- "Obtaining Progressive Insurance In Denver CO" is Easy with A Plus Insurance

- Benefits of Progressive Insurance for Denver, CO residents

- Progressive Insurance In Denver CO has Comprehensive coverage options

- Competitive pricing and discount opportunities for Progressive Insurance in Denver co

- Progressive has Convenient digital tools and a mobile app

- Denver residents enjoy exceptional customer service with Progressive

- Progressive Insurance in Denver, CO: Committed to Local Support and Community Engagement

- Progressive Insurance Denver Clients Experience a Smooth claims process

- Good Rates Compared to other Insurance providers in Denver, CO

- Is Progressive Insurance in Denver CO good for young drivers?

- Conclusion: Why Progressive Insurance is the best choice for Denver, CO residents

- What are the coverage options provided by Progressive Insurance in Denver, CO?

- How can I contact Progressive Insurance in Denver, CO for more information?

- What makes Progressive Insurance the best option in Denver, CO?

- Content Related Links

- Edit Article Information

“Obtaining Progressive Insurance In Denver CO” is Easy with A Plus Insurance

Benefits of Progressive Insurance for Denver, CO residents

As a leading insurance provider, Progressive has built a reputation for its commitment to customer satisfaction and innovation. By choosing progressive insurance In Denver Colorado, you can enjoy the peace of mind that comes with knowing they are protected by a reputable company that offers competitive rates and excellent coverage options!

Progressive Insurance In Denver CO has Comprehensive coverage options

First things first, what makes Progressive stand out in the Denver insurance scene? Well, it’s all about that comprehensive coverage. Progressive understands that one size doesn’t fit all when it comes to insurance, and that’s why they offer a smorgasbord of options. Whether you’re insuring your car, your home, or your rental, Progressive’s got a plan that suits you like a glove.

Let’s talk Auto Insurance. Denverites, you know traffic here can be a rollercoaster. That’s why Progressive goes above and beyond with their coverage. From basic liability to comprehensive and collision plans, they’ve got your back. They even throw in coverage for those pesky uninsured and underinsured drivers, so you’re never left hanging. Click to view Auto Insurance Requirements in Denver

Now, for the Homeowners in the house, Progressive has you covered, pun intended. Their home insurance not only protects your house but also your prized possessions, liability, and extra living expenses if things go south. Whether you’ve got a loft in LoDo or a bungalow in Baker, Progressive’s got the right plan for you.

Even Renters aren’t left out in the cold. With Progressive Insurance In Denver CO, your stuff is shielded from life’s curveballs. They’ve got your personal belongings, liability, and extra living expenses in case things take an unexpected turn.

But that’s not all, folks! Progressive doesn’t just offer cookie-cutter coverage. You can customize your policy to add extra protection for your valuables, like that vintage vinyl collection or your shiny new laptop. And if you’re into recreational toys like motorcycles, boats, or RVs, they’ve got plans for those too.

Progressive’s comprehensive coverage options give Denver residents the flexibility to choose the insurance that best fits their lifestyle and budget. With their wide range of options, you can feel confident that you’re getting the coverage you need without paying for unnecessary extras.

Competitive pricing and discount opportunities for Progressive Insurance in Denver co

“Price-conscious folks in Denver, take note! Progressive Insurance, right here in Denver, not only offers competitive rates but also a buffet of discounts to make your wallet smile. Safe drivers, multi-policy holders, and those who bundle multiple policies together can all enjoy extra savings. And if you’re all about convenience, Progressive Insurance in Denver CO, even offers discounts for paying your premium in full and setting up automatic payments.”

| Average rates for liability coverage by Company | Average Monthly Rate |

|---|---|

| Progressive Insurance | $102 |

| Dairyland | $105 |

| The General | $111 |

| Mendota Ins. Company | $132 |

| Bristol West | $135 |

Progressive has Convenient digital tools and a mobile app

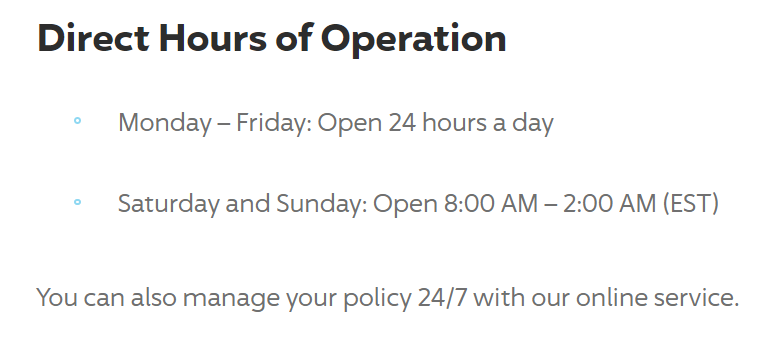

Now, let’s talk tech. In the digital age, convenience is king. Progressive knows this, which is why they’ve cooked up a slew of digital tools and a nifty mobile app. You can manage your policy online with ease, whether you’re making changes, updating your info, or checking on your coverage. And that mobile app? It’s like having your insurance agent right in your pocket. You can access your policy, file claims, track your progress, and even summon roadside assistance, all with a few taps.

- Online Portal Magic: Imagine having all your insurance needs just a few clicks away. Progressive’s online portal is your virtual gateway to policy bliss. You can easily access your policy info, make payments, and dive into the nitty-gritty of your coverage—all without leaving your cozy couch. Need to make tweaks to your policy? No sweat! Add a new car, drop one, or update your contact deets; it’s all a breeze.

- The App that Goes the Extra Mile: Now, let’s talk about Progressive’s mobile app. It’s like having your insurance agent right in your pocket. No matter where you are, your insurance policies are a tap away on your smartphone. Need to flash your ID cards? Easy peasy. Got a claim to file? No problem. And guess what? You can even keep tabs on your claim’s progress and summon roadside assistance with a few taps.

- Snapshot®: Your Driving Ally: But wait, there’s more! Progressive’s app isn’t just about policy management; it’s your wingman for safe driving too. Say hello to Snapshot®—the feature that watches your driving habits. Why? Because it could score you discounts based on your safe driving behavior. Plus, it serves up personalized insights and nifty tips to help you become a better, safer driver and pocket some savings on your insurance premiums.

So, whether you’re chilling at home or on the move, Progressive’s digital arsenal has your back. It’s all about having your insurance info at your fingertips, giving you peace of mind, and saving you heaps of time and effort.

Denver residents enjoy exceptional customer service with Progressive

When it comes to insurance, top-notch customer service plays a pivotal role. Progressive Insurance places paramount importance on delivering exceptional customer service to the fine folks of Denver, CO, at every juncture of their insurance journey.

Right from the moment you decide to seek a quote, all the way to the day you may need to file a claim, Progressive’s unwavering commitment to customer satisfaction shines through. Picture this: a dedicated team of insurance pros, well-versed in their craft, always eager to assist you. They’re not just knowledgeable; they’re friendly and approachable, ready to field your queries and address your concerns with a smile.

Now, the cherry on top is their accessibility. Progressive’s customer service squad is at your beck and call via phone, email, or online chat. They’ve got all the bases covered, ensuring you can reach out to them in the manner most convenient to you. So, whether you’ve got a burning question about your policy, need a helping hand with a claim, or simply want to tweak your coverage, rest easy knowing that Progressive’s customer service team is just a call or a click away.

But that’s not where their commitment ends. Progressive Insurance goes the extra mile by providing a treasure trove of resources on its website. It’s like having an insurance encyclopedia at your fingertips. They serve up informative articles, guides, and FAQs—all designed to demystify the world of insurance and empower you to make well-informed decisions about your coverage.

Progressive Insurance in Denver, CO: Committed to Local Support and Community Engagement

But it’s not just about convenience; it’s also about being a good neighbor. Progressive Insurance in Denver CO, is deeply rooted in the local community. They’re not just here to sell insurance; they’re here to make a positive impact. Progressive Insurance in Denver CO, supports local charities, sponsors community events, and chips in to help local organizations thrive. When you choose Progressive Insurance, you’re not just insuring your future; you’re investing in your community’s future too.

Progressive Insurance Denver Clients Experience a Smooth claims process

Navigating the murky waters of insurance claims can often feel like an anxiety-inducing journey. But fear not, dear Denver residents, for Progressive Insurance has your back, striving to transform this nerve-wracking experience into a smooth and hassle-free process.

Good Rates Compared to other Insurance providers in Denver, CO

Last but not least, the pricing. When you’re shopping for insurance, it’s all about comparing your options. Among the sea of insurance providers, Progressive Insurance in Denver CO floats to the top. Their comprehensive coverage, competitive pricing, outstanding customer service, and community involvement set them apart from the pack.

| Insurance Denver Company | Avg. Full Coverage Monthly Rate |

|---|---|

| State Farm | N/A |

| Dairyland | $191.00 |

| State Auto | N/A |

| Progressive Insurance | $174.00 |

| Acceptance RTR | $202.00 |

| Geico | $167.00 |

| Travelers | N/A |

| National General | $166.00 |

| Safeco | N/A |

| 21st Century | N/A |

| Allstate | N/A |

| Bristol West | $192.00 |

| Nationwide | N/A |

| Mendota Ins. Company | $205.00 |

| GAINSCO | $168.00 |

| AssuranceAmerica | $171.00 |

| USAA | N/A |

| The General | $177.00 |

Is Progressive Insurance in Denver CO good for young drivers?

When searching for insurance for young drivers in Denver, CO, it’s essential to consider various factors such as coverage options, pricing, and customer satisfaction. While I don’t have real-time data or specific reviews, several insurance companies are generally known for offering competitive rates and good coverage for young drivers. Some of these companies include:

Progressive: Progressive is known for its user-friendly online tools, and it often provides competitive rates. They offer Snapshot, a usage-based insurance program that can help lower premiums for safe driving.

Progressive offers a variety of auto insurance coverages to meet the needs of different drivers. Here are some of the common coverages provided by Progressive:

- Liability Coverage:

- Bodily Injury Liability: Covers injuries to others in an at-fault accident.

- Property Damage Liability: Covers damage to others’ property in an at-fault accident.

- Collision Coverage:

- Pays for damage to your vehicle in a collision with another vehicle or object.

- Comprehensive Coverage:

- Covers non-collision events such as theft, vandalism, natural disasters, and other incidents not involving collisions.

- Uninsured/Underinsured Motorist Coverage:

- Protects you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage.

- Medical Payments Coverage (MedPay):

- Pays for medical expenses for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP):

- Provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident.

- Roadside Assistance:

- Offers services such as towing, flat tire changes, and fuel delivery.

- Rental Reimbursement:

- Covers the cost of renting a car while your vehicle is being repaired after a covered claim.

- Custom Parts and Equipment Coverage:

- Protects customized or aftermarket parts and accessories added to your vehicle.

- Gap Insurance:

- Pays the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your car is totaled.

Conclusion: Why Progressive Insurance is the best choice for Denver, CO residents

In conclusion, if you’re a Denver resident in need of insurance, Progressive is a top pick. They’ve got the coverage you need, the prices you’ll love, and a commitment to the community that’s hard to beat. So, don’t settle for less. Choose Progressive Insurance and enjoy the peace of mind that comes with being in the hands of experts who understand the unique needs of Denver, Colorado. It’s not just insurance; it’s protection, convenience, and community all rolled into one.

What are the coverage options provided by Progressive Insurance in Denver, CO?

Progressive Insurance offers a variety of coverage options, including auto, home, renters, and more.

How can I contact Progressive Insurance in Denver, CO for more information?

For further information, please call us at 1.888.445.2793.

What makes Progressive Insurance the best option in Denver, CO?

Progressive stands out due to its competitive rates, innovative tools, superior customer service, and various policy options.

Content Related Links

Obtaining Liability Insurance in Colorado

Affordable Colorado Motorcycle Insurance

Edit Article Information

Here you can edit the information about Progressive Insurance in Denver, CO.

- Progressive Insurance in Denver, Colorado offers comprehensive coverage for residents.

- Discover 7 compelling reasons to choose Progressive Insurance in Denver.

- For more information or to get a quote, call us at 1.888.445.2793.

Last Updated on by Marlon Moss