- What is a Double Deductible?

- Choosing Your Deductibles

- When Do I Pay My Deductible?

- Now, What is a Double Deductible?

- Pros and Cons of a Double Deductible

- What is a Double Deductible – In Summary

- Frequently Asked Questions about Double Deductibles

- What is a double deductible in insurance?

- When might a double deductible be applied in an insurance policy?

- Do I need a double deductible for my valuable possessions?

- What We Do at A Plus Insurance

- How to Get a Free Quote and Save!

Here’s What Our Clients Say About Us

Choosing Your Deductibles

So, we have heard of ‘regular’ deductibles, now what is a Double Deductible in regard to your Auto Insurance policy? First, let’s dive into the basics of full coverage and deductibles to get a better understanding.

Full coverage consists of Comprehensive and Collision coverage. Comprehensive (Other than Collision) will cover things like theft, fire, vandalism, and glass breakage. Collision will cover an impact with another vehicle or object.

A lower deductible will result in a higher car insurance rate, whereas a higher deductible will result in a lower car insurance rate. This means, the more you are responsible for paying out of pocket in the event of a claim, the cheaper Insurance rates you will be offered.

Usually, the standard deductible options are $100, $250, $500, and $1,000. Some companies offer a lower glass deductible such as $50, or $100 glass because windshield replacements may not cost as much as your deductible if you have a higher deductible selected.

When Do I Pay My Deductible?

Scenario 1 – If you are found At Fault in an Accident, but there is no damage to your vehicle you will not be subject to a deductible. Your Insurance company will pay out to the other party involved in the accident, up to your liability limits. This means if you carry a liability limit of 50/100/50, your insurance will pay $50,000 per person BI, up to $100,000 per accident, and $50,000 for property damage to their vehicle.

Scenario 2– If you are found At Fault in an Accident, and there is damage to your vehicle, then you need to pay your deductible. If you file a claim after an accident, that falls under Collision. You would pay your Collision deductible to the insurance company before they pay out for either the cost to repair/fix your vehicle, or the cost to replace it if totaled.

In some instances, if the Insurance adjuster decides to total the vehicle, you do not need to come up with the deductible out of pocket, they can subtract that from the payout price of the vehicle. For example, your vehicle is totaled and it is worth $15,000. They may write you a check for $14,000 (if you had a $1000 deductible).

Scenario 3– The other party/person is found At Fault in an accident, their liability limits will pay out for your bodily injury expenses and property damage to your vehicle. You are not subject to a deductible in this scenario because the other person’s Insurance will cover that cost whether or not you carry full coverage on your insurance policy or just liability.

Now, What is a Double Deductible?

In short, a double deductible means you will pay your deductible twice if you are subject to it. If one of the scenarios listed above requires you to pay your deductible, instead of paying $1000 deductible, you would pay $2000 or 2X your deductible.

- A double deductible means you pay twice your normal deductible amount for certain claims.

- It’s like having two deductibles stacked on top of each other.

When does it apply?

- First 30 days: Some policies have a double deductible for claims during the first month.

- Specific claim types: Certain events like vandalism, hail damage, or single-vehicle accidents might trigger it.

- Young drivers: Some insurers apply it to drivers under a certain age (e.g., 25).

- At-fault accidents: Some policies double the deductible if you’re deemed at fault.

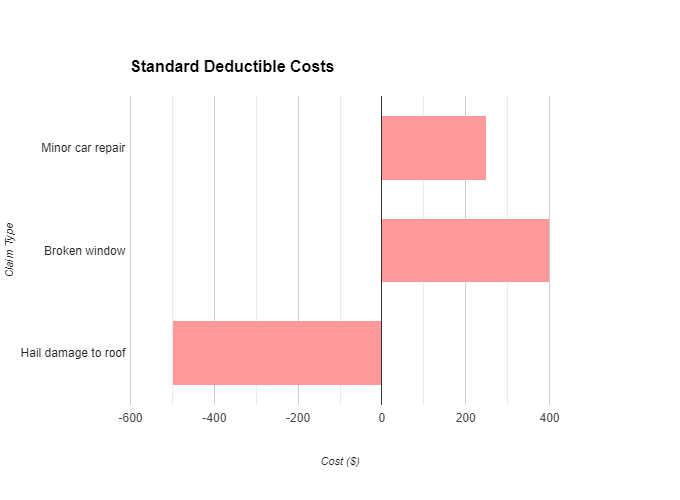

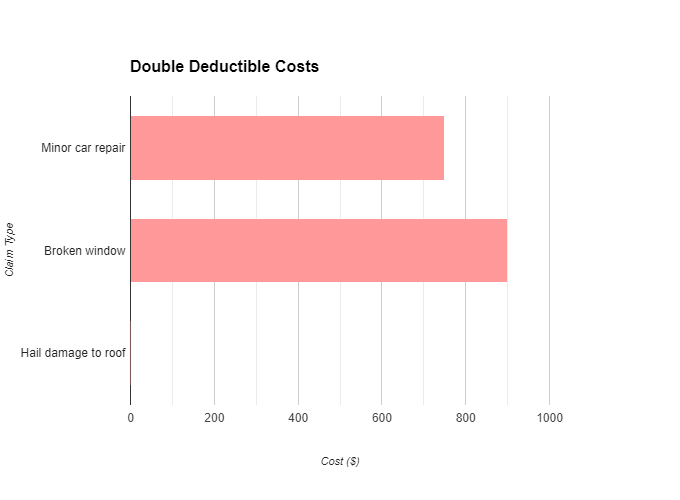

Comparison:

| Scenario | Standard Deductible | Double Deductible |

|---|---|---|

| Minor fender bender | Pay $500 | Pay $1000 |

| Vandalism to car | Pay $250 | Pay $500 |

| Teen driver’s accident | Pay $1000 | Pay $2000 |

drive_spreadsheetExport to Sheets

Tips:

- Read your policy carefully: Understand exactly when the double deductible applies.

- Choose wisely: Consider your risk tolerance and budget before opting for a double deductible.

- Maintain a good driving record: This helps avoid some double deductible situations.

- Negotiate with your insurer: They might be flexible depending on your circumstances.

- Have an emergency fund: Be prepared for higher upfront costs if needed.

Remember: A double deductible can significantly impact your out-of-pocket costs. Weigh the pros and cons carefully before choosing it.

Why would you want this double deductible? If you consider yourself a safe driver with no accidents or violations, this may be a cheaper option for you. You are saying you will pay 2X your deductible if you are required, which means the Insurance rates will be cheaper in this case.

Pros and Cons of a Double Deductible

When considering the option of a double deductible for your insurance policy, it’s important to weigh the benefits and drawbacks carefully. A double deductible typically means that the policyholder agrees to pay twice the usual deductible amount in the event of a claim. This option can affect both your premium costs and out-of-pocket expenses for repairs or replacements. Below, we explore the pros and cons of opting for a double deductible, followed by a supporting table to visually summarize these points.

Pros:

- Lower Premiums: Opting for a higher deductible, including a double deductible, can significantly lower your insurance premiums. This is because you’re assuming more of the financial risk yourself, reducing the potential payout from the insurer in the event of a claim.

- Reduced Small Claims: With a higher deductible, policyholders are less likely to file small claims, preserving their no-claims bonus and preventing premium increases over minor incidents.

- Better for Rarely Used Policies: For vehicles or properties that are rarely used or at lower risk of claims, a double deductible can make financial sense, minimizing annual costs for insurance that is seldom needed.

Cons:

- Higher Out-of-Pocket Costs: In the event of a claim, you’re responsible for a larger portion of the repair or replacement costs. This could be financially burdensome if you’re not prepared for the sudden expense.

- Risk of Financial Strain: If saving on premiums doesn’t translate to available cash when needed, the higher deductible can create a financial strain at the worst possible time—during a loss or damage event.

- Not Suitable for High-Risk Items: For high-value or high-risk items, properties, or vehicles, a double deductible could mean a prohibitively high cost in the event of a claim, outweighing the savings on premiums.

| Factor | Pros | Cons |

|---|---|---|

| Premium Costs | Significantly lower premiums due to higher financial risk on policyholder | None |

| Out-of-Pocket Costs | None | Higher out-of-pocket costs in the event of a claim |

| Claim Frequency | Reduced likelihood of filing small claims | None |

| Financial Planning | Can be part of a strategic financial plan for rarely used assets | Potential for financial strain if not prepared for the higher deductible expense |

| Risk Management | Encourages careful behavior to avoid claims | Not suitable for items at high risk of damage or loss |

What is a Double Deductible – In Summary

If you are a safe driver and chances are you will not be found At Fault in an accident, then the other person’s insurance would end up paying your damages anyways, so why not opt for the double deductible if it can save you? This option may not be in the best interest of everyone, so talk with your Insurance provider for greater insight if you are on the fence about this option.

Frequently Asked Questions about Double Deductibles

What is a double deductible in insurance?

A double deductible in insurance refers to a specific provision in some policies, typically for high-value items such as jewelry, fine art, or collectibles. With a double deductible, if a covered loss occurs, the policyholder must pay not one but two deductibles before receiving a payout from the insurance company. It provides additional protection for valuable possessions but may result in higher out-of-pocket expenses in case of a claim.

When might a double deductible be applied in an insurance policy?

A double deductible is commonly applied to insurance policies for high-value items, as mentioned earlier. It’s often seen in policies for jewelry, fine arts, antiques, or collectibles, where the items have a significantly higher value than the standard deductible of the homeowner’s or renter’s insurance policy. This provision ensures that valuable items receive specialized coverage and protection.

Do I need a double deductible for my valuable possessions?

Whether you need a double deductible for your valuable possessions depends on the specific items you own and their value. It’s essential to assess the worth of your possessions and discuss your insurance needs with a licensed insurance agent. If you have questions or need assistance, please feel free to call us at 1.888.445.2793. Our team of insurance professionals is here to help you make informed decisions and ensure your valuables are adequately protected.

What We Do at A Plus Insurance

How to Get a Free Quote and Save!

01.

Contact Us

Start by reaching out to us, either online, by phone, or in person. Provide basic personal and vehicle information to initiate the quote process.

02.

Details

Provide more detailed information about your driving history, the vehicle you wish to insure, and any specific coverage needs or preferences you have

03.

Quote

We will process your information and present you with a customized insurance quote, outlining coverage options and prices tailored to your needs.

04.

Decision

Review the provided quote at your leisure. If you decide to proceed, you can finalize the policy, setting up payment and coverage start dates.

Last Updated on by Veronica Moss