- What Is The Average Cost Of A Car Accident

- Cost of a Car Accident: Minimum Limits

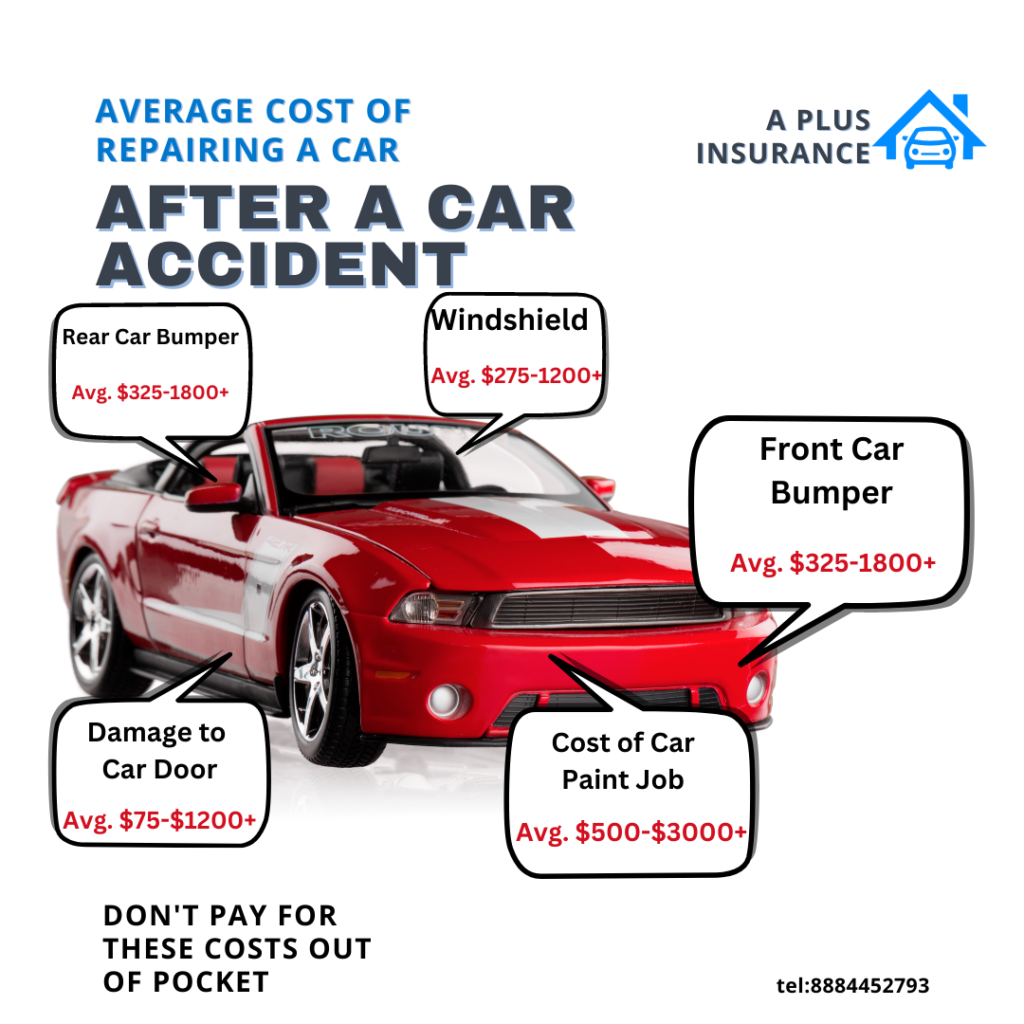

- Average Cost of a Car Accident

- Cost of a Car Accident- Easy Ways to Protect Yourself

- What factors determine the average cost of a car accident?

- How can A Plus Insurance help me find the best rates after a car accident?

- Do you offer assistance over the phone? How can I reach you?

- How much do most accidents cost?

- What We Do at A Plus Insurance

- How to Get a Free Quote and Save!

Here’s What Our Clients Say About Us

Cost of a Car Accident: Minimum Limits

Average Cost Of A Car Accident: When it comes to auto insurance, understanding what you are protecting now could prevent financial hardships later down the road. Minimum limit policies may save you money on your monthly premiums, but when they are put to the test are the few dollars saved worth it? Many states require that drivers carry at least a minimum limits auto policy (you can read about auto liability limits here), the problem is those limits are relatively low in comparison to the actual cost of a car accident where the other drivers are injured, or their cars are completely totaled.

And what many drivers don’t realize is that if they are deemed at fault in the accident, then they are financially responsible for property damage and bodily injury the other driver incurs and the average cost of a car accident can be expensive.

When at fault you are also financially responsible for the damages to your vehicle and if you don’t have full coverage you will be paying for the cost of a car accident out of pocket, and you will have to pay for your medical payments to the injuries that you and the other driver incur as well which could be paid with the maximum limit of your personal property injury.

Furthermore, coverages such as emergency roadside assistance and rental car reimbursement coverage can help tow your car to the nearest repair shop or if your car is completely totaled can help you have transportation while your car is getting fixed at the shop whether you are at fault or not.

While property damage is easy to assess, bodily injury can become more difficult and more costly. You aren’t just paying for broken bones, but time missed from work, duties that can no longer be performed in the home, taking kids to school, cooking dinner, grocery shopping, and mental stress or pain and suffering.

Average Cost of a Car Accident

Depending on the severity of the auto crash, it will depend on the amount that is paid out. According to data collected by the National Safety Council, an auto accident where a fatal injury occurs could reach upwards of $ 1 million, whereas an auto accident that leaves the other party severely disabled could be $80,000.

These numbers are for initial medical expenses alone, then you add follow-up care, lost wages, the other parties legal fees, plus your legal fees, and the amount skyrockets. It’s easy to see your minimum limits of $25,000 will be exhausted quickly and you will be left to pay out of pocket.

That is for bodily injury alone, you also have to consider the cost of property damage. Look around the area where you drive every day. Do you live in a city full of SUV-driving soccer moms? The average cost of a car accident with an SUV is $15,000 and that isn’t going to replace a Suburban or a Tahoe, it’s best to increase your limits that fit your surroundings.

Another concern that most clients have is that their car value will depreciate due to the car accident, however, if you are not at fault in a said accident then you will be reimbursed for the lost resale value of the vehicle.

Furthermore, insurance companies will and should help you cover the difference before it was wrecked and the repair cost. The downside of this is that there’s a potential possibility that your car insurance premium will rise after said accent.

Cost of a Car Accident– Easy Ways to Protect Yourself

Even if you are thinking, I don’t have a lot of assets now; keep in mind future assets can be at stake in a liability lawsuit. Upping your auto liability limits from the state minimum to a policy with 100,000/300,000/100,000 isn’t a huge price jump and is worth the peace of mind.

If you have more assets to protect, it’s wise to consider adding a personal umbrella policy as well. Most umbrella policies will add a million dollars worth of liability coverage for a relatively inexpensive annual premium. However, can you really put a price on knowing your financial future is secure especially when the average cost of a car accident can be so expensive?

We are here to help, if you have any questions about your current coverage or are looking to upgrade, give us a call

Frequently Asked Questions

What factors determine the average cost of a car accident?

The average cost of a car accident depends on various factors, including the severity of the collision, the extent of property damage, medical expenses, and legal costs.

How can A Plus Insurance help me find the best rates after a car accident?

A Plus Insurance shops multiple carriers to help you find the best rates. Our experienced team works with various insurance providers to ensure you get competitive and customized coverage.

Do you offer assistance over the phone? How can I reach you?

Yes, we offer assistance over the phone. Call us at 1.888.445.2793 to speak with one of our representatives for personalized assistance.

How much do most accidents cost?

The cost of a car accident varies significantly based on its severity. Minor accidents may involve costs in the lower thousands, while accidents resulting in injuries can start at around $40,000. Severe crashes leading to disabilities or fatalities can cost upwards of $155,000 to $1.8 million respectively. These estimates include medical expenses, lost productivity, property damage, and other associated costs.

What We Do at A Plus Insurance

How to Get a Free Quote and Save!

01.

Contact Us

Start by reaching out to us, either online, by phone, or in person. Provide basic personal and vehicle information to initiate the quote process.

02.

Details

Provide more detailed information about your driving history, the vehicle you wish to insure, and any specific coverage needs or preferences you have

03.

Quote

We will process your information and present you with a customized insurance quote, outlining coverage options and prices tailored to your needs.

04.

Decision

Review the provided quote at your leisure. If you decide to proceed, you can finalize the policy, setting up payment and coverage start dates.

Last Updated on by Veronica Moss