- CHEAP LIABILITY INSURANCE KANSAS: All about Liability Insurance in KS

- CHEAP LIABILITY INSURANCE KANSAS – THE RIGHT FIT?

- HOW MUCH WILL YOU PAY FOR CHEAP LIABILITY INSURANCE IN KANSAS?

- What are these Rating Factors?

- RATING FACTORS

- Cheap Liability Insurance Kansas: IS THERE A WAY TO BRING YOUR PRICE DOWN?

- GOOD CREDIT

- BAD CREDIT

- CLEAN DRIVING RECORD

- HOW MUCH IS CAR INSURANCE IN KANSAS PER MONTH?

- Cost for Liability only in Kansas (by city)

- Should I upgrade to full coverage in Kansas (by city)

- Who has the lowest liability price in Kansas (by city)

- Frequently Asked Questions About Cheap Liability Insurance in Kansas

- DOES KANSAS REQUIRE LIABILITY INSURANCE?

- OTHER HELPFUL LINKS – CHEAP LIABILITY INSURANCE KANSAS

Minimum Liability Requirements for KANSAS

25/50/25 and Uninsured Motorist 25/50. That translates to $25,000 per person up $50,000 per accident and $25,000 in Property damage. But also Uninsured motorist coverage at the same limits.

CHEAP LIABILITY INSURANCE KANSAS – THE RIGHT FIT?

It’s no secret that we all want a great rate for everything. Insurance is no different! The key may just be to go Liability Only with your policy!

“IS IT SMART TO GO LIABILIITY ONLY OR AM I LEAVING MYSELF UNDERINSURED?”

When it comes to insurance, the key is to get the right coverage for you. For example, if you are driving a PAID OFF vehicle that is a bit older and worth a couple thousand then adding Comprehensive and Collision would be OVER-INSURING you!! Let’s illustrate it!

STORY TIME: This is Janet, she owns a 2004 Toyota and it is pushing 300,000 miles! The bluebook on this bad boy is less than $2,000! If she opts for Full-Coverage adding Comp/Coll to her policy with $1,000 dollar deductibles and she damages the car door…. will it be Totaled? Or worth the cost to repair the car? A Car worth nearly the same amount as the deductible to repair it? Liability Only may be the way to go in this instance.

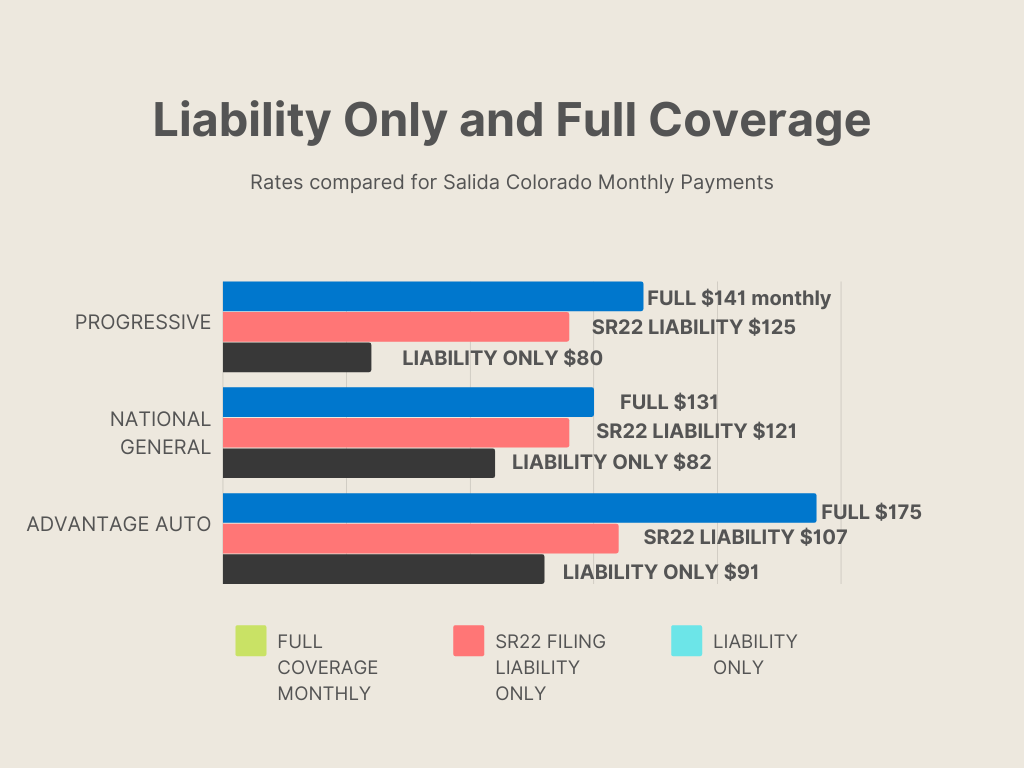

Check out the difference in the rates of LIABILITY ONLY and FULL COVERAGE! If you are making payments on your car, or a total loss of the vehicle would put you out dramatically getting full coverage is not the best option. Save yourself some money, take care of your clunker, and opt for Liability Only.

COST FOR CHEAP LIABILITY INSURANCE KANSAS

| Geico | $80 |

| The General | $82 |

| Progressive Insurance | $90 |

| National General | $94 |

| AssuranceAmerica | $95 |

| Mendota Ins. Company | $103 |

| Dairyland | $112 |

| Acceptance RTR | $117 |

| Safeco | $117 |

| State Auto | $120 |

| Bristol West | $121 |

| American Family | $122 |

| Travelers | $122 |

| USAA | $126 |

| 21st Century | $127 |

Make no mistake however, Liability Insurance does cover quite a bit! If you are involved in an accident, your Cheap Liability Insurance in Kansas will pay $25,000 in Bodily Injury expenses! This isn’t a small amount. The state deemed this limit to be sufficient for the average driver. Thus caring the State Minimums is a great guide.

HOWEVER!

You may opt for greater limits! Why? Well, consider the fact that the Bodily Injury limit is $50,000 per INCIDENT. That may not cover a person’s full medical expenses if there are multiple inured parties. You may choose to raise your limits higher, surprisingly the cost isn’t always tremendous to raise these coverage ceilings.

The same applies to Property Damage, which the State Minimum limit is set at $25,000.

Look up the cost of cars around you now. Do you see many within the $25,000 dollar range? If so, your limits are right where they should be. BUT, the average car in this current climate is worth MUCH more. It may be prudent to raise those limits as well.

THANKFULLY Kansas requires drivers to carry UNINSURED MOTORIST COVERAGE, which covers your if you are hit by an uninsured driver. Which unfortunately happens more than we’d like to admit.

THUS, you may not need FULL COVERAGE, but you may opt to simply raise your current limits of liability to better cover you.

HOW MUCH WILL YOU PAY FOR CHEAP LIABILITY INSURANCE IN KANSAS?

The answer to this question boils down to A FEW FACTORS.

The Average driver may be paying something similar to the chart below. By it’s definition an average is the typical value in a set of data. What this data is comprised of is what you are interested in, because this impacts your rate. So even though the average below isn’t dreadfully off base, there are factors that’ll swing this higher or lower.

| Progressive Insurance | $80 |

| Dairyland | $81 |

| National General | $85 |

| The General | $87 |

| Geico | $107 |

| Mendota Ins. Company | $110 |

| Bristol West | $112 |

| AssuranceAmerica | $114 |

| Nationwide | $114 |

| 21st Century | $125 |

| State Farm | $125 |

| Allstate | $130 |

| USAA | $135 |

| Farmers | $147 |

| Acceptance RTR | $148 |

As eluded to these figures don’t tell the whole story, to really know what you’ll be paying you have to key in on a few crucial pieces of information.

For Example, the price changes tremendously if YOU are a young driver as shown in the chart below:

| National General | $139 |

| Progressive Insurance | $142 |

| Dairyland | $144 |

| Acceptance RTR | $145 |

| The General | $156 |

| Mendota Ins. Company | $157 |

| American Family | $161 |

| Bristol West | $162 |

| Farmers | $163 |

| 21st Century | $169 |

| Allstate | $171 |

| GAINSCO | $171 |

| Liberty Mutual | $174 |

| AssuranceAmerica | $178 |

| USAA | $180 |

YOUNG DRIVER LIABILITY ONLY

Why is this? Well the short answer is RATING FACTORS!

Ratings Factors are used by the insurance carriers to decide how much you will pay for your insurance. It isn’t all about the car, a lot of our monthly premiums lean heavily on the DRIVER.

What are these Rating Factors?

CHECK OUT THIS QUICK VIDEO THAT BREAKS IT DOWN

RATING FACTORS

As you can see in the above video, there are a few essential items that impact your rate. Age, Gender, Year/Make/Model of Car, Credit, and so much more. Notice the charts below, we are going to show you the GENDER price difference!

MALE DRIVERS – CHEAP LIABILITY INSURANCE KANSAS

| Bristol West | $150 |

| Geico | $153 |

| Nationwide | $156 |

| The General | $157 |

| National General | $161 |

| Dairyland | $163 |

| Progressive Insurance | $167 |

| GAINSCO | $172 |

| Mendota Ins. Company | $174 |

| 21st Century | $182 |

| AssuranceAmerica | $182 |

| Acceptance RTR | $185 |

| Farmers | $188 |

| State Auto | $193 |

| Travelers | $193 |

MALE COMPARISON

The prices aren’t the worst, but this is for CHEAP LIABILITY INSURANCE IN KANSAS, not FULL COVERAGE. Clearly these prices are looking quite high, especially when compared to the Females. Notice the chart below:

FEMALE DRIVERS – CHEAP LIABILITY INSURANCE IN KANSAS

| 21st Century | $131 |

| Dairyland | $137 |

| AssuranceAmerica | $139 |

| Acceptance RTR | $149 |

| GAINSCO | $149 |

| The General | $150 |

| Bristol West | $155 |

| National General | $155 |

| Mendota Ins. Company | $157 |

| Progressive Insurance | $159 |

| Nationwide | $163 |

| Geico | $166 |

| Farmers | $173 |

| Travelers | $177 |

| Allstate | $180 |

FEMALE DRIVER COMPARISON

Why the gap is premiums when it comes to male vs female? Well as the above video explains, young male drivers are statically more likely to get in a car accident. This

Cheap Liability Insurance Kansas: IS THERE A WAY TO BRING YOUR PRICE DOWN?

The Short answer is YES.

How? Let’s break this down into Rating Factors that we can control, this is the key to winning at insurance!

A Rating Factor that heavily impacts your pocket is whether you have Good Credit or Bad Credit. Why?

Think about the kind of field this is, INSURANCE. The Carrier, be it Progressive, National General, The General, or etc. are promising to be there for you in the case of a catastrophe. But, don’t forget this is still a business and businesses have to make a Profit. Thus when deciding if someone is an ‘Insurable Risk’ you have to see if they are dependable. Are the bills being paid? Are there tremendous outstanding debts? Do they owe other insurance carriers a significant amount? These are just three items that can have an influence on your rate

If you haven’t already guessed it, we like charts. Notice below the difference in price between someone who has Good Credit and someone who has Bad Credit.

GOOD CREDIT

| Progressive Insurance | $128 |

| Dairyland | $133 |

| GAINSCO | $135 |

| Mendota Ins. Company | $138 |

| Geico | $141 |

| The General | $143 |

| AssuranceAmerica | $144 |

| Bristol West | $148 |

| Acceptance RTR | $153 |

| Nationwide | $158 |

| State Auto | $159 |

| National General | $166 |

| 21st Century | $170 |

| Farmers | $171 |

| Liberty Mutual | $178 |

BAD CREDIT

| Progressive Insurance | $155 |

| Geico | $158 |

| The General | $164 |

| AssuranceAmerica | $174 |

| 21st Century | $175 |

| Acceptance RTR | $182 |

| Dairyland | $183 |

| GAINSCO | $184 |

| National General | $185 |

| Bristol West | $187 |

| Farmers | $187 |

| Mendota Ins. Company | $187 |

| Nationwide | $199 |

| American Family | $201 |

| State Auto | $203 |

To put it simply, improve your credit. Have a financial plan. This can be a great stepping stone to better rates. Are there anymore ways to improve your rate that you can control?

YES!

CLEAN DRIVING RECORD

Remember, the insurance company is taking a risk by insuring an individual. The hope is that nothing occurs, everyone is safe, and life is perfect! BUT, rarely does this occur. Accidents happen. Life isn’t perfect. Thus, so that an individual is not burdened by the financial full weight of a loss, insurance companies step in to bare the burden.

THAT BEING SAID, if you have accidents, violations, and claims on your driving history…. it is a RED FLAG to insurance companies. It is a signal that this person has a history of poor judgement. There is a higher statistical likelihood that the insurance carrier will be paying money for this person with a Bad Driving Record than a Clean Driver.

| Dairyland | $127 |

| Nationwide | $133 |

| 21st Century | $136 |

| The General | $136 |

| Progressive Insurance | $141 |

| Acceptance RTR | $151 |

| GAINSCO | $152 |

| AssuranceAmerica | $157 |

| Mendota Ins. Company | $161 |

| USAA | $163 |

| Bristol West | $164 |

| Geico | $164 |

| Safeco | $165 |

| National General | $167 |

| American Family | $172 |

CLEAN DRIVER

ABOVE is a CLEAN Driver, now notice below:

| Progressive Insurance | $152 |

| 21st Century | $158 |

| GAINSCO | $166 |

| Dairyland | $174 |

| National General | $176 |

| Nationwide | $177 |

| Bristol West | $178 |

| Geico | $180 |

| The General | $180 |

| AssuranceAmerica | $186 |

| Mendota Ins. Company | $188 |

| Acceptance RTR | $190 |

| Travelers | $200 |

| State Auto | $202 |

| Farmers | $217 |

Bad Driving Record

As you can see with just two rating factors you can improve or ruin your insurance rates. Good credit and clean driver = Lower Cost. When you really look at the chart the price different isn’t DRASTIC, but remember, there are upwards of 20 different rating factors that can help or hurt you. Pull them all together and what could that look like?

Male, 22, bad credit, multiple violations could be paying $439.00 monthly.

Female, 28, good credit, no violations could be paying $123.54 monthly.

There are other ways to save on your monthly premium and the is the WAY you PAY!

HOW MUCH IS CAR INSURANCE IN KANSAS PER MONTH?

As we’ve discussed cost can very greatly. Below is an average what what folks in Kansas are paying for cheap liability insurance.

| The General | $82 |

| Progressive Insurance | $83 |

| Mendota Ins. Company | $88 |

| Dairyland | $94 |

| National General | $108 |

| USAA | $109 |

| Allstate | $110 |

| 21st Century | $112 |

| Nationwide | $114 |

| AssuranceAmerica | $115 |

| American Family | $122 |

| Farmers | $125 |

| Liberty Mutual | $128 |

| Travelers | $139 |

| Bristol West | $141 |

AVERAGE COST MONTHLY

BUT! Did you know the WAY YOU PAY has an impact on you premium for the full 6 months or year?

Certain Kinds of payment methods earn discounts that the insurance carriers happily dole out to smart insureds such as yourself! Check em out below:

PAY IN FULL: By the far the most economical way to pay. Pay in full means that you are paying your entire 6 month or 1 year policy in one shot. To insurance companies this screams commitment. Meaning after 2 and half months of the policy you’re not going to cut and run to another. You are paying your policy off, and not worrying about it for a year!

SAVINGS: Many carriers give discounts up to 15% when paying in full.

PAY BY EFT: This is the next most cost effective way to pay for your policy. Paying by EFT means you are paying monthly with an electronica transfer either with an ACCOUNT AND ROUTING NUMBER (Bigger savings) or by a CREDIT/DEBIT CARD.

SAVINGS: Many carriers give discounts up to 8% when paying by EFT.

Cost for Liability only in Kansas (by city)

| City | Price |

|---|---|

| Independence | $107.00 |

| Kansas City | $93.00 |

| Pratt | $93.00 |

| Ottawa | $97.00 |

| Mission | $98.00 |

| Wamego | $98.00 |

| Hays | $92.00 |

| Augusta | $105.00 |

| Fort Riley | $97.00 |

| Winfield | $91.00 |

| Haysville | $106.00 |

| Gardner | $88.00 |

| Clay Center | $91.00 |

| Baxter Springs | $91.00 |

| Iola | $105.00 |

| Goddard | $94.00 |

| Andover | $104.00 |

| Mulvane | $109.00 |

| Lawrence | $107.00 |

| Dodge City | $102.00 |

| McPherson | $103.00 |

| Abilene | $97.00 |

| Hugoton | $87.00 |

| Baldwin City | $103.00 |

| Paola | $91.00 |

| Topeka | $90.00 |

| Olathe | $103.00 |

| Ulysses | $106.00 |

| Leavenworth | $107.00 |

| El Dorado | $96.00 |

| Bel Aire | $98.00 |

| Roeland Park | $101.00 |

| Garden City | $99.00 |

| Salina | $107.00 |

| Park City | $105.00 |

| Shawnee | $103.00 |

| Manhattan | $97.00 |

| Emporia | $100.00 |

| Russell | $106.00 |

| Prairie Village | $95.00 |

| Coffeyville | $102.00 |

| Hutchinson | $98.00 |

| Arkansas City | $98.00 |

| Junction City | $94.00 |

| Wellington | $90.00 |

| Lansing | $107.00 |

| Overland Park | $98.00 |

| Leawood | $107.00 |

| Rose Hill | $95.00 |

| Chanute | $110.00 |

| De Soto | $101.00 |

| Wichita | $93.00 |

Should I upgrade to full coverage in Kansas (by city)

| City | Price |

|---|---|

| Shawnee | $175 |

| Wellington | $167 |

| Chanute | $166 |

| Independence | $181 |

| Tonganoxie | $171 |

| Paola | $179 |

| Osawatomie | $173 |

| Gardner | $175 |

| Pratt | $182 |

| Lansing | $146 |

| De Soto | $155 |

| Park City | $154 |

| Valley Center | $170 |

| Louisburg | $178 |

| El Dorado | $165 |

| McPherson | $148 |

| Topeka | $152 |

| Bel Aire | $154 |

| Leavenworth | $164 |

| Edwardsville | $174 |

| Parsons | $181 |

| Andover | $170 |

| Olathe | $162 |

| Goddard | $162 |

| Ottawa | $158 |

| Russell | $164 |

| Bonner Springs | $159 |

| Ulysses | $171 |

| Kansas City | $152 |

| Prairie Village | $168 |

| Wichita | $168 |

| Derby | $161 |

| Dodge City | $159 |

| Salina | $159 |

| Goodland | $164 |

| Abilene | $170 |

| Rose Hill | $153 |

| Basehor | $171 |

| Overland Park | $149 |

| Mission | $173 |

| Fort Riley | $175 |

| Baxter Springs | $164 |

| Haysville | $156 |

| Coffeyville | $182 |

| Atchison | $155 |

| Arkansas City | $170 |

| Mulvane | $157 |

| Newton | $178 |

| Augusta | $169 |

| Clay Center | $164 |

| Colby | $152 |

| Leawood | $166 |

| Junction City | $156 |

| Fort Scott | $159 |

| Hutchinson | $174 |

| Maize | $163 |

| Spring Hill | $175 |

Who has the lowest liability price in Kansas (by city)

| City | Carriers |

|---|---|

| Arkansas City | The General |

| Eudora | Geico |

| Paola | Geico |

| Baxter Springs | The General |

| Prairie Village | Geico |

| Osawatomie | The General |

| Gardner | Progressive |

| Hugoton | The General |

| Bel Aire | The General |

| Emporia | Progressive |

| De Soto | Progressive |

| Fort Riley | The General |

| Abilene | Liberty Mutual |

| Wellington | The General |

| Leavenworth | Progressive |

| Hutchinson | Farmers |

| Goodland | The General |

| Great Bend | Liberty Mutual |

| Fort Scott | Geico |

| Liberal | Progressive |

| Manhattan | Geico |

| Independence | Geico |

| Louisburg | Geico |

| Lawrence | The General |

| Hays | Farmers |

| Overland Park | Progressive |

| Shawnee | The General |

| Merriam | Geico |

| Salina | The General |

| Wichita | The General |

| Bonner Springs | The General |

| Edwardsville | Dairyland* |

| Colby | The General |

| Olathe | Dairyland* |

| Derby | The General |

| Rose Hill | Bristol West |

| Lenexa | The General |

| Augusta | Progressive |

| Chanute | Geico |

| Iola | The General |

| Pratt | Progressive |

| Leawood | The General |

| Haysville | Progressive |

| Ottawa | Progressive |

| Topeka | Bristol West |

| El Dorado | Progressive |

| Ulysses | The General |

| Maize | Progressive |

| Lansing | Progressive |

| Russell | Geico |

| Roeland Park | Progressive |

| Andover | Liberty Mutual |

| Kansas City | Progressive |

| Pittsburg | Farmers |

| Atchison | Progressive |

| Winfield | The General |

| Clay Center | Geico |

| Mission | Progressive |

| Garden City | Geico |

| Goddard | Progressive |

| Wamego | Progressive |

| Coffeyville | Geico |

| Parsons | Geico |

| Park City | Dairyland* |

| Baldwin City | Progressive |

| McPherson | Progressive |

| Concordia | Liberty Mutual |

| Basehor | Liberty Mutual |

| Valley Center | National General |

Frequently Asked Questions About Cheap Liability Insurance in Kansas

Q1: What is liability insurance, and why is it important in Kansas?

A1: Liability insurance provides coverage for damages you may cause to others in an accident. In Kansas, liability insurance is mandatory for all drivers to ensure that they can cover the costs of injuries or property damage they may cause in a car accident.

Q2: How can I find affordable liability insurance in Kansas?

A2: To find affordable liability insurance in Kansas, you can compare quotes from multiple insurance providers, consider higher deductibles, maintain a good driving record, and inquire about any available discounts or savings opportunities, such as multi-policy discounts.

Q3: What are the minimum liability insurance requirements in Kansas?

A3: In Kansas, the minimum liability insurance requirements typically include coverage limits for bodily injury and property damage. It’s essential to meet these minimum requirements to legally drive in the state. However, you may choose to purchase higher coverage limits for added protection.

DOES KANSAS REQUIRE LIABILITY INSURANCE?

Yes, Kansas requires liability insurance for all registered vehicles operating within the state. The minimum liability insurance coverage mandated by Kansas law includes $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. These requirements ensure that drivers have financial responsibility in the event of accidents they cause. Failure to maintain the minimum liability insurance coverage can result in penalties such as fines, license suspension, or vehicle impoundment. Therefore, it is essential for all Kansas drivers to obtain and maintain the required liability insurance coverage to comply with state law and protect themselves and others on the road.

OTHER HELPFUL LINKS – CHEAP LIABILITY INSURANCE KANSAS

| Looking for SR22 Insurance in Kansas? |

| Looking for Dairyland Insurance in Kansas? |

| Looking for Cheapest Broadform Policy in Kansas? |

| Looking for Auto Insurance Kansas? |

Last Updated on by Marlon Moss