- Which Insurance Company has the Best Rates for Maryland Homeowners Insurance?

- Which Companies Offer Maryland Homeowners Insurance?

- Maryland Homeowners Insurance Discounts You Need to Know About!

- Maryland Homeowners Insurance

- Products to bundle with Maryland Homeowners Insurance

- Cheapest Homeowners Rates by City

- Will my Maryland Home Insurance Policy Cover Mold?

- Most common Causes for Loss and claims for Maryland Homeowners Insurance (and nationwide)

- Why Your Policy Might be so High: Rating Factors for Maryland Homeowners Insurance

- Maryland Homeowners Insurance: Do You Know What Your Insurance Covers?

- Average Cost of Homeowners (by city)

- How Much Is Maryland Homeowners Insurance? Rates by company

- Maryland Homeowners Insurance Most Frequently Asked Questions

- Additional Helpful Links

- Questions About Homeowners Insurance In Another State?

- Other Guides to the Best Insurance Rates in Maryland

- INSURANCE SERVICES WE OFFER

Which Insurance Company has the Best Rates for Maryland Homeowners Insurance?

Just because you want the best coverages for you home, doesn’t mean you want to pay a whole lot. Here are some companies that have the best and lowest prices on Homeowners Insurance in Maryland!

If you spend the extra time to shop a few Home Insurance companies, you will have a better idea if you are really getting the best bang for your buck, and it will give you a better understanding of the different coverage options each company offers.

| Company | Rank |

|---|---|

| Farmers Insurance | 1 |

| Nationwide | 2 |

| MetLife Inc. | 3 |

| Auto-Owners | 4 |

| Liberty Mutual | 5 |

| American International | 6 |

| Chubb | 7 |

| American Family | 8 |

| Progressive | 9 |

Which Companies Offer Maryland Homeowners Insurance?

Did you just purchase a home in Maryland? We made it easy for you and listed a few companies that offer Homeowners there!

Since all companies vary in coverages offered, and prices, its best to shop multiple insurance providers before making a final decision. We make it easy for you, and are able to shop our companies to compare costs and coverages in a matter of minutes. Call one of our agents today for a free Home Insurance quote.

| Company | Homeowners Offered |

|---|---|

| MetLife Inc. | yes |

| USAA | yes |

| Auto-Owners | yes |

| State Farm | yes |

| Hartford | yes |

| Farmers Insurance | yes |

| Travelers | yes |

| American International | yes |

| Progressive | yes |

| American Family | yes |

| Allstate Corp. | yes |

| Chubb | yes |

| Liberty Mutual | yes |

| Nationwide | yes |

Maryland Homeowners Insurance Discounts You Need to Know About!

Everyone wants discounts where they can get them! Did you know that there are numerous ways you can get discounts on your homeowners insurance? We have listed some below for you to check out!

While some discounts like auto pay, or paid in full are well known to policyholders, there are other safety features that can give you a good discount on your policy premium such as smoke alarms, automatic water shut off and water sensers, as well as home protection systems.

| Gated community |

| Smoke detector (monitored) |

| EFT |

| Non-smoking discount |

| Upgraded roof |

| Upgraded plumbing |

| Home monitoring / Bruglar |

| New home discount |

| Married discount |

| Bundling Multiple Polices |

Maryland Homeowners Insurance

When it comes to homeowners insurance in Maryland, coverage for your roof can vary depending on the type of policy you have and the specific terms outlined in your insurance contract. Here’s what you need to know about roof coverage:

- Types of Coverage:

- Dwelling Coverage: This part of your homeowners insurance policy typically covers the structure of your home, including the roof, against specific perils such as fire, windstorm, hail, and other covered hazards. If your roof is damaged due to a covered peril, your insurance may help pay for repairs or replacement.

- Actual Cash Value vs. Replacement Cost: It’s important to understand whether your policy provides coverage for the actual cash value (ACV) or replacement cost (RC) of your roof. ACV coverage takes depreciation into account, meaning you may receive less money for an older roof. RC coverage reimburses you for the cost of replacing the damaged roof with a new one of similar quality, without deducting for depreciation.

- Named Perils vs. All-Risk Coverage: Some policies provide coverage for specific named perils, while others offer broader all-risk or open-peril coverage. Review your policy to understand which perils are covered and which are excluded. Common exclusions may include wear and tear, neglect, and gradual deterioration.

- Exclusions and Limitations:

- Your insurance policy may have exclusions or limitations related to roof coverage. For example, damage caused by neglect or lack of maintenance may not be covered. Additionally, certain types of roofs, such as older roofs or those made of specific materials, may have limited coverage or higher deductibles.

- Some policies may exclude coverage for certain perils, such as damage caused by earthquakes or floods. Consider purchasing separate coverage, such as earthquake insurance or flood insurance, if you live in an area prone to these hazards.

- Preventive Measures and Maintenance:

- Insurance companies may expect homeowners to take preventive measures and maintain their roofs to minimize the risk of damage. Regular inspections, maintenance, and prompt repairs can help prevent issues and maintain the integrity of your roof.

- Failure to properly maintain your roof could result in coverage denial for related damages. Keep records of inspections, repairs, and maintenance activities, as they may be helpful in the event of a claim.

- Policy Endorsements and Riders:

- Depending on your insurance provider and policy options, you may have the opportunity to purchase additional endorsements or riders to enhance your roof coverage. For example, you might consider adding extended roof replacement coverage or coverage for roofing materials upgrades.

- Claims Process:

- In the event of roof damage, it’s essential to promptly report the damage to your insurance company and follow their claims process. Document the damage with photographs or videos, and keep records of any communication with your insurer.

- Your insurance company may send an adjuster to assess the damage and determine the coverage amount. Be prepared to provide documentation and cooperate with the claims process to expedite the resolution.

Before purchasing or renewing your homeowners insurance policy, carefully review the terms, conditions, and coverage limits related to roof coverage. If you have questions or concerns, discuss them with your insurance agent or provider to ensure you have adequate protection for your roof and your home.

Products to bundle with Maryland Homeowners Insurance

You know bundling your home and auto can save you money! But did you know that you can bundle other things with your homeowners insurance and save? Look at some ideas below!

By bundling your auto, home, and ATV, you will save money on each individual insurance policy which can lead to hundreds of dollars extra in your pocket!

| ATV |

| RV |

| Boat |

| Umbrella |

| Business |

| Motorcycle |

| Health |

| Auto |

| Life |

Maryland Homeowners Insurance:

Cheapest Homeowners Rates by City

We wanted to help you see who has the cheapest Homeowners insurance rates in each city in Maryland. Check out your city and see who it is!

When purchasing a new home, location should be a factor to consider the cost of insurance, as well as your desired location. Some homes have high brush fire scores, which make it more expensive to insure, or other associated risks.

Click Here to View a List of Best Rates by City

City Company Elkridge Progressive (ASI) North Bethesda Farmers Towson Liberty Mutual North Potomac Allstate Bel Air South Progressive Columbia Liberty Mutual Clinton Liberty Mutual Fairland Farmers Germantown Liberty Mutual Chillum Progressive Laurel Liberty Mutual Ballenger Creek Progressive (ASI) Parkville Amica Arnold Amica Owings Mills Travelers Middle River State Farm Arbutus Travelers Woodlawn USAA Rosedale NationWide Crofton Farmers Carney NationWide Oxon Hill Travelers Milford Mill American Family Annapolis USAA Wheaton American Family Salisbury Progressive Perry Hall Progressive (ASI) White Oak NationWide Hyattsville Travelers Ellicott City Progressive Clarksburg Liberty Mutual Dundalk Progressive Greenbelt Travelers Beltsville Travelers Randallstown Chub Baltimore NationWide Frederick NationWide Rockville Liberty Mutual Glen Burnie Liberty Mutual Cockeysville USAA Fort Washington Travelers Landover Travelers Odenton Chub Edgewood Liberty Mutual Pikesville Travelers Langley Park NationWide South Laurel Travelers Cumberland Farmers Eldersburg USAA Ilchester Liberty Mutual Severna Park USAA Bel Air North State Farm Gaithersburg Travelers

Will my Maryland Home Insurance Policy Cover Mold?

While some Insurance companies have policy exclusions, meaning things that they will not cover, you can get mold damage covered on your home insurance policy. If mold damage is the result of a sudden, unexpected occurrence such as a pipe burst that then caused mold damage, you will most likely be covered.

If mold has resulted from the owners own negligence, it is unlikely that will be covered under the home insurance policy. Some companies offer special endorsement coverages to cover these instances, check with your insurance company to see if they offer this for an additional cost.

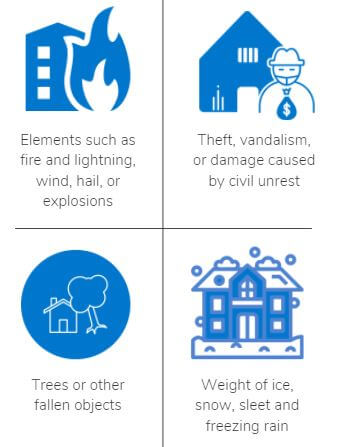

Most common Causes for Loss and claims for Maryland Homeowners Insurance (and nationwide)

By having homeowners insurance you are protecting yourself from the day to day unknown. There are so many things that can cause a loss to your home, so it’s good to be protected!

One of the most common claims that are made on Homeowners policies are injuries, secondly are weather related claims such as hail damage. If you live in an area with a lot of wind/hail damage, your insurance prices may be more.

| Injuries |

| Other Weather related |

| Theft |

| Water Damage |

| Vandalism |

| Lightning |

| Loss of Use |

| Hail |

| Fire |

| Wind |

Why Your Policy Might be so High: Rating Factors for Maryland Homeowners Insurance

Many things go into making up homeowners insurance rates. Some of these factors are listed below for your review.

Some of the biggest liabilities for insurance companies are properties with a swimming pool, or trampoline. Since swimming pools that are unfenced can become a liability, most insurance companies will not insure a home that does not have a locked fence around the entire pool. Most companies also will not insure a home that has a trampoline, or they may have special policy exclusions to not cover if someone were to get hurt on the trampoline.

| Protection Class Proximity to fire station |

| Home liability limits |

| Upgrades to Wiring plumbing |

| Dog breed |

| Deductible |

| Swimming pool or hot tub |

| Roof condition |

| Wood-burning stoves |

| Claims |

| Insurance score |

| Credit history |

| Value of home Replacement cost |

| Age of Home |

| Home-based business |

Maryland Homeowners Insurance: Do You Know What Your Insurance Covers?

Maryland Homeowners Insurance:

Average Cost of Homeowners (by city)

Homeowners rates can be different by city, state and company. Here are some companies with great AM ratings, check them out to see some rates!

When searching for reputable insurance companies, make sure to check AM Best and JD power to find all the ins and outs of each company. These sites will rate the companies on every category such as customer service, claims process, etc.

Click Here to View Average Cost by City

City Price Pikesville $1,376.00 Hyattsville $1,390.00 Silver Spring $1,167.00 Olney $1,279.00 Bowie $1,130.00 Landover $1,146.00 Oxon Hill $1,325.00 Clinton $1,300.00 Owings Mills $1,318.00 Wheaton $1,296.00 Dundalk $1,358.00 Carney $1,344.00 Germantown $1,281.00 Laurel $1,123.00 Seabrook $1,238.00 North Bethesda $1,393.00 Baltimore $1,353.00 Ilchester $1,329.00 Elkridge $1,222.00 Annapolis $1,354.00 Rockville $1,388.00 Westminster $1,349.00 Parkville $1,289.00 Chillum $1,323.00 College Park $1,315.00 Eldersburg $1,266.00 North Laurel $1,299.00 Cumberland $1,154.00 Fort Washington $1,335.00 Suitland $1,199.00 Bel Air North $1,261.00 Clarksburg $1,134.00 White Oak $1,397.00 Perry Hall $1,366.00 Fairland $1,373.00 Greenbelt $1,362.00 Middle River $1,371.00 Woodlawn $1,295.00 Salisbury $1,159.00 North Potomac $1,330.00 Glen Burnie $1,259.00 South Laurel $1,423.00 Towson $1,164.00 Aspen Hill $1,404.00 Cockeysville $1,245.00

How Much Is Maryland Homeowners Insurance? Rates by company

Of course, homeowners insurance rates vary per each company. Why not get multiple quotes at once to compare your options?

You could be paying more than you need to in home insurance, so every year when you get your renewal, check around to see if there are other competitive prices which may save you money.

| Company | Homeowners ($250,000) |

|---|---|

| Liberty Mutual | $1,453 |

| State Farm | $1,366 |

| USAA | $1,521 |

| Hartford Financial Services | $1,265 |

| Chubb | $1,447 |

| Erie Insurance | $1,327 |

| Travelers Companies Inc. | $1,509 |

| MetLife Inc. | $1,385 |

| Progressive | $1,291 |

| Farmers Insurance Group | $1,507 |

| Auto-Owners Insurance | $1,423 |

| American Family Insurance | $1,262 |

| Nationwide Mutual | $1,370 |

| Allstate | $1,313 |

Maryland Homeowners Insurance Most Frequently Asked Questions

What is the average cost of homeowners insurance in Maryland?

The average cost for homeowners insurance in Maryland is $1100-$1400 a year.

Is homeowners insurance required in Maryland?

Although homeowners insurance is not required in Maryland, if you have a loan on the home you will need to have the home insured.

What is the Maryland homeowners tax credit?

The Maryland Homeowners’ Property Tax Credit sets a limit on the amount of property taxes any homeowner must pay based on their income.

Additional Helpful Links

Questions About Homeowners Insurance In Another State?

Other Guides to the Best Insurance Rates in Maryland

| Best Auto Insurance in Maryland |

| Cheapest SR22 Insurance In Maryland |

| Motorcycle Insurance In Maryland: Best Rates |

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

Last Updated on by Marlon Moss