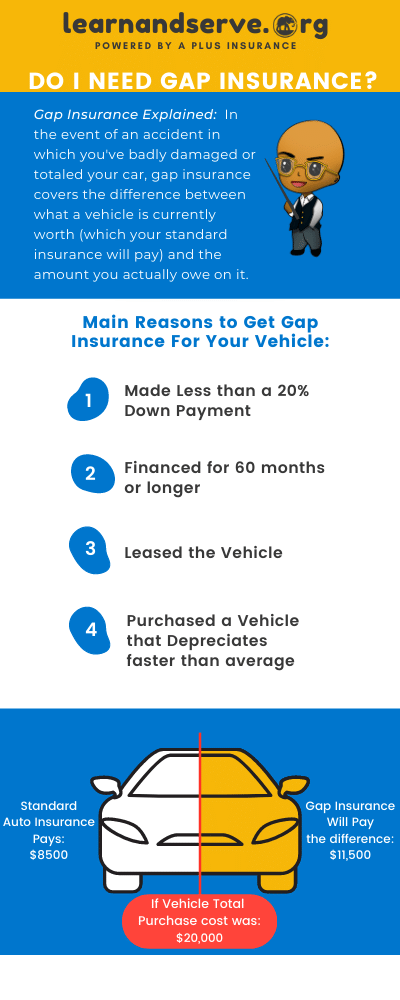

Gap Insurance Explained

1. Gap Insurance, What Is It? Gap insurance, also known as Guaranteed Asset Protection insurance, is a type of insurance coverage that helps protect you financially if your car is totaled or stolen and the amount you owe on the car loan is higher than the actual cash value of the vehicle. What Exactly Does […]

Gap Insurance Explained Read More »

![Ultimate Guide To Common Insurance Terms [Glossary] February 27, 2025 Questions About Insurance](https://learnandserve.org/wp-content/uploads/2017/06/ultimate-insurance-glossary.png)

![7 Reasons Why Washing Your Car Isn'T A Waste Of Time [Carwash Tips] February 24, 2025 Image Depicts An Individual Wiping Down A Car](https://learnandserve.org/wp-content/uploads/2020/09/car-image-updated.jpg)

![Hit By An Uninsured Motorist: Everything You Need To Know [Faqs] November 2, 2023 Uninsured Motorist](https://learnandserve.org/wp-content/uploads/2021/06/uninsured-motorist-featured-image.png)