Cheap Car Insurance Denver: First Fulfill your State Requirements

When it comes to car insurance, each State has it’s own requirements in regards to limits. So it’s important to make sure you understand your state’s requirements.

In Colorado, all drivers must carry liability insurance that covers at least $25,000 per person and $50,000 per accident for bodily injury liability, as well as $15,000 in property damage liability., however, we always recommend upping property damager to $25,000 since it’s only a few dollars more per month.

By fulfilling your state’s requirements first, you can ensure that you are adequately covered in case of an accident or lawsuit. This will also lead to have cheaper car insurance in Denver, CO.

The Secret to Cheap Car Insurance Denver: Liability Only Coverage

If you’re looking for cheap car insurance Denver, liability only coverage might be your best bet. This type of coverage only covers damages and injuries you cause to others in an accident, rather than covering your own damages and injuries. While it may not provide as much protection as full coverage insurance, it can be significantly cheaper.

It’s important to note that liability only coverage is required by law in Colorado, so it’s a necessary expense if you plan on driving in Denver.

5 Reasons Why Liability Only Coverage Can be Your Ticket to Cheap Denver Rates

One way to save some money is to consider liability only coverage as was mentioned above. Here are five reasons why choosing liability only coverage can help you get cheap rates:

- It meets state requirements: Liability coverage is the minimum coverage required by law in Colorado. According to Colorado law, it’s required to have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $15,000 in property damage liability coverage. Choosing liability only coverage means you are meeting the state’s minimum requirements.

- It’s cheaper than full coverage: Liability only coverage is generally considered cheap car insurance compared to full coverage because it only covers damages you cause to others in an accident, not damages to your own vehicle. This means you’ll pay lower premiums each month.

- It’s ideal for older vehicles: If you have an older car that’s not worth much, it may not make sense to pay for full coverage. Liability only coverage can protect you financially if you were to cause an accident, but it won’t cover repairs or replacement for your own vehicle.

- You can still add extras: Even if you choose liability only coverage, you can still add on extras like roadside assistance or rental car coverage for an additional fee. This means you can customize your coverage to fit your needs and budget. However, this is not the case with all companies.

- It’s a good choice for safe drivers: If you’re a safe driver with a good record, choosing liability only coverage can be a smart financial decision. You’re less likely to cause an accident, so you may not need the extra coverage offered by full coverage policies. This means you can save money on your premiums without sacrificing protection, but even if you’re a good driver, others on the road may not be. That’s something to take into consideration as well.

Overall, liability only coverage can be a great option for drivers who want to cheap car insurance Denver and save their hard earned money. However, it’s important to remember that this type of coverage only covers damages you cause to others in an accident, so you’ll need to weigh the potential risks against the cost savings before making a decision.

If you are currently financing your vehicle or it’s still considered ‘new’, then liability only may not be for you.

Affordable Liability Insurance in Denver With an SR22

If you are required to file an SR22 in Denver, it means that you are considered a high-risk driver by the state. This can make it quite a challenge to find something that’s affordable. Here are five ways you can still acquire cheap car insurance Denver – even with an SR22:

- Shop around: Different insurance companies offer different rates, so it is essential to compare prices from different providers to find the most affordable option.

- Consider raising your deductible: Increasing your deductible can help lower your monthly insurance premium if you have Full Coverage.

- Maintain a clean driving record: Avoid traffic violations or accidents to maintain a clean driving record, which can help you qualify for lower insurance rates. Don’t have the greatest driving record now? Start today to work towards that goal.

- Look for discounts: Many insurance providers offer discounts for things like safe driving, multiple policies, paperless, and paying your premium in full.

- Work with an insurance agent: An experienced insurance agent can help you navigate the SR22 process and find the best coverage options for your needs and circumstances.

Cheap Car Insurance Denver for Young Drivers: Save with Liability Only

According to data from the National Association of Insurance Commissioners, younger drivers tend to pay more for car insurance compared to those older. Drivers under the age of 25, for example, pay an average of $1,784 per year for car insurance, while drivers over the age of 55 pay an average of $1,326 per year. You can clearly see the difference between these numbers.

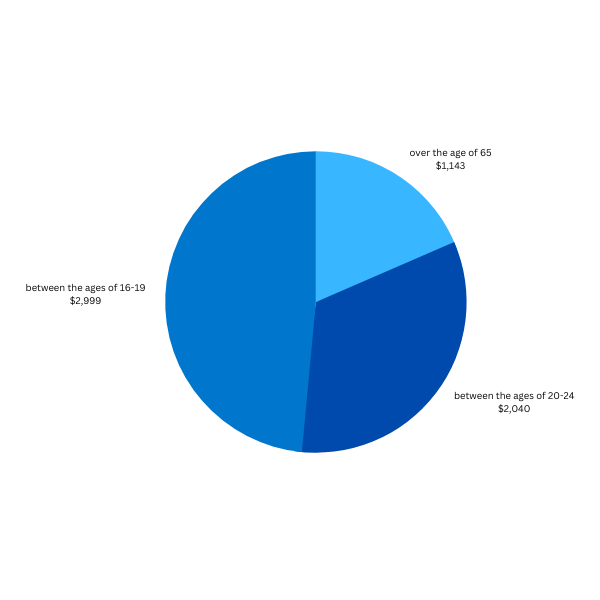

To break it down further, drivers between the ages of 16-19 pay the most for car insurance, with an average annual premium of $2,999. Drivers between the ages of 20-24 pay an average of $2,040 per year. In contrast, drivers over the age of 65 pay the least for car insurance, with an average annual premium of $1,143. This is not ideal when looking for cheap car insurance Denver.

All of these statistics can be represented in a pie chart to show the breakdown of average car insurance premiums by age group.

Young drivers in Denver can save on their insurance rates by choosing liability only car insurance. This type of coverage only pays for damages to other people and their property in case of an accident you caused. While it may not cover your own car damages or medical expenses, it can significantly reduce your monthly premiums, resulting in cheap car insurance Denver. This is because young drivers are typically seen as higher risk to insurers, and by choosing liability only coverage, you can lower your insurance costs while still meeting the minimum legal requirements for driving in Colorado.

Here are a couple helpful tips:

- 1. If possible, get on your parents insurance and pay them. This usually results in a cheaper rate for you.

- 2. Don’t buy a new vehicle or a sports car. Opt in for something older. Yeah it’s not as cool, but it will be hundreds of dollars cheaper.

Below is the average cheap car insurance Denver prices for young drivers or other high-risk drivers.

| Carrier | Average Price |

|---|---|

| American Family | $141 |

| National General | $143 |

| Progressive Insurance | $148 |

| The General | $152 |

| Acceptance RTR | $154 |

| Bristol West | $158 |

| Dairyland | $160 |

| Allstate | $162 |

| USAA | $162 |

| AssuranceAmerica | $164 |

| GAINSCO | $165 |

| Farmers | $169 |

| 21st Century | $172 |

| Mendota Ins. Company | $174 |

What is the Most Affordable Car Insurance in Colorado?

| Carrier | Average Price |

|---|---|

| National General | $93 |

| The General | $93 |

| AssuranceAmerica | $95 |

| Progressive Insurance | $105 |

| Mendota Ins. Company | $109 |

| State Farm | $112 |

| Dairyland | $119 |

| Liberty Mutual | $130 |

| 21st Century | $136 |

| Farmers | $136 |

| Geico | $136 |

Keep in mind that rates can vary depending on your driving history, age, and other factors. It’s always a good idea to compare rates from multiple insurance companies before making a decision.

Cheapest Car Insurance Denver Rates with Good Credit Vs. Bad Credit

In Colorado, having good credit can significantly impact the amount you pay for cheap car insurance Denver. The statistic’s show that a driver with good credit can pay an average of $1,513 per year for car insurance, while a driver with bad credit can pay an average of $2,266 per year. That’s a difference of $753 per year, or roughly $62.75 per month.

Now, these rates and figures are just averages and your actual rate could be very different. Factors like age, driving history, and the type of car you drive, the coverage your choose have a an impact on prices. However, having good credit is usually seen as a positive factor by a lot of insurance companies, since it shows that you are financially responsible and less likely to file a claim.

So, if you’re looking to save money on car insurance in Denver, improving your credit score may be a good place to start. Just look at the chart below for comparisons.

| Cheap Car Insurance Denver | Good Credit | Bad Credit |

|---|---|---|

| Dairyland | $126 | $153 |

| 21st Century | $131 | $192 |

| Bristol West | $132 | $158 |

| AssuranceAmerica | $133 | $158 |

| GAINSCO | $133 | $172 |

| Progressive Insurance | $141 | $184 |

| Geico | $147 | $190 |

| National General | $151 | $190 |

| The General | $151 | $178 |

| Acceptance RTR | $158 | $183 |

| Farmers | $159 | $155 |

| Mendota Ins. Company | $159 | $189 |

| USAA | $164 | $155 |

| Liberty Mutual | $166 | $145 |

Best Vehicles to Insure With Liability only in Denver, CO

Here are ten vehicles that are known for their affordability and may have lower insurance rates for cheap car insurance Denver coverage:

Honda Civic

Toyota Corolla

Ford Focus

Nissan Altima

Hyundai Elantra

Kia Optima

Chevrolet Cruze

Mazda3

Volkswagen Jetta

Subaru Impreza

How to Start Your Cheap Car Insurance Denver Policy Today

Use an Insurance Broker

Using an insurance broker is a smart choice because they act as your insurance “helpers.” Brokers know a lot about insurance and can easily explain thing’s like coverages. They normally work with different insurance companies, so they can find the best one that fit’s your needs. This means you’d save time & money *gasp!* What a great deal!

Instead of spending a lot of time figuring out insurance on your own, brokers make it simple and find you the best deal. So, using an insurance broker is like having a friendly guide to get the right insurance without all the stress and confusion.

Frequently Asked Questions About Cheap Car Insurance in Denver

Q1: How can I find affordable car insurance in Denver, Colorado?

A1: To find affordable car insurance in Denver, Colorado, consider comparing quotes from multiple insurance providers. You can also explore discounts, such as safe driver discounts, bundling policies, and maintaining a good driving record. Working with an independent insurance agent can help you navigate your options and find budget-friendly coverage.

Q2: What factors affect car insurance rates in Denver?

A2: Car insurance rates in Denver can be influenced by various factors, including your driving history, age, vehicle type, coverage levels, and even your location within the city. Additionally, factors like your credit score and the deductible you choose can impact your insurance premiums.

Q3: What types of coverage should I consider for cheap car insurance in Denver?

A3: When looking for cheap car insurance in Denver, it’s essential to consider the coverage that best suits your needs. While you may want to save on premiums, ensure you have adequate coverage for your vehicle. Common coverage options include liability insurance, collision and comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP).

Additional Information

Motorcycle Insurance In Colorado

Homeowners Insurance in Colorado

Liability Car Insurance in Colorado

By Amanda Moss | Licensed Agent at Learnandserve.org | Powered by A Plus Insurance | Cheap Car Insurance Denver

Last Updated on by Amanda Moss