Home › Auto Quotes › Comprehensive vs. Collision

Comprehensive vs. Collision Coverage Guide

Plain-English answers with real examples so you can decide: keep both, adjust deductibles, or trim cost—without getting caught by lender rules or surprise exclusions.

Key Concepts People Mix Up

- “Full coverage” isn’t a product. It just means Liability + Collision + Comprehensive. If that’s your goal, start a quote.

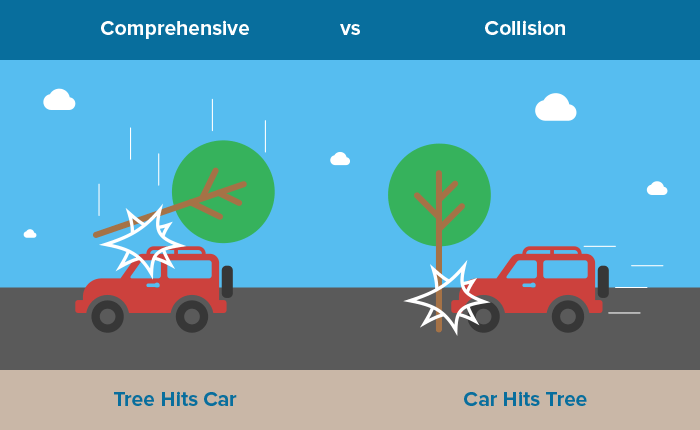

- Comprehensive covers non-collision events. Think hail, theft, vandalism, deer. Many carriers (e.g., Dairyland) offer glass-friendly options.

- Collision covers crash damage to your car. Single-car impacts and potholes count. Some carriers (Mendota) offer OEM parts endorsements.

- Lenders often require both coverages. Expect deductible caps if you lease/finance. Not sure? We’ll check your lender’s rules.

Comprehensive vs. Collision vs. Liability (with Real Examples)

| Feature | Comprehensive | Collision | Liability | Real-world example |

|---|---|---|---|---|

| What it covers | Non-collision perils: weather, theft, vandalism, animals, fire, falling objects | Impact with a vehicle/object, including single-car incidents | Injuries/property damage you cause to others | Hail dents roof/hood → comp; rear-end at stoplight → collision; you scuff a neighbor’s fence → liability |

| Pays for your car? | Yes (minus comp deductible) | Yes (minus collision deductible) | No | Deer strike smashes grille → comp pays after deductible; curb impact cracks wheel → collision |

| Pays others? | No | No | Yes | You’re at fault in a fender-bender → liability pays the other driver’s repairs (up to your limits) |

| Typical deductible | $250–$1,500 (glass options can differ) | $500–$2,000 | None (it’s a limit, not a deductible) | $500 comp deductible for hail; $1,000 collision for a parking-lot crash |

| Required by law? | No | No | Usually yes (varies by state) | Missouri requires liability; compare MO rates: car-insurance quotes in MO |

| Lender/lease requirements | Often required | Often required | Separate from loan/lease rules | Lease may cap deductibles (e.g., max $1,000); we’ll confirm during your quote |

Want exact numbers for your vehicle and deductible? Start your quote or call (888) 445-2793.

FAQs

What exactly does comprehensive insurance cover?

Short version: non-collision events—hail, wind, flood, theft, vandalism, fire, falling objects, and animal strikes (deer counts as comp, not collision).

Good-to-know nuances: glass can be separate (some carriers offer $0 windshield), flood is comp (not covered by collision), and claims pay up to your car’s actual cash value (ACV) after the deductible.

Park outside or live in a storm belt? Protect against weather & theft—get a tailored quote. Read carrier details like Dairyland.

What does collision insurance cover?

Short version: damage to your vehicle from an impact with a vehicle/object—including single-car crashes (pole, curb, pothole).

Good-to-know nuances: collision has its own deductible; payouts are capped at ACV; an OEM parts endorsement (available with some carriers) can limit aftermarket parts in repairs.

Unsure if the premium is worth it for your vehicle value? See side-by-side pricing or check carriers like Mendota.

Is “full coverage” an actual policy?

No—it’s a nickname for Liability + Collision + Comprehensive. It doesn’t automatically include rental reimbursement, roadside, GAP/loan-lease, rideshare, or custom parts coverage.

Lender tip: financed/leased cars typically require comp & collision and can cap deductibles (e.g., ≤$1,000). We’ll check your lender’s rules during your quote. California shoppers can also review Progressive Drive Insurance California.

How should I choose my deductibles?

Cash-comfort rule: pick the highest deductible you could pay today without stress. If you rarely claim, raising deductibles can trim premium.

Claims behavior matters: if you’d repair small dings via insurance, keep deductibles lower; if you’d self-pay small stuff, raise them.

Glass exception: windshield options can be $0 or a lower fixed amount, independent of your main comp deductible.

We’ll model the trade-offs for your car and location—run a quick quote. Missouri drivers can compare local pricing here: MO auto quotes.

When does it make sense to drop collision?

Math check: if yearly collision premium is a big slice of your car’s ACV, the payout upside may be limited.

Do not drop if: your vehicle is leased/financed (lienholders usually require both) or you’d struggle to self-fund a major repair.

Keep comp even if you drop collision: it protects against hail/theft/fire—common risks for older vehicles.

Unsure? We’ll do the ACV-vs-premium comparison with you: start your quote or call (888) 445-2793.

What really drives the cost of “full coverage”?

Inputs: driving record, age, miles, prior lapses; vehicle repair costs & safety tech; local claim patterns (hail/theft/flood); and your chosen limits/deductibles.

Ways to save: safe-driver and telematics discounts, bundling home + auto, and adjusting deductibles strategically.

We shop multiple carriers for fit + price—compare quotes or learn about Dairyland options.

Which carriers should I compare?

Look for differences in glass endorsements, OEM parts, rental reimbursement, and how each carrier prices hail/theft risk.

We commonly compare: Dairyland, Mendota, and for California, Progressive Drive Insurance.

Want our best-fit pick for your profile? Start your quote.

How to Decide in 3 Steps

Want the math done for you? Start a fast quote or call (888) 445-2793.

Why A Plus Insurance

Licensed brokers in 35 states. We shop multiple carriers to fit your budget and coverage goals.

1,000+ 4-star reviews. Independent, friendly help from real humans—by phone or online.

Here’s What Our Clients Say About Us

A Plus Insurance: Powered by Legacy

What We Do at A Plus Insurance

Last Updated on by Zee Caddick