- Unbelievably Affordable, Best Car Insurance Denver: A Guide to Cheap Rates

- What Car Insurance Coverage Should I Have in Colorado?

- Best Car Insurance Denver: Types of Coverages Available

- Best Car Insurance Denver: Is Full coverage required by law?

- Best Car Insurance Denver: Full Coverage Vs. Liability Only

- Best Car Insurance Denver: Full Coverage Companies

- Factors Affecting Car Insurance Rates in Denver

- Utilizing Discounts to Lower Your Denver Full Coverage Premiums

- Best Car Insurance Denver: How Bundling Can Lower Your Denver Full Coverage Rates

- Conclusion: Finding the Best Car Insurance Denver

- Frequently Asked Questions

- What factors determine the best car insurance in Denver?

- How can I find the right car insurance coverage in Denver?

- Do you need assistance choosing the best car insurance in Denver?

What Car Insurance Coverage Should I Have in Colorado?

Colorado mandates that all drivers carry minimum liability coverage, consisting of at least $25,000 per person and $50,000 per accident for bodily injury, along with $15,000 for property damage. However, considering the rising costs of medical care and vehicle repairs, opting for higher coverage limits is often advisable to ensure comprehensive protection.

Beyond the state’s minimum requirements, it’s essential to consider additional coverage options for enhanced protection. Comprehensive and collision coverage can safeguard your vehicle from damages not related to collisions, such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage is also recommended, providing financial support in case you’re involved in an accident with a driver who lacks sufficient insurance. As a seasoned auto insurance agent, I recommend discussing your specific needs with our experienced brokers to tailor a policy that not only meets Colorado’s legal requirements but also provides comprehensive coverage for your unique situation. Our goal is to ensure you have the peace of mind that comes with knowing you’re adequately protected on the road.

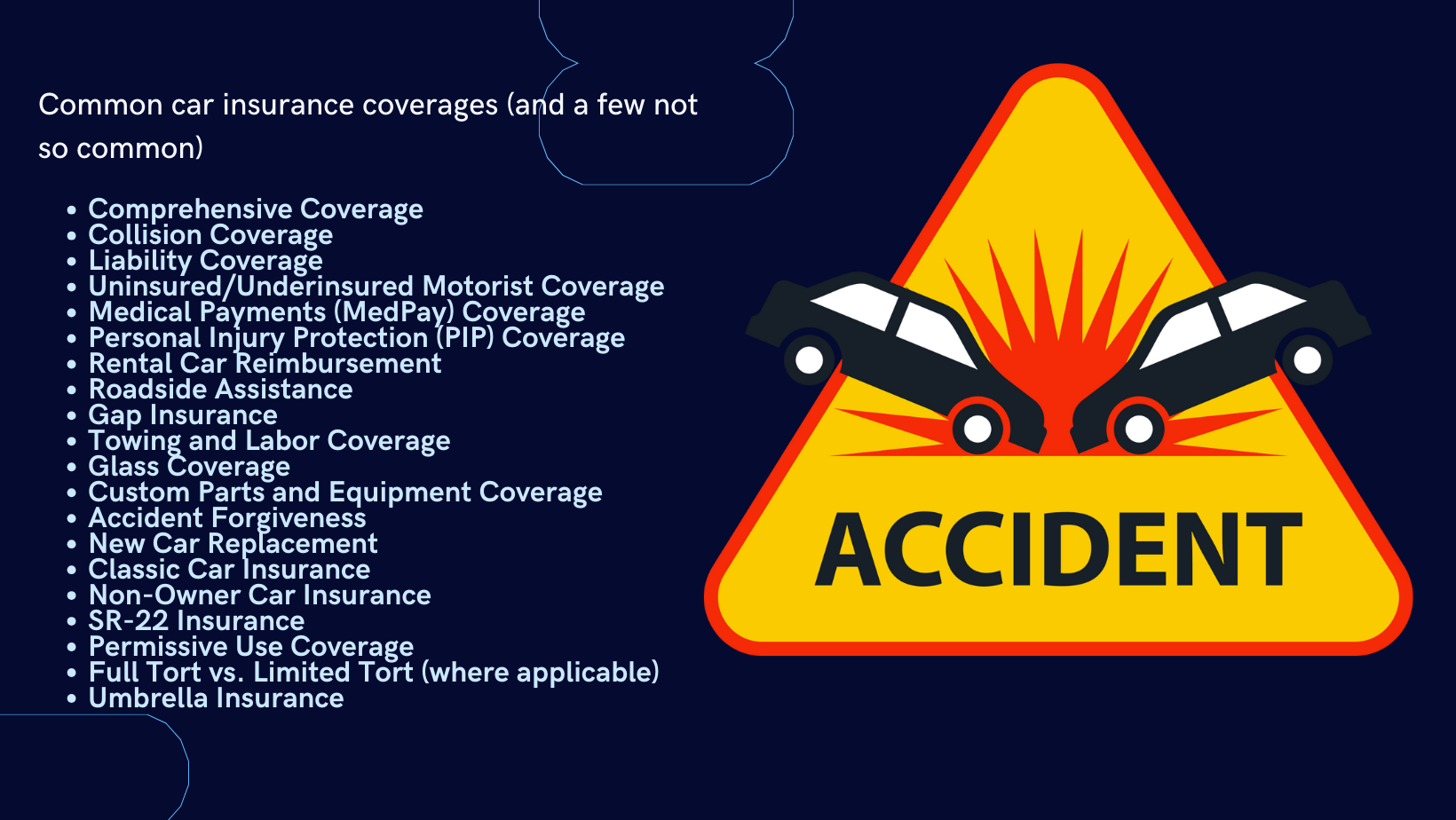

Best Car Insurance Denver: Types of Coverages Available

When it comes to car insurance options in Denver, there’s a wide array to explore. Denver residents can choose from various policies tailored to their individual needs in their search for the best car insurance in Denver.

It’s crucial not to misconstrue the term “full coverage” car insurance. It simply means that a car insurance policy includes comprehensive and collision coverages alongside required liability. However, it doesn’t encompass all possible add-ons and options. As shown below, there are quite a few coverage options when it comes to car insurance.

These options provide a range of choices to tailor your policy to your specific needs and preferences while driving in Denver.

This thorough examination ensures your policy not only meets your needs but also fits your budget, making it the ultimate choice for the best car insurance in Denver for your unique situation.

Best Car Insurance Denver: Is Full coverage required by law?

When it comes to understanding Denver’s car insurance requirements, a common question arises: “Is full coverage required by the state?” The answer can depend on a few factors. The easy answer: While Denver mandates liability insurance, the requirement for full coverage remains optional.

Nonetheless, opting for full coverage is a wise decision for more peace of mind.

When considering car insurance options, instead of asking “Is it required?” ask yourself “Why might I need full coverage?” Several compelling reasons come into play.

- Comprehensive Vehicle Protection: Full coverage provides peace of mind by safeguarding your vehicle against various risks, including accidents, theft, and damage caused by natural disasters.

- Loan or Lease Requirements: If you’re financing or leasing your vehicle, lenders often mandate full coverage to protect their investment until you’ve paid off the loan or lease.

- Protection from Uninsured Drivers: In the unfortunate event of an accident with an uninsured or underinsured driver, full coverage ensures you’re not left shouldering the financial burden.

- Personal Asset Protection: Beyond your car, full coverage can extend to protect your personal assets in case of a lawsuit resulting from an accident where you’re at fault.

- Enhanced Peace of Mind: Knowing you have comprehensive coverage means less stress on the road, allowing you to drive with confidence.

- Coverage for Special Circumstances: Full coverage often includes extras like roadside assistance, rental car reimbursement, and glass coverage, which can prove invaluable in specific situations.

While full coverage may come at a higher cost, the added protection and peace of mind it offers can make it a wise investment, depending on your individual circumstances and risk tolerance. It’s essential to assess your needs, budget, and the value of your vehicle to determine if full coverage is the right choice for you.

Best Car Insurance Denver: Full Coverage Vs. Liability Only

When it comes to understanding auto insurance, it’s vital to grasp the distinction between two common options you will be offered: full coverage and liability-only insurance. These choices represent different levels of protection, each with its own set of advantages and considerations.

Full Coverage Insurance:

Full coverage insurance is often seen as the more comprehensive option. It typically includes two main components:

- Liability Coverage: Just like liability-only insurance, full coverage includes liability insurance, which covers damages you may cause to others in an accident where you’re at fault. This is a legal requirement in most places, including Denver.

- Comprehensive and Collision Coverage: What sets full coverage apart is the addition of comprehensive and collision coverage. These protect your own vehicle against various perils, including accidents, theft, vandalism, and natural disasters. They can be especially valuable if your vehicle is newer or has a higher value.

Liability-Only Insurance:

Liability-only insurance, as the name suggests, provides coverage for liability only. It includes:

- Liability Coverage: This component covers damages you might cause to others in an accident where you’re at fault. It’s the minimum coverage required by law in many places, including Denver.

Key Differences:

The primary difference between the two lies in what they cover:

- Full coverage protects both your vehicle and others, making it more comprehensive and, consequently, more expensive.

- Liability-only insurance covers only the damages you might cause to others, making it a more budget-friendly option.

The choice between full coverage and liability-only insurance ultimately depends on your individual circumstances, including your vehicle’s value, your budget, and your risk tolerance. If you have a newer or more valuable car, full coverage may provide the peace of mind you need. Conversely, if you’re looking to save on premiums, liability-only insurance may be a more suitable choice. It’s essential to evaluate your priorities and financial situation to make an informed decision.

Best Car Insurance Denver: Full Coverage Companies

When it comes to finding the best full coverage car insurance coverage in Denver, CO, a variety of reputable companies offer options to suit your needs. Here’s a list of insurance providers known for their full coverage policies in the Denver area, along with some potential monthly rates.

Keep in mind insurance rates can VARY quite dramatically from person to person, and from city to city.

| Carrier | Average Price |

|---|---|

| Progressive Insurance | $142 |

| National General | $148 |

| Acceptance RTR | $151 |

| Nationwide | $151 |

| American Family | $159 |

| Travelers | $160 |

| State Farm | $163 |

| GAINSCO | $167 |

| 21st Century | $168 |

| The General | $168 |

| Farmers | $169 |

| Liberty Mutual | $169 |

| Bristol West | $170 |

| Allstate | $171 |

| Geico | $171 |

Remember that the availability of full coverage options may vary based on your individual circumstances and the specific area within Denver. It’s advisable to compare quotes, read customer reviews, and consult with insurance agents to determine which company and policy align best with your needs and budget.

Factors Affecting Car Insurance Rates in Denver

While searching for the best car insurance rates in Denver, it’s essential to recognize the multifaceted factors at play. Here are 10 influential rating factors that can significantly impact your car insurance premiums in the Mile-High City:

- Driving Record: Your personal driving history, including accidents and traffic violations, can significantly affect your rates. A clean record usually leads to lower premiums.

- Age and Gender: Younger and male drivers often face higher insurance rates due to statistical risk factors.

- Vehicle Type: The make, model, and year of your vehicle can influence rates. Expensive or high-performance cars generally incur higher premiums.

- Location: Where you live within Denver can impact your rates. Areas with higher crime rates or traffic congestion may result in higher premiums.

- Coverage Levels: The extent of coverage you choose, whether it’s minimum liability or full coverage, directly affects your rates.

- Credit Score: In many states, including Colorado, your credit score can be used as a factor in determining your insurance rates.

- Annual Mileage: The number of miles you drive annually can affect your rates. Less time on the road can lead to lower premiums.

- Marital Status: Married individuals often enjoy lower rates compared to single drivers.

- Discounts: Taking advantage of discounts for factors like bundling policies, good student discounts, and safe driving programs can help reduce your rates.

- Local Regulations: Denver’s unique insurance regulations and requirements, along with state laws, can also impact your rates.

Understanding how these factors interplay in the calculation of your car insurance rates can empower you to make informed decisions and potentially find ways to lower your premiums while ensuring you have the coverage you need.

Utilizing Discounts to Lower Your Denver Full Coverage Premiums

When it comes to lowering your car insurance rates in Denver, snagging discounts can make a significant difference in your premiums. Here are some top-notch discounts to consider:

- Multi-Policy Discount: Bundling your auto insurance with other policies like home or renters insurance from the same provider often results in substantial savings.

- Safe Driver Discount: Maintaining a clean driving record without accidents or violations can lead to lower rates.

- Good Student Discount: If you’re a student with excellent grades, you can earn discounts on your car insurance premiums.

- Defensive Driving Course: Completing a defensive driving course can not only enhance your driving skills but also unlock discounts with many insurers.

- Anti-Theft Device Discount: Equipping your vehicle with anti-theft features can reduce the risk of theft and lead to insurance discounts.

- Low Mileage Discount: If you don’t drive your car frequently, you may qualify for lower rates due to the reduced risk of accidents.

- Pay-Per-Mile Insurance: Some insurers offer pay-per-mile policies, where your rate is based on how much you drive, making it ideal for occasional drivers.

- Safety Features Discount: Vehicles equipped with safety features like airbags, anti-lock brakes, and electronic stability control often qualify for lower premiums.

- Military Discount: If you or a family member is in the military, you may be eligible for special discounts from certain insurers.

- Loyalty Discount: Staying with the same insurance provider for an extended period can earn you loyalty discounts.

- Usage-Based Insurance: Opting for a usage-based insurance program, where your rate is determined by your driving habits, can lead to substantial savings.

- Good Credit Discount: Maintaining a solid credit score may make you eligible for lower insurance rates with some companies.

| Impact on rates | Discounts Available |

|---|---|

| Mild | Multi Policy |

| High | Auto Pay |

| Very High | Continuous Insurance |

| Mild | Multi Vehicle |

| Mild | Education Discount |

| Mild | Paperless Discount |

| High | Advanced Quote |

| Mild | Homeowners |

| High | No Accidents or Violations |

By exploring these discounts and discussing them with your insurance provider, you can tailor your policy to maximize savings while ensuring you have the coverage you need to navigate Denver’s roads with confidence.

| Progressive | Dairyland | Mendota/Advantage Auto |

|---|---|---|

| Married | Military | Paid in Full |

| Multi Vehicle | No Accidents or Violations | Homeowners |

| No Accidents or Violations | Homeowners | Multi Vehicle |

| Military | Multi Vehicle | Married |

| Continuous Insurance | Paid in Full | Auto Pay |

| Advanced Quote | Married | No Accidents or Violations |

| Education Discount | Multi Policy | Continuous Insurance |

| Multi Policy | Continuous Insurance | |

| Paperless Discount | Auto Pay | |

| Homeowners | ||

| Auto Pay | ||

| Paid in Full |

Best Car Insurance Denver: How Bundling Can Lower Your Denver Full Coverage Rates

Bundling insurance policies is a savvy financial move. Combining your auto, home, and other coverage under one provider not only streamlines paperwork but can also lead to significant savings. Insurers often reward bundling with discounts, making it an effective way to maximize your insurance benefits while minimizing costs.

| Company | Bundle | Without Bundle |

|---|---|---|

| Dairyland | $124 | $175 |

| Progressive Insurance | $131 | $142 |

| Bristol West | $132 | $170 |

| Mendota Ins. Company | $135 | $150 |

| Acceptance RTR | $136 | $151 |

Conclusion: Finding the Best Car Insurance Denver

In conclusion, finding the best car insurance for your needs in Denver, Colorado, requires careful consideration of various factors. It’s crucial to assess your specific requirements, including coverage types, deductibles, and budget constraints.

Additionally, researching and comparing quotes from multiple insurance providers can help you make an informed decision. Keep in mind that factors such as your driving history, location, and the type of vehicle you own also play a significant role in determining the right insurance coverage.

Ultimately, the best car insurance policy will be one that offers the right balance of coverage and affordability to meet your unique needs in Denver’s dynamic driving environment.

Frequently Asked Questions

What factors determine the best car insurance in Denver?

The best car insurance in Denver depends on several factors including coverage options, deductibles, premiums, customer service, discounts, and the insurer’s reputation for handling claims efficiently.

How can I find the right car insurance coverage in Denver?

To find the right car insurance in Denver, assess your needs, compare quotes from multiple insurers, consider coverage options, review customer feedback, and ensure the policy aligns with your specific requirements and budget.

Do you need assistance choosing the best car insurance in Denver?

Feel free to call us at 1.888.445.2793 if you need assistance in choosing the best car insurance in Denver. Our team is ready to help you with expert guidance and information.

Last Updated on by Marlon Moss