gap insurance Cheat Sheet: 7 Frequently Asked Questions Answered Now!

1. Gap Insurance, What Is It?

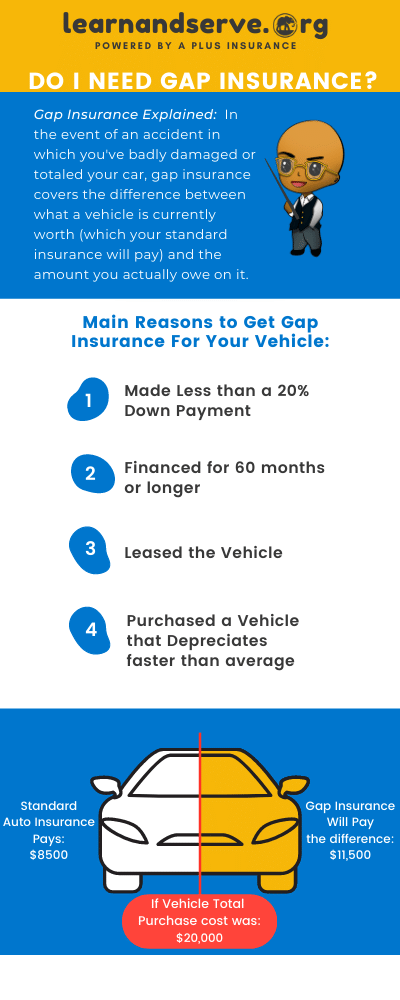

Gap insurance, also known as Guaranteed Asset Protection insurance, is a type of insurance coverage that helps protect you financially if your car is totaled or stolen and the amount you owe on the car loan is higher than the actual cash value of the vehicle.

What Exactly Does Gap Insurance Cover?

When you purchase a new or used car and finance it with a loan, the value of the car depreciates over time. In the event of an accident or theft, your auto insurance policy typically covers the current market value of the car, which may be significantly less than the amount you still owe on your loan. This difference between the car’s value and your outstanding loan balance is known as the “gap.”

2. Is Gap Insurance Worth It?

Is it worth it? The answer lies in one word, Depreciation!

Standard Auto Insurance policies cover a depreciated vehicle at the current market value. But what if you owe more on the car than it is worth? GAP IT! That is when you will see it is worth it.

It is designed to bridge that gap by paying the difference between what your car insurance company pays and the remaining balance on your loan. It helps ensure that you are not left with a financial burden of making payments on a car you no longer have.

3. When do you need gap insurance?

Here are 5 easy reasons to say yes…IF:

- You made less than a 20 percent down payment, GAP IT!

- You financed your vehicle for 60 months or more, GAP IT!

- You are leasing your car and…

- You purchased a vehicle that depreciates faster than the average, GAP IT!

- Have a high-interest rate on your loan.

4. When can you skip Gap Insurance?

You can skip this coverage when your loan balance doesn’t exceed the vehicle’s value.

It’s important to note that this coverage is typically optional and not required by law. However, it can be beneficial in certain situations, especially if you have a large loan amount, a high-interest rate, or if you’re financing a vehicle with a high rate of depreciation.

5. How much is Gap Insurance?

The answer may be “cheap.” Like all types of insurance, there are multiple rating factors such as age, vehicle, and location. All of these combine to create the rate for your specific vehicle. There is no blanket price for any insurance.

The cost varies depending on factors such as the type of vehicle, the loan amount, and the insurance provider.

6. Should you buy Gap Insurance from a dealer?

You don’t have to buy it from the dealership. Do your research to find the perfect rate for you. Some companies like A Plus Insurance do the shopping for you! Give us a call and our friendly Agents will get you a quote in minutes!

Gap can be purchased from your auto insurance provider, a dealership, or an independent insurance company.

7. How long do you need Gap Insurance?

If it is a new vehicle, then you need will need it for at least the first couple of years you own it. By then, you should owe less on the car than it is worth. If leasing, for most companies, it is a requirement.

Before purchasing, it’s advisable to review your auto insurance policy and consult with your insurance agent to understand the coverage limits, terms, and conditions to ensure it meets your specific needs.

What is gap insurance, and why do I need it?

Gap insurance, or guaranteed asset protection insurance, covers the difference between the actual cash value of a vehicle and the balance still owed on the car loan in case of a total loss. To understand if gap insurance is right for you, contact A Plus Insurance at 1.888.445.2793.

When should I consider purchasing gap insurance?

Gap insurance is particularly useful if you have a new car, leased vehicle, or if you owe more on your auto loan than the current market value of your car. Contact A Plus Insurance at 1.888.445.2793 to discuss if gap insurance is a good fit for your situation.

How can A Plus Insurance help me find affordable gap insurance?

A Plus Insurance shops multiple carriers to help you find the most affordable gap insurance rates. Call us at 1.888.445.2793 for personalized assistance in securing the best gap insurance coverage for your needs.

For personalized advice on gap insurance, call us at 1.888.445.2793.

Last Updated on by Alexis Karapiperis