Auto Insurance in Colorado, and More!

Yes We Can Find Drivers Auto Insurance in Colorado, but we can find you insurance in 34 More States! We can help you find affordable rates, need an SR-22? We got you! Homeowner, renter, mobile home owner: Let us help protect your property! We compare prices and save you money!

Explore a wide range of auto insurance solutions at A Plus Insurance. Whether you need full coverage for total peace of mind, liability-only for basic requirements, or non-owners insurance for occasional driving, we have a policy that fits your needs and budget.

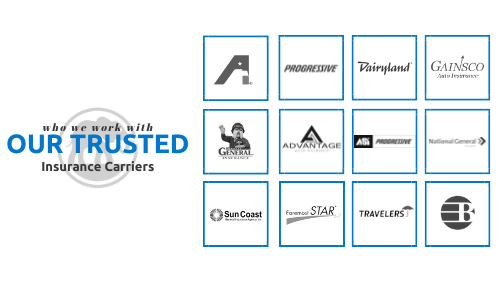

Even if you don’t know A Plus Insurance (you need to though!) perhaps you recognize some of these well known companies that offer car insurance in Colorado Springs (full coverage and liability only).

What types of auto insurance coverage are available in Colorado Springs?

Auto insurance coverage in Colorado Springs can include liability, comprehensive, collision, uninsured/underinsured motorist, and personal injury protection (PIP) among others. The specific coverage you need depends on your individual circumstances and preferences.

How does A Plus Insurance help customers find the best rates for auto insurance in Colorado Springs?

A Plus Insurance shops multiple carriers to ensure our customers in Colorado Springs find the best rates for auto insurance. Our team compares quotes from various providers to provide you with customized and affordable coverage options.

Do you offer assistance over the phone? How can I reach you?

Yes, we offer assistance over the phone. Call us at 1.888.445.2793 to speak with one of our representatives for personalized assistance with your auto insurance needs in Colorado Springs.

See Our Google Reviews!

At A Plus Insurance, our exceptional service has earned us rave reviews. Customers praise our expertise, affordability, and commitment to going the extra mile.

About A Plus Insurance: Your Colorado Springs Car Insurance Experts

Meet our Team: Find out more about our company and our leadership!

A Plus was established in 1999 in Colorado Springs, CO. Shawn Christie, and his wife Amy, are its owners. We are a family owned and operated insurance broker. We offer a full range of products for drivers looking to lower the cost of their car insurance in Colorado Springs, and 34 other states. Our goal is to service a wide spectrum of personal insurance needs, as well as business insurance needs in your state. It is our objective to provide quality, low-cost coverage to meet the needs of our clients and gain a trusted customer. Learn more here!

How To Get a Car Insurance Quote in Colorado (and other States)

Step 1. Call Us! We know the cost of insurance is crazy and we are real people happy to help you drivers save. Click on the phone icon below or dial: 888-445-2793. You can always text us if you can’t talk, and we can prepare an insurance quote via text.

Step 2. Be prepared to spend 10-15 minutes on the phone to get your auto insurance quote, and about 15-20 minutes for a homeowners insurance quote. You will need to give some information, but it’s not to stalk you or hurt your credit, we can’t rate you if we don’t have what we need.

Step 3. If you like the price you hear, we will ask for you to provide your Vehicle Identification number and your drivers license number. That way we can run the required MVR and insurance score report (a soft credit pull).

Step 4. After running the report, we will have the insurance quote with the finalized rate for you. If you are happy with it, we can start your policy immediately.

Step 5. Provide payment. We accept EFT and major debit/credit cards. For any other payment methods, we might have to double check with the insurance company.

Step 6. After your payment is processed and we obtain all required signatures, we can issue you your policy and ID cards (or declaration page if its renters/homeowners) and you are officially an A Plus customer.

Let Us Do the Shopping For You

Home & Auto Insurance in Colorado Springs, Colorado

The following minimum car insurance coverages are required by the state of Colorado, although policies with higher coverages may be purchased by drivers: $25,000 for bodily injury or death to any one person in an accident; $50,000 for bodily injury or death to all persons in any one accident; and $15,000 for property damage in any one accident.

- Best Auto Insurance Rates in Colorado Springs (and in 34 More States)

- Auto Insurance in Colorado Springs: Find Better Rates Now

- What types of auto insurance coverage are available in Colorado Springs?

- How does A Plus Insurance help customers find the best rates for auto insurance in Colorado Springs?

- Do you offer assistance over the phone? How can I reach you?

- About A Plus Insurance: Your Colorado Springs Car Insurance Experts

- How To Get a Car Insurance Quote in Colorado (and other States)

- Home & Auto Insurance in Colorado Springs, Colorado

- Top Companies and Average Liability only Rates in CO

- Home and Auto Insurance in Colorado Springs, Colorado Springs: How A Plus Insurance Can Help

- Auto Insurance In Colorado Springs: How Age Affects Your Rates

- Auto Insurance in Colorado: Car Insurance Discounts by Colorado Springs Companies

- Auto Insurance In Colorado Springs: Nearby Cities and Why Your Zip Code Matters

- How Much Can an Accident Impact my Colorado Springs Car Insurance Rates?

- Auto Insurance In Colorado Springs: Other Types of Insurance We Carry

- Auto Insurance in Colorado: How We Can Assist Young & Youthful Drivers

- Who Can Get a Driver’s License & Auto Insurance In Colorado?

- Obtaining Auto Insurance In Colorado Springs: What Information You Will Need To Provide

- What should you take to the Colorado DMV?

- Auto Insurance In Colorado Springs: DMV Addresses and Phone Numbers

- The Advantages Of Using This Site When Looking For Colorado Springs Auto insurance

- Auto Insurance In Colorado: A Plus Insurance Company Info

Top Companies and Average Liability only Rates in CO

| Progressive Insurance | $80 |

| National General | $82 |

| Bristol West | $90 |

| The General | $96 |

| Dairyland | $100 |

| Geico | $108 |

| Mendota Ins. Company | $108 |

Home and Auto Insurance in Colorado Springs, Colorado Springs: How A Plus Insurance Can Help

Our specialty is providing fast and friendly online insurance quotes for affordable car insurance coverage for all drivers.

Not only do we provide the cheapest rates for your vehicles for full coverage and liability only, but we have multiple insurance types for coverage for homes, motorcycle, and renters. There are options for every customer, regardless of your credit history.

We also specialize in helping find reliable carriers that offer an SR22 in Colorado.

We serve Florida, South Carolina, Texas, and Alaska and many other states.

Our fast, friendly agents get you the quotes you are looking for in a no pressure process. This allows you to quote, buy, and print identification cards for proof of coverage at your own pace.

After you submit your information for an online quote, your rates are delivered in seconds. Live agents are available, via phone, to help drivers choose your best policy option and break down the cost. We will do our best to find you great rates for Insurance in Colorado Springs and the entire state of Colorado.

Auto Insurance In Colorado Springs: How Age Affects Your Rates

Yes, age does affect the cost of your car insurance rates.

When you are a young customer, new driver, you are considered high risk because you are inexperienced and there is a higher risk of accidents equaling a higher risk of reporting claims to the insurance company.

Also, a person’s credit history can affect their rates. If they have a good credit score, that leads to great rates. However a young person usually has not had the time to build up a good credit score.

Not only will age determine affect your rates, but gender does also too…a highly debatable topic…but so far most car insurance companies look at gender during the underwriting process.

Studies show that on average, women drivers pay less on their policy than males in auto insurance. Statistics have shown that males tend to drive more than women…leading to a higher chance of traffic incidents.

The chart below shows what some of the average coverage rates could look like in Colorado Springs depending on your gender and age.

| Age Range | Average Monthly Rates-Males | Average Monthly Rates-Females |

|---|---|---|

| 16-18 | $ 231.84 | $ 184.09 |

| 19-24 | $ 193.20 | $ 161.00 |

| 25-30 | $ 139.84 | $ 124.84 |

| 31-40 | $ 110.40 | $ 106.08 |

| 41-50 | $ 109.48 | $ 98.44 |

| 50-65 | $ 99.36 | $ 101.48 |

| 65+ | $ 106.08 | $ 114.08 |

One good thing about auto insurance Colorado coverage is that your rates go down the older you get (and that’s in every state)!

Auto Insurance in Colorado: Car Insurance Discounts by Colorado Springs Companies

Many people do not realize how many car insurance policy discounts that are available to them to lower the cost of auto insurance in Colorado Springs.

Some drivers also do not realize that something as simple as a homeowners discount could mean up to $40-60 in savings on their Auto policy coverage.

Below you will see the discounts available for Mendota Insurance and Travelers Insurance.

While each company offers different discounts that vary by state and company, they do have a couple of discounts in common such as married discount, paid in full, auto pay discount and more.

One of the easiest discounts you can obtain, is an autopay discount. Simply sign up and have your payments automatically charged to a credit or debit card, or do an electronic funds transfer. This will save you tons each month!

| Mendota(Advantage Auto) Discounts |

|---|

| Auto Pay |

| No Accidents or Violations |

| Homeowners |

| Paid in Full |

| Multi Vehicle |

| Continuous Insurance |

| Married |

| Travelers Insurance Co. |

|---|

| Continuous Insurance |

| No Accidents or Violations |

| Multi Policy |

| Auto Pay |

| Married |

| Homeowners |

| Multi Vehicle |

Auto Insurance In Colorado Springs: Nearby Cities and Why Your Zip Code Matters

Colorado Springs, Colorado…while not the capital of the state of Colorado, is definitely one of the largest cities of the state. Along with being one of the largest, it is highly populated and full of drivers.

So…what does this have to do with auto insurance? Your zip code and city plays another part in determining your the cost of your car insurance rates.

The higher the populated city- the higher the insurance rates for those residents. If there are a lot of weather related claims in a city, full coverage rates are probably higher than average. See the data below to check out the closest cities and neighborhoods in Colorado Springs.

| Neighborhoods in Colorado Springs, Colorado |

|---|

| Downtown |

| Stratton Meadows |

| Middle Shooks Run |

| Pleasant Valley |

| Cities Near Colorado Springs |

|---|

| Canon City, CO |

| Cripple Creek, CO |

| Woodland Park, CO |

| Manitou Springs, CO |

| Zip Codes in Colorado Springs |

|---|

| 80916 |

| 80903 |

| 80909 |

How Much Can an Accident Impact my Colorado Springs Car Insurance Rates?

Many people wonder how much an accident can affect their car insurance rates. And unfortunately in Colorado Springs there are a lot of accidents. Take a look at the following chart to see sample rate you might pay each month WITH an accident on your record vs without.

But even with a record riddled with accidents, affordable coverage on your policy is possible, and we can find an insurance policy for you.

If you have a good credit history, you could still see reasonable prices.

| Colorado Springs Car Insurance Companies | Average Auto Rates WITH Accidents | Average Auto Rates WITHOUT Accidents |

|---|---|---|

| Bristol West | $150 | $134 |

| Nationwide | $155 | $136 |

| Acceptance RTR | $166 | $157 |

| AssuranceAmerica | $167 | $134 |

| National General | $169 | $140 |

| 21st Century | $175 | $161 |

| The General | $177 | $138 |

| Dairyland | $182 | $124 |

| Mendota Ins. Company | $186 | $134 |

| GAINSCO | $187 | $135 |

| Progressive Insurance | $189 | $133 |

| State Auto | $198 | $168 |

| Geico | $199 | $164 |

Auto Insurance In Colorado Springs: Other Types of Insurance We Carry

Here at A Plus Insurance, we offer much more than just auto insurance in Colorado! We carry non owners insurance, home, boat, motorcycle, and more insurance products in Colorado Springs.

Yes! If you have a home you need insured, we can help you with that. If you have a boat, motorcycle, or RV…we can help you with getting coverage for those products as well! We offer a variety of different insurances that doesn’t have to cost you and arm and a leg. Check out the list and see if we can help you find a policy with the cheapest rates!

| Type of Coverage | Our Top Companies |

|---|---|

| Renters Insurance | ASI, Foremost |

| Commercial Auto Insurance | Progressive |

| Boat Insurance | Travelers, Progressive |

| Home Insurance | Travelers, ASI, Foremost Star |

| Motorcycle Insurance | Dairyland, Progressive |

| Car Insurance | Progressive, Dairyland, |

| Business Insurance | BTIS, Hiscox |

Auto Insurance in Colorado: How We Can Assist Young & Youthful Drivers

If you have a teen driver, you are likely aware that from time to time fatherly advice falls on deaf ears.

All of our agents are instructed to take extra time to explain and have a frank discussion with our youthful drivers about the importance of taking this new responsibility of driving seriously.

We talk in great detail about the grave consequences that carelessness behind the wheel can have. It will cost you not only financially, but in a lot of ways.

Hearing this from a someone who is not mom or dad but an independent professional agent that has first-hand knowledge can be very powerful.

When looking for the cheapest car insurance, owners can go to individual companies to get separate quotes for a potential policy. This takes a lot of driving around and filling out multiple forms. Going online to different companies can be time-consuming. Putting the car owner’s information on so many forms can be risky. Going online to our site may be a more convenient choice.

This site provides online quotes from many different auto insurance companies in a comparative format that is easy for the car owner to understand.

*Important to note: While running rates for our clients does perform a soft credit pull, your credit score is NOT affected.

Who Can Get a Driver’s License & Auto Insurance In Colorado?

Resident drivers who have been in the state of Colorado for 90 consecutive days can get licensed and insured.

New residents have 30 days to transfer their out of state drivers licenses to Colorado. They have 90 days to register their vehicles.

Obtaining Auto Insurance In Colorado Springs: What Information You Will Need To Provide

To determine your rates, your agent will need to obtain information such as your age, driving record, and claim history. Your agent will also ask about your cars garaging location, vehicle make, and model. Then your agent will ask about the age of the car and use the automobile.

Also, what kind of coverage will you need? Liability only? Full coverage? Non owners?

Other pertinent information will be collected to determine which additional discounts you may be eligible for. This information will be used to determine which car insurance company will offer you the best rates and the best coverage possible. The website partners with many top companies practicing in Colorado Springs to provide insurance quotes to those using the site.

What should you take to the Colorado DMV?

• Birth certificate passport, military ID, or other valid identification proofs

• Your social security number/ card

• Proof of current address, and the application fee.

* Sr22 (if you have one)

If the vehicle is being registered, the applicant must have the out of state registration forms and title for the car, proof of converting the title to a Colorado title, evidence of insurance and emissions, and the title and registration fees. Notice that drivers must have valid Car insurance in Colorado coverage to register and license vehicles. We also now offer Texas Insurance.

Auto Insurance In Colorado Springs: DMV Addresses and Phone Numbers

DMV’s… never fun huh?

Well, whether we like them or not, DMVs play a mutual role in meeting our everyday needs if we are insured motorists or have a vehicle and are seeking car insurance in Colorado.

Some DMV locations even have where you can go online and make an appointment or even see if there are some of your needs that you can take care of your pre Colorado auto insurance needs online. In Colorado Springs, they have the Registration and Titling and the actual Drivers License Office.

See below the website, address, and phone numbers.

Colorado Springs Registration & Titling: 2447 N Union Blvd, Colorado Springs, CO 80909 | (303) 205-5694

Colorado Springs Driver License Office: 5650 Industrial Pl #100, Colorado Springs, CO 80916 | (719) 520-6240

What additional information can be found on our site regarding auto and home insurance?

Additional information such as company customer service contact phone numbers and claims numbers can be found on this website. We also have an insurance glossary to help define typical insurance terms that are found in insurance policies. Insurance auto, home, business, all of it…can be confusing!

The Advantages Of Using This Site When Looking For Colorado Springs Auto insurance

- Using a website that gives multiple quotes can save the driver time and money.

- Car owners can access the internet site at their convenience anytime day or night in the comfort of their home.

- You will get quotes from many companies that have already been vetted for quality coverage and dependability for your vehicle insurance.

- There is safety in only having to give out personal information one time instead of many times too many agents.

- The multiple quotes will be presented in a way that makes the rates and coverage easy to compare. For additional information, please refer to the website and use our self service for quick quotes for insurance in Colorado Springs.

WE MAKE GETTING AUTO & HOME COVERAGE IN COLORADO SPRINGS EASY

We are happy to help you find cheap auto insurance rates and are available during your policy period to help you with any policy service you may need.

Auto Insurance In Colorado: A Plus Insurance Company Info

The following address is mailing only:

A PLUS INSURANCE

PLAZA OF THE ROCKIES

121 S TEJON ST. Unit 1107

COLORADO SPRINGS, CO. 80903

719 392 4000

Types of coverage in Colorado Springs we specialize in:

Auto, Motorcycle, Home, Full Coverage, Liability, and SR22.

Looking for cheap insurance in Colorado Springs? Seven out of ten times we can beat your current company, including Geico.

If you need a good roofing contractor in Greenville SC Call these Guys

Last Updated on February 20, 2024 by Marlon Moss