- Motorcycle Insurance in Alabama: State Requirements

- Motorcycle Insurance in Alabama: How Do You Get a Motorcycle License?

- Motorcycle Insurance in Alabama: Cost for Full Coverage

- Motorcycle Insurance In Alabama: Laws You Need to Know

- Motorcycle Insurance in Alabama: Discounts You Might Be Missing Out On

- RATING FACTORS FOR MOTORCYCLE INSURANCE IN ALABAMA

- Motorcycle Insurance in Alabama: Cheapest Rates by City

- Motorcycle Insurance in Alabama: Liability Only Rates

- Motorcycle insurance in Alabama: Coverage Options

- What are the minimum requirements for motorcycle insurance in Alabama?

- How can A Plus Insurance help me find affordable motorcycle insurance in Alabama?

- Can I call A Plus Insurance at 1.888.445.2793 for more information about motorcycle insurance in Alabama?

- INSURANCE SERVICES WE OFFER

Motorcycle Insurance in Alabama: State Requirements

Did you know that each state has certain minimum liability requirements you must carry by law? Motorcycle Insurance in Alabama is no different. The amount varies by State, and product. Usually the state liability limits required for your car are the same limits required for your motorcycle. That being said, always check with your insurance agent to be sure.

In Alabama, you must carry Liability Limits of at least $25,000 for bodily Injury Protection per person, $50,000 for Bodily injury per accident, and $25,000 for Property Damage.

Of course, you can alter these limits higher, if desired, for greater coverage. Not sure what limits are appropriate to carry? You want to match your liability limits to your assets as best you can to ensure you are properly covered in the event of an accident. Talk with one of our Insurance Agents at A Plus Insurance if you need advice, or a greater explanation of the importance. We also offer free Motorcycle Insurance quotes with several Insurance providers to offer affordable rates in Alabama.

| State | State Minimum | PIP? |

|---|---|---|

| Alabama | 25/50/25 | N/A |

Motorcycle Insurance in Alabama: How Do You Get a Motorcycle License?

So what do you need to do in order to get your motorcycle?

- Make sure you meet the age requirement. In Alabama, you must be age 14 or older for a restricted Class M License, and age 16 or above for a Non-Restricted Class M License.

- You must either pass a Motorcycle Knowledge Test or Safety Course (either is acceptable). The test must be designed by the Alabama Law Enforcement Agency, and the Safety Course must be offered by the Alabama Motorcycle Safety Program.

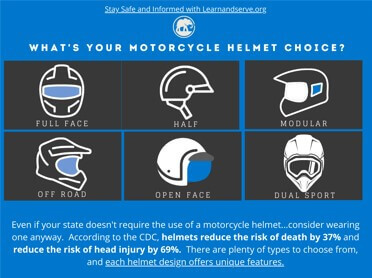

- Get your motorcycle gear! Once licensed, you are free to hit the road! But remember, by law, drivers and passengers must wear a Motorcycle Helmet at all times.

Motorcycle Insurance in Alabama: Cost for Full Coverage

The cost for Motorcycle Insurance in Alabama will vary upon several factors. Insurance companies use rating factors to determine a potential risk, and therefor; calculate the premium accordingly. Some rating factors include Driving history, driving experience, marital status, age/gender, affiliation with a Motorcycle Group, and the type of Motorcycle and coverages desired.

If you are financing a motorcycle, or own a newer motorcycle, chances are you will want to carry full coverage insurance. Full coverage consists of Comprehensive and Collision. Comprehensive covers fire, theft, vandalism and Collision covers impact with another vehicle/object/motorcycle.

You can add extra coverage onto full coverage such as Roadside, Rental/Trip Interruption.

Many companies like Progressive, Geico and Dairyland Insurance include coverages such as Safety Riding Apparel and accessory coverage which is included in the premium. These coverages will cover the cost of any helmets, riding gear, or custom permanently attached equipment up to a specific limit.

Motorcycle Insurance in Alabama varies by the city…so check out the average full coverage rates.

Click to View Cheapest Insurance Companies by Alabama City

| City in Alabama Motorcycle Insurance | Average Monthly Rate for Full Coverage |

|---|---|

| Moody | $221 |

| Vestavia Hills | $212 |

| Gadsden | $197 |

| Tuscaloosa | $177 |

| Muscle Shoals | $198 |

| Foley | $215 |

| Calera | $180 |

| Jacksonville | $213 |

| Meadowbrook | $187 |

| Atmore | $238 |

| Pelham | $221 |

| Dothan | $209 |

| Pell City | $206 |

| Montgomery | $233 |

| Trussville | $213 |

| Helena | $216 |

| Russellville | $232 |

| Huntsville | $197 |

| Daphne | $202 |

| Saraland | $195 |

| Hoover | $189 |

| Decatur | $233 |

| Jasper | $231 |

| Birmingham | $213 |

| Mobile | $221 |

| Tillmans Corner | $175 |

| Auburn | $203 |

| Gardendale | $193 |

| Center Point | $204 |

| Enterprise | $192 |

| Scottsboro | $230 |

| Fultondale | $212 |

| Madison | $179 |

| Chelsea | $207 |

| Selma | $194 |

| Irondale | $183 |

| Mountain Brook | $201 |

| Eufaula | $175 |

| Oxford | $176 |

| Rainbow City | $192 |

| Fairhope | $205 |

| Ozark | $207 |

| Prattville | $236 |

| Prichard | $188 |

| Cullman | $215 |

| Alabaster | $199 |

| Millbrook | $221 |

| Troy | $210 |

| Athens | $216 |

| Boaz | $219 |

| Valley | $213 |

| Bessemer | $226 |

| Sheffield | $235 |

| Phenix City | $192 |

| Opelika | $198 |

| Pleasant Grove | $177 |

| Leeds | $227 |

| Alexander City | $239 |

| Northport | $196 |

| Talladega | $223 |

| Fairfield | $175 |

| Florence | $202 |

| Hueytown | $194 |

| Albertville | $213 |

| Gulf Shores | $177 |

| Sylacauga | $228 |

Motorcycle Insurance In Alabama: Laws You Need to Know

While operating a Motorcycle can give you a sense of freedom and liberation, they can also be dangerous and deadly. This is why Alabama, and all States, have specific Motorcycle Laws to follow:

First – Class M Endorsement Drivers License Laws. You must pass the Departments of Public Safety knowledge exam or safety course to obtain a Motorcycle endorsement on your license.

Secondly- Helmet and Footwear Laws. All drivers and passengers are required to wear a proper motorcycle helmet that fits appropriately and are required to wear shoes at all times.

Motorcycle Passenger Laws. All passengers must have a designated seat and dedicated footrests, separate from the driver with a strap or firm handholds for the passenger to hold onto.

Lane Sharing Laws. In the State of Alabama, a maximum of two motorcycles may share a lane side by side, as it is deemed unsafe for any number greater than 2 to share a lane. The act of ‘lane splitting’ is illegal in Alabama, as it is in many other states, which is the action of travelling between two vehicles.

Motorcycle Insurance in Alabama: Discounts You Might Be Missing Out On

Insurance companies offer a wide variety of discounts to help customers save money on their Motorcycle Insurance. Alabama insurance discounts vary with each Insurance company. Two well known companies that we work with are Progressive and Dairyland Insurance for cheap motorcycle Insurance in Alabama. Discounts are shown below.

Dairyland Motorcycle Discounts: MC Endorsement on License, Years of riding experience, Operator’s Education Course, Operators Safety Course, Motorcycle Rider Group Discount, HOG Discount, Garaged or locked storage, vehicle usage & Mileage (pleasure, commute, etc). Others; Homeownership Discount, Multi Lines Discount, Continuous Insurance Discount, Married discount, EFT Discount, PIF Discount

Progressive Motorcycle Discounts: Anti lock brakes, LoJack device, education discount, approved safety course, prior insurance, association membership, multi policy, advanced quote, PIF, prompt payment, EFT, paperless, Responsible driver. If you are curious, you can always ask your agent about any of the discounts below, to see if your carrier offers it, and if you qualify.

| Potential Motorcycle Insurance in Alabama Discounts |

|---|

| Multi Lines Discount |

| vehicle usage & Mileage |

| Homeownership Discount |

| education discount |

| PIF Discount |

| Anti lock brakes |

| Motorcycle Rider Group Discount |

| LoJack device |

| EFT Discount |

| advanced quote |

| prior insurance |

| approved safety course |

| Operators Safety Course |

| multi policy |

| Continuous Insurance Discount |

| Years of riding experience |

| HOG Discount |

| Responsible driver |

| Garaged or locked storage |

| association membership |

| MC Endorsement on License |

RATING FACTORS FOR MOTORCYCLE INSURANCE IN ALABAMA

What are rating factors?

Rating Factors are used by insurance companies to help determine the premium for customer’s based on several things.

Common motorcycle rating factors include:

- Type of bike (engine size, year make model)

- rider age

- gender

- location

- rider experience

- marital status

- education level

- occupation

- Credit

- driving history

- riding frequency

- member of recognized association & coverages

Why does age and gender matter when determining Motorcycle Insurance premiums? The more experience you have on the road, generally the better driver you are and the less likely to cause an accident. Insurance companies recognize these drivers as a safer option to insure, or low-risk.

Motorcycle Insurance in Alabama: Cheapest Rates by City

Motorcycle prices will range differently depending upon the city in Alabama. Finding the best motorcycle insurance in Alabama is possible if you do a little research.

Cities with a higher population generally means more drivers on the road, and more likely an accident to occur. Same goes for surrounding cities…premiums are calculated based upon the amount of drivers in the area and surrounding areas. The less accidents and claims in an area, the cheaper the insurance rates will be!

Unsure what the average cost for motorcycle insurance is in your city? Check below for the cheapest insurance provider in your city.

Click to View Cheapest Insurance Rates by Alabama City

| Alabama City | Cheapest Insurance Carrier |

|---|---|

| Alexander City | Progressive |

| Chelsea | Geico |

| Albertville | Geico |

| Daphne | Progressive |

| Tuscaloosa | Dairyland |

| Sheffield | Geico |

| Phenix City | Farmers |

| Northport | Geico |

| Foley | The General |

| Boaz | The General |

| Millbrook | Geico |

| Troy | Progressive |

| Florence | Progressive |

| Pelham | Progressive |

| Saks | Geico |

| Scottsboro | Geico |

| Talladega | Dairyland |

| Gardendale | Progressive |

| Dothan | Geico |

| Muscle Shoals | Dairyland |

| Russellville | Progressive |

| Enterprise | Dairyland |

| Saraland | Progressive |

| Center Point | Progressive |

| Ozark | The General |

| Rainbow City | The General |

| Pike Road | Geico |

| Gadsden | Farmers |

| Hartselle | Progressive |

| Oxford | Geico |

| Madison | Dairyland |

| Gulf Shores | Dairyland |

| Jacksonville | The General |

| Atmore | Progressive |

| Decatur | Progressive |

| Helena | Farmers |

| Montgomery | Farmers |

| Opelika | Dairyland |

| Sylacauga | Progressive |

| Mountain Brook | Geico |

| Bay Minette | The General |

| Jasper | Farmers |

| Tillmans Corner | The General |

| Athens | Dairyland |

| Forestdale | Geico |

| Prattville | Geico |

| Homewood | Progressive |

| Calera | Dairyland |

| Fairhope | The General |

| Trussville | Farmers |

| Prichard | Progressive |

| Vestavia Hills | Geico |

Motorcycle Insurance in Alabama: Liability Only Rates

Motorcycle Insurance in Alabama requires at least having the minimum liability limits. What is liability Insurance and why is it required?

Liability insurance is the Minimum Required to make you legal on the road.

The liability limits you have selected will pay out to another party if you are the one At Fault in an accident. Your liability limit needs to be at least the State minimum, but can be altered for higher coverage if needed. The other person’s liability limit is what will pay out to you if they are found At Fault in an accident. See how this works?

You can also add additional coverages onto your Insurance policy like Uninsured and Underinsured Motorist Bodily Injury protection. These coverages are similar, but a bit different.

The Uninsured Motorist Bodily Injury Protection will pay out to you, if you are hit by an Uninsured Motorist or if it is a ‘hit and run’. This coverage is important to consider, because without someone carrying insurance, how will your bodily injury expenses be covered without coming out of your pocket?

Underinsured Motorist coverage applies if you are hit by a driver who carries lower liability limits than you do. This will help fill the gap between their liability limits and yours.

Liability Only Rates by City in Alabama

Alabama City-Best Insurance Rates Average Monthly Liability Rates Alabaster $104.00 Fairfield $115.00 Anniston $98.00 Decatur $104.00 Center Point $133.00 Moody $100.00 Rainbow City $122.00 Athens $131.00 Oxford $107.00 Tuscaloosa $130.00 Calera $101.00 Ozark $102.00 Auburn $122.00 Cullman $110.00 Clay $104.00 Hueytown $96.00 Irondale $105.00 Prattville $131.00 Fort Payne $121.00 Trussville $126.00 Vestavia Hills $112.00 Florence $98.00 Gulf Shores $135.00 Valley $99.00 Saks $108.00 Gardendale $103.00 Sheffield $127.00 Chelsea $128.00 Albertville $112.00 Montgomery $117.00 Muscle Shoals $117.00 Fairhope $116.00 Selma $130.00 Millbrook $116.00 Sylacauga $133.00 Pelham $133.00 Mountain Brook $101.00 Northport $125.00 Mobile $127.00 Hartselle $100.00 Bessemer $135.00 Jasper $132.00 Boaz $101.00 Scottsboro $112.00 Alexander City $123.00 Russellville $121.00 Bay Minette $126.00 Talladega $129.00 Dothan $129.00 Helena $112.00 Tillmans Corner $133.00 Huntsville $108.00 Hoover $121.00 Gadsden $105.00 Forestdale $129.00 Birmingham $120.00 Madison $104.00 Prichard $123.00 Foley $112.00 Homewood $117.00 Opelika $127.00 Atmore $130.00 Daphne $106.00

Motorcycle insurance in Alabama: Coverage Options

Now, let’s dive into coverages! There are so many options to choose from when it comes to finding the best rates for motorcycle insurance in Alabama.

You can opt for Liability coverage if you are not concerned about replacing your bike in the event of an At Fault Accident, and this is likely a cheaper option than full coverage. If you own an older bike that may not be worth much, it may be wise to carry liability so that you’re not paying more than what the Motorcycle is worth, in insurance.

You can carry full coverage, which is Comprehensive and Collision.

Generally, you are able to select whether you would like ACV for the bike, or Total Loss. The deductibles are usually $100, $250, $500 or $1000 which you may be subject to pay in the event of an At Fault Accident.

You can also add Roadside/Trip Interruption. This will pay for a place to stay, or transportation if you are broken down more than a certain amount of miles from your home. Carried contents coverage can be selected (usually up to $3000), and transport trailer coverage. You can also choose to carry Disappearing Deductibles, which over time your deductible may diminish resulting in you paying less of a deductible.

| Motorcycle Insurance Coverage Options |

|---|

| Safety riding apparel |

| Collision |

| Comprehensive |

| Roadside |

| Rental Reimbursement |

| Carried contents |

| Transport Trailer coverage |

| Uninsured Motorist Property damage |

| Diminishing Deductible |

| Trip Interruption |

| Physical Damage Plus |

| Medical Payments |

| Liability |

| Roadside/Trip Interruption |

| Uninsured Motorist Bodily Injury |

| Accessory Coverage |

| Optional Equipment |

| Guest Passenger Liability |

What are the minimum requirements for motorcycle insurance in Alabama?

In Alabama, the minimum requirements for motorcycle insurance typically include liability coverage, which covers injuries or property damage you may cause to others while riding.

How can A Plus Insurance help me find affordable motorcycle insurance in Alabama?

A Plus Insurance shops multiple carriers to help you find the most affordable motorcycle insurance rates in Alabama. We tailor coverage to meet your needs and budget.

Can I call A Plus Insurance at 1.888.445.2793 for more information about motorcycle insurance in Alabama?

Certainly! For more information about motorcycle insurance in Alabama or to get a personalized quote, feel free to call us at 1.888.445.2793.

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

| Other Alabama Insurance |

|---|

| Auto Insurance in Alabama |

| Alabama Car Insurance |

| Alabama Home Insurance |

| Alabama SR-22 Insurance |

| Why Use an Insurance Broker? |

| Progressive Insurance in Alabama |

For personalized motorcycle insurance solutions, call us at 1.888.445.2793.

Last Updated on by Marlon Moss