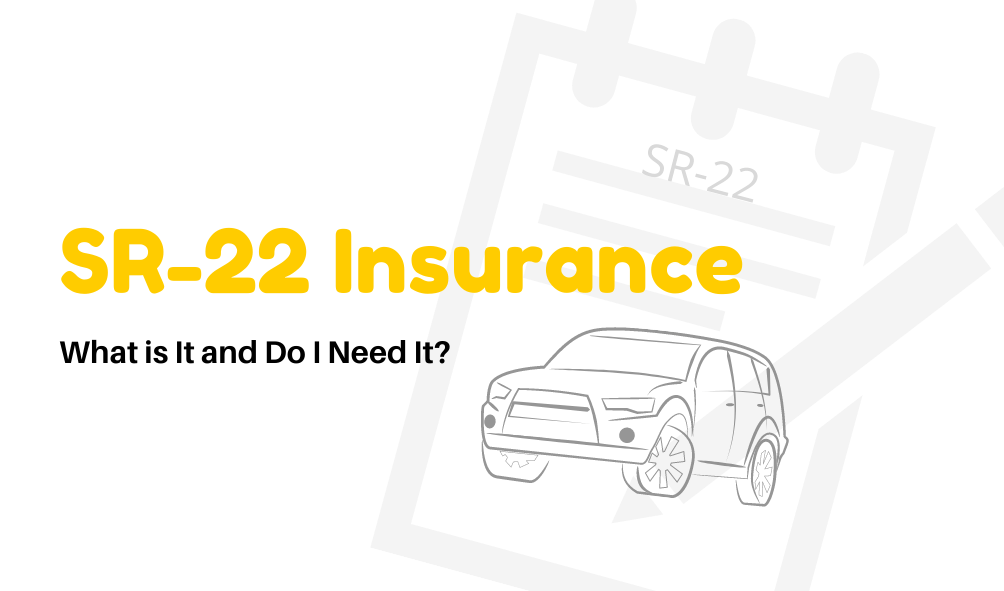

How much does SR-22 Insurance cost in Arizona? And is it affordable?

Arizona is the sunniest state in the country. Take that Florida! But it may not be so sunny when you have a serious moving violation against you. Make sure to follow up with the state to see how long you need this SR-22 filing for.

An SR-22 allows you to keep on the road after you’ve been convicted of a DUI, DWI, or another violation suspending your license. This will also be one of the items you will need prior to reinstating your license after a conviction. So if you need cheap SR-22 Insurance in Arizona, please fill free to reach out to us.

Please Note: An SR-22 is NOT insurance. It is an attachment that goes along with your auto insurance policy. It then gets sent to the state as proof that you are a responsible individual.

Average Monthly Rates with an SR-22

| Car Insurance Company | Average Monthly Payment |

|---|---|

| Mendota | $90 |

| National General | $91 |

| GEICO | $95 |

| Progressive | $99 |

| The General | $105 |

Arizona Insurance – What is SR-22 Insurance?

Have you been convicted of a major violation, such as reckless driving, or a DUI? The DMV may request that you obtain SR-22 Insurance. What is this? How can I get it? How much is it? These are all common questions you may be asking, at this confusing time.

Simply, SR-22 is an attachment that is added onto an insurance policy, which has at least the State Minimum Liability limits. The Insurance company will let the DMV know that you are carrying insurance, in order for you to get your license reinstated. Most Insurance companies charge a 1 time fee of $0-$25 for each term. However, come insurance companies do not offer SR-22 because the driver is considered ‘high risk’. Talk with one of our agents today for a free insurance quote, we do the shopping for you.

Arizona Insurance – Least Expensive Insurance Rates For Young Arizona Drivers

Inexperienced and weekend driving are key factors for an Insurance Company!

Teens are more likely than older drivers to not recognize or to underestimate dangerous situations on the road. More than half (52%) of car crashes happened on a Friday, Saturday or Sunday!

But don’t worry, we can find a rate that is affordable from our trusted brands here at A Plus Insurance!

Average Monthly Rates For Young Drivers

| Car Insurance Company | Average Monthly Payment |

|---|---|

| Dairyland | $133 |

| USAA | $145 |

| Progressive | $148 |

| Bristol West | $154 |

| American Family | $155 |

Best Arizona Car Rates With a Bundle/Homeowners Discount

Copper, cattle, cotton, citrus, and climate…the 5 C’s when bundled together make Arizona! Do you know what else you can bundle in Arizona?!

Your Arizona Insurance for Auto and Homeowners. In fact it could lead to savings on both.

Call A Plus Insurance whether you are soaking in the hot climate with a delicious citrus drink atop a soft cotton saddle while riding your cattle in the copper sunset. We can get an Arizona Insurance bundle that works for you!

Average Monthly Rates With a Bundle/Homeowners Discount

| Car Insurance Company | Average Monthly Payment |

|---|---|

| Mendota | $134 |

| Bristol West | $135 |

| Dairyland | $142 |

| GAINSCO | $146 |

| Nationwide | $146 |

How much is Renters Insurance in Arizona?

Not a homeowner yet? Consider bundling your auto policy with a renters insurance policy. Renters insurance is generally very inexpensive, and will cover your personal belongings. On average, most renters insurance policies will cost $10-$15/each month. When applying the bundle discount, the renters policy will also drop the cost of your auto insurance down, so you could end up paying only $5 extra each month for renters.

Cheapest Arizona Auto Insurance Rates

With Bad or Poor Credit

Some Insurance companies will reject an application if you have a poor credit score. You may be risky business for them.

Fear not, just like you can stand in four states at once in Arizona, we will scour multiple insurance companies with our trusted brands to find an affordable rate for you!

Average Monthly Rates Bad or Poor Credit

| Car Insurance Company | Average Monthly Payment |

|---|---|

| GEICO | $154 |

| AssuranceAmerica | $158 |

| The General | $160 |

| Dairyland | $165 |

| Bristol West | $168 |

Affordable Arizona Auto Insurance Rates

With DUIs, Accidents, and Violations

Arizona is a no-tolerance state for driving while intoxicated, meaning you can be arrested with a blood-alcohol content of less than the legal limit of 0.08 percent.

Violations like a DUI typically increase insurance rates because the carrier now views the driver as ‘riskier’. That does not mean you are out to dry in the Arizona sun, options exist at reasonable rates.

Average Monthly Rates With Violations on Your Record

| Car Insurance Company | Average Monthly Payment |

|---|---|

| National General | $155 |

| 21st Century | $156 |

| Bristol West | $157 |

| Mendota | $157 |

| Dairyland | $158 |

Average cost for Car Insurance in Arizona cities

Since Insurance prices vary based on your location, as well as several other factors, you will see different insurance prices depending on where yo live. Larger cities such as Phoenix area, and Glendale are heavily populated, which leads to a greater number of accidents, and claims in those particular areas. Insurance prices will be slightly higher in areas with a greater population of people. You can do your part to help keep insurance prices in Arizona low and affordable, by always carrying insurance, and practicing safe driving habits at all times.

| Rank | City | Avg. Annual Premium |

|---|---|---|

| 1 | Phoenix | $1,895 |

| 2 | Glendale | $1,769 |

| 3 | Tempe | $1,593 |

| 4 | Scottsdale | $1,585 |

| 5 | Mesa | $1,576 |

| 6 | Tucson | $1,520 |

Least Expensive Arizona Auto Insurance Rates for Male Drivers

Men are from Mars and the surface of Arizona is just as Hot! It is known statistically that male drivers pay more than their female counterparts. 8% more to be exact.

That may be out of this world, but your Arizona Insurance rates can be down to earth if you shop around.

Average Monthly Rates For Male Drivers

| Car Insurance Company | Average Monthly Payment |

|---|---|

| Nationwide | $155 |

| 21st Century | $157 |

| Progressive | $159 |

| Bristol West | $160 |

| Dairyland | $165 |

Frequently Asked Questions About Auto Insurance in Arizona

Frequently Asked Questions about Arizona Insurance

What types of insurance are available in Arizona?

In Arizona, we offer a range of insurance types including auto, home, life, and business insurance, each tailored to meet the unique needs and regulations of the state.

How do Arizona’s climate and location affect insurance needs?

Arizona’s unique climate and geographical factors, like its desert terrain and monsoon season, can influence insurance needs, particularly for home and auto insurance. Coverage for natural events is a key consideration.

Where can I get personalized insurance advice for my situation in Arizona?

For personalized insurance advice tailored to your specific needs in Arizona, please call us at 1.888.445.2793. Our experts will guide you through selecting the most suitable insurance options.

Who has the cheapest car insurance in Arizona?

Finding the cheapest car insurance in Arizona can vary depending on various factors such as your driving history, vehicle type, and coverage needs. To get the most accurate and personalized quote, please contact our team at 1.888.445.2793. We’ll help you find the most affordable car insurance options available.

Something good to know about Good drivers in Arizona– drivers without a recent at-fault accident can save 37% on their car insurance! But with this said, rates vary still depending on age, good or bad driving history, exact location of where you live in Arizona, Etc. The best way to know you’re getting the best policy for your property is to compare as many insures as possible.

Last Updated on by Camron Moss