- Why Did My Insurance Rate Go Up?

- KEY TAKEAWAYS

- Why did my insurance rate go up?

- Did my Insurance rate go up because of my Driving Record?

- Why did my insurance go up? Is it because of my Credit Report?

- Why did my Insurance Rate go up? Is it because I made changes to my policy?

- Do insurance rates go up randomly?

- Why did my Insurance Rate go up? Is it because my lost some discounts?

- Technology and Telematics: The Role in Rate Adjustments

- How to Get a Free Quote for Progressive Insurance in [state]

- SR22 Insurance Process

- Frequently Asked Questions about [keyword]

- Why did my insurance rate go up?

- How can A Plus Insurance help me find the best rates?

- What factors should I consider when shopping for insurance?

KEY TAKEAWAYS

- Accidents, Violations, and Claims can increase your rate.

- Policy Changes can increase your rate like upgrading to full coverage, adding drivers, or even adding more cars.

- Discounts Dropping off of your policy can increase your rate, like dropping auto pay, discontinuing the paperless discount, and/or accident-free discounts.

Why did my insurance rate go up?

Rate increases occur regularly! This is partly due to the price of EVERYTHING going up. Inflation is impacting everyone and auto insurance is effected as well.

If the cost of the car part has gone up, the cost to repair it has. If the cost of labor has raised then the consumer is paying more. That results in higher cost to the insurance carrier in the case of an accident.

But that is not always the cause to blame. Rate increases tend to be a combination of reasons.

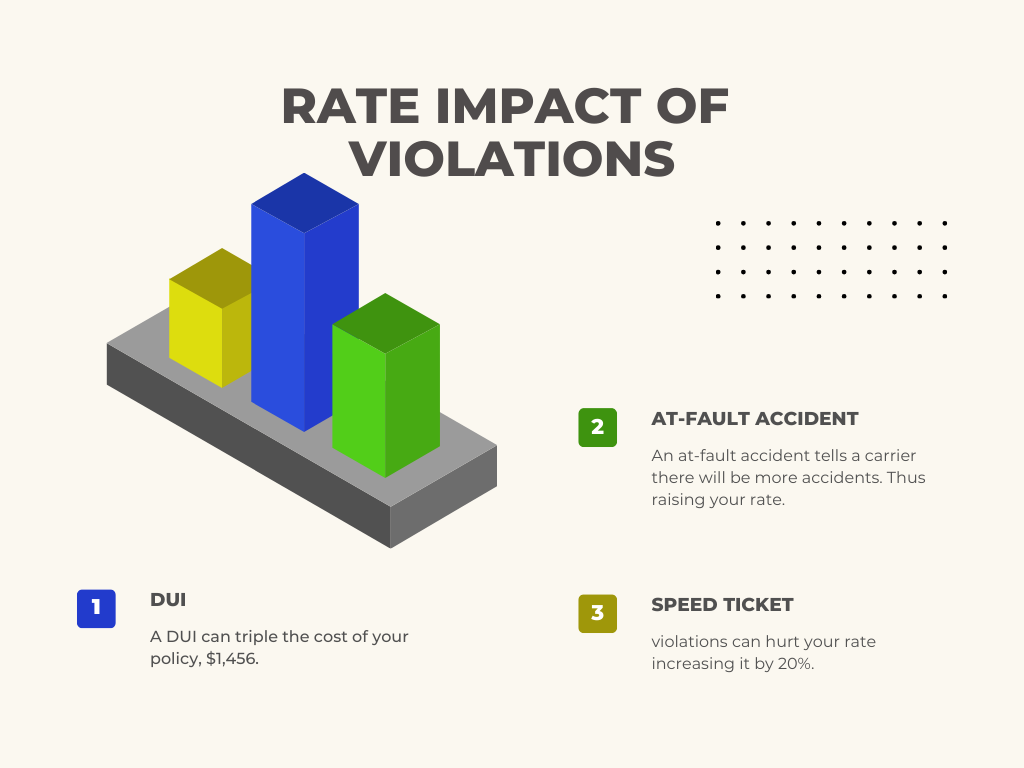

Did my Insurance rate go up because of my Driving Record?

Yes, your driving record whether good or bad can hurt or help the cost of your auto insurance. Let’s break this down:

- Accidents and Claims:

- At-Fault Accidents: If you’ve been involved in accidents where you were deemed at fault, expect an increase in your premiums. The severity of the accident may also influence the extent of the increase.

- Claims History: Making frequent claims, regardless of fault, can result in higher premiums. Insurance companies view policyholders who make numerous claims as higher risk.

- Traffic Violations:

- Speeding Tickets: Speeding tickets and other traffic violations can also lead to higher premiums. The more serious the violation, the greater the impact on your rates.

- DUI/DWI Convictions: Driving under the influence of alcohol or drugs is a serious offense that can have a substantial and lasting impact on your insurance premiums.

- Driving Record Period:

- Look-Back Period: Insurance companies typically assess your driving record over a specific period, often three to five years. Incidents within this period have a more significant impact on your premiums.

- Clean Driving Record:

- Safe Driver Discounts: On the flip side, a clean driving record can result in discounts and lower premiums. Some insurers offer safe driver discounts for individuals with no accidents or traffic violations.

- Insurance Points:

- Point System: Some states use a point system to track driving infractions. Insurance companies may use this system to assess risk, and accumulating points can lead to higher premiums.

- Insurance Score:

- Credit-Based Insurance Score: In addition to your driving record, insurance companies often consider your credit history when determining premiums. A good credit score can help offset the impact of a less-than-perfect driving record.

- Policyholder Age and Experience:

- Young Drivers: Inexperienced or young drivers may face higher premiums, as insurers consider them higher risk. A clean driving record becomes even more critical for these individuals.

| Mendota Ins. Company | $158 |

| Acceptance RTR | $160 |

| Progressive Insurance | $162 |

| GAINSCO | $164 |

| The General | $164 |

Why did my insurance go up? Is it because of my Credit Report?

Credit scores can play a role in determining insurance rates. Here’s how the relationship between credit scores and insurance rates works:

- Credit-Based Insurance Score:

- Insurance companies use a credit-based insurance score, which is distinct from the traditional credit score used by lenders. This insurance score is calculated based on factors in your credit report and is used to predict your likelihood of filing a claim.

- This score is not the same as your FICO credit score, but it shares some similarities. It considers information such as your payment history, outstanding debt, length of credit history, new credit accounts, and types of credit in use.

- Correlation with Risk:

- Insurers argue that there is a correlation between credit history and the likelihood of filing insurance claims. According to their data, individuals with lower credit-based insurance scores are more likely to file claims, and those claims are often more costly.

- However, the specific formula used to calculate these scores is proprietary information held by each insurance company, making it difficult to know exactly how your credit information is being used.

- Impact on Premiums:

- Individuals with higher credit-based insurance scores may be eligible for lower insurance premiums, while those with lower scores may face higher premiums.

- The impact of credit scores on insurance rates can vary by state and insurance company. Some states regulate or restrict the use of credit scores in insurance pricing.

- State Regulations:

- Some states have regulations in place that limit the use of credit scores in insurance pricing or require insurers to provide an alternative if an individual’s credit history is adversely affecting their rates.

- It’s important to be aware of the regulations in your state and understand your rights regarding the use of credit information in insurance.

- Improving Your Credit-Based Insurance Score:

- To improve your credit-based insurance score, focus on maintaining a positive credit history. Pay your bills on time, reduce outstanding debt, and avoid opening unnecessary new credit accounts.

- Regularly review your credit report for errors and address any discrepancies.

- Shopping Around for Insurance:

- Insurance companies weigh credit information differently, so it’s worthwhile to shop around for insurance quotes. Different insurers may place varying emphasis on credit scores, and you may find better rates with one company over another.

While the use of credit-based insurance scores is controversial, it is legal in many states and widely practiced by insurers.

Why did my Insurance Rate go up? Is it because I made changes to my policy?

Making adjustments to your coverage can directly impact the amount you pay for your auto insurance. Here’s how coverage changes can influence your premium:

- Coverage Levels:

- Increasing Coverage: If you decide to increase your coverage limits or add additional types of coverage (e.g., adding comprehensive or collision coverage), your premium is likely to go up. This is because you are expanding the scope of protection provided by your policy.

- Decreasing Coverage: Conversely, if you reduce your coverage limits or remove certain types of coverage, your premium may decrease. However, this also means you may have less financial protection in the event of an accident or loss.

- Deductibles:

- Increasing Deductibles: If you choose to raise your deductible amounts, your premium is likely to decrease. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can result in lower premiums.

- Decreasing Deductibles: On the other hand, lowering your deductibles generally leads to higher premiums but reduces the amount you pay upfront in the event of a covered incident.

- Adding or Removing Vehicles:

- Adding Vehicles: Adding a vehicle to your policy usually increases your premium because you are extending coverage to an additional vehicle.

- Removing Vehicles: Removing a vehicle from your policy may result in a decrease in your premium since there is one less vehicle covered.

- Changing Drivers on the Policy:

- Adding High-Risk Drivers: If you add a high-risk driver to your policy (such as a young or inexperienced driver), your premium may increase. Insurance companies assess risk based on the driving records of all individuals covered by the policy.

- Removing High-Risk Drivers: Conversely, if you remove a high-risk driver or someone with a poor driving record from your policy, your premium may decrease.

- Mileage Changes:

- Reducing Mileage: If your driving habits change, such as driving less annually, your insurance company may offer a lower premium. Reduced mileage is often associated with a lower risk of accidents.

- Credit Score Changes:

- Improving Credit Score: Improving your credit-based insurance score may lead to lower premiums. Many insurance companies use credit information to assess risk and determine rates.

- Discounts:

- Qualifying for Discounts: Taking advantage of discounts, such as safe driver discounts, good student discounts, or multi-policy discounts, can result in lower premiums.

- Claims History:

- Claims Frequency: Making frequent claims can lead to higher premiums. If you have a history of filing multiple claims, your insurance company may consider you a higher-risk policyholder.

It’s important to review your auto insurance policy regularly and make adjustments based on changes in your circumstances or needs.

Do insurance rates go up randomly?

It may seem like your insurance rates have a mind of their own, but they don’t rise arbitrarily. Insurance companies determine rates based on various factors, including claims history, driving record, and economic trends. Your rates might increase due to factors such as an accident, traffic violation, or even changes in your credit score. Insurance carriers regularly review their risk assessment models, which can lead to rate adjustments for certain demographics or regions. However, these adjustments aren’t random; they’re based on data analysis and actuarial principles.

- Factors influencing insurance rates:

- Claims history

- Driving record

- Economic trends

- Credit score changes

- Accident or violation history

Comparison of Rate Increases by Insurance Carrier:

| Insurance Company | Average Rate Increase |

|---|---|

| Progressive | $20 per month |

| Dairyland | $15 per month |

| Gainsco | $25 per month |

| Assurance America | $30 per month |

| National General | $22 per month |

Why did my Insurance Rate go up? Is it because my lost some discounts?

Auto insurance discounts are incentives offered by insurance companies to policyholders that can result in lower premium costs. These discounts are designed to reward certain behaviors, characteristics, or features that reduce the overall risk for the insurance provider. Here are common auto insurance discounts:

- Safe Driver Discounts:

- Accident-Free Discount: Offered to drivers with a clean driving record and no recent at-fault accidents.

- Good Driver Discount: Similar to the accident-free discount, this is for drivers with a history of safe driving.

- Vehicle Safety Features:

- Safety Features Discount: Given to policyholders with vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft systems.

- Policy and Account Discounts:

- Multi-Policy Discount: Bundling multiple insurance policies (such as auto and home insurance) with the same provider often results in a discount.

- Multi-Car Discount: If you insure more than one vehicle on the same policy, you may receive a discount.

- Driver Education and Training:

- Defensive Driving Course Discount: Completing a defensive driving course can lead to a discount on your premium.

- Driver Education Discount: Some insurance companies offer discounts to young drivers who have completed an approved driver education course.

- Good Student Discount:

- Good Grades Discount: Full-time students who maintain a high GPA may qualify for a good student discount.

- Low Mileage Discounts:

- Low Mileage Discount: If you drive fewer miles than the average driver, you may be eligible for a low mileage discount.

- Membership and Affiliation Discounts:

- Affinity Group Discount: Some insurers offer discounts to members of certain organizations, alumni associations, or professional groups.

- Military Discount: Military personnel and veterans may be eligible for discounts with certain insurers.

- Payment Discounts:

- Paid in Full Discount: Paying your annual premium in full rather than in installments may result in a discount.

- Auto Pay or Electronic Funds Transfer (EFT) Discount: Setting up automatic payments may qualify you for a discount.

- Loyalty Discounts:

- Renewal Discount: Some insurers offer discounts for policyholders who renew their policies with the same company.

- Usage-Based Discounts:

- Telematics Discount: Some insurance companies offer discounts based on data collected through telematics devices that monitor driving behavior, such as speed, braking, and mileage.

- Senior Discounts:

- Senior Driver Discount: Some insurers offer discounts to mature drivers who meet certain age and experience criteria.

- Green Vehicle Discounts:

- Hybrid or Electric Vehicle Discount: Owners of environmentally friendly vehicles may qualify for discounts.

Technology and Telematics: The Role in Rate Adjustments

- Usage-Based Insurance (UBI):

- Data Collection: Telematics devices, often installed in vehicles, collect data on driving habits, including speed, acceleration, braking, mileage, and even the time of day a vehicle is driven.

- Personalized Pricing: UBI allows insurers to tailor premiums to an individual’s actual driving behavior rather than relying on traditional risk factors. Safer drivers may receive lower premiums, while riskier driving behavior could lead to higher rates.

- Driver Behavior Monitoring:

- Safe Driving Incentives: Telematics data enables insurers to incentivize safe driving. Drivers who exhibit safe behavior, such as avoiding harsh braking or acceleration, may receive discounts or other rewards.

- Risk Assessment: Insurers can use telematics data to better assess risk and set premiums based on the actual risk profile of each individual policyholder.

- Anti-Theft and Recovery:

- Stolen Vehicle Recovery: Telematics technology can be used to track and recover stolen vehicles. Some insurers offer discounts for vehicles equipped with anti-theft and recovery systems.

- Usage Patterns:

- Low Mileage Discounts: Telematics data allows insurers to accurately track the number of miles driven. Drivers with lower annual mileage may qualify for discounts, as they are considered at lower risk for accidents.

- Time-of-Day Adjustments:

- Peak Hour Monitoring: Some insurers use telematics to monitor the time of day a vehicle is in use. Driving during low-risk hours may lead to lower premiums, as certain times of the day or night may pose higher risks.

- Environmental Impact:

- Eco-Friendly Driving Discounts: Telematics data can assess driving habits that contribute to fuel efficiency and reduced emissions. Insurers may offer discounts for environmentally friendly driving.

- Customer Engagement:

- Feedback and Coaching: Telematics devices often provide real-time feedback to drivers, encouraging safer habits. This engagement can contribute to improved driving behavior over time.

- Challenges and Concerns:

- Privacy Concerns: The use of telematics raises privacy concerns, as it involves the collection of detailed driving data. Insurers must address these concerns and ensure that customers are comfortable with the level of data collection.

Looking for SR22 Insurance? We’ve got the carriers you need for your financial responsibility filing, both in the State and out of the State.

How to Get a Free Quote for Progressive Insurance in [state]

01.

Contact Us

Start by reaching out to us, either online, by phone, or in person. Provide basic personal and vehicle information to initiate the quote process.

02.

Details

Provide more detailed information about your driving history, the vehicle you wish to insure, and any specific coverage needs or preferences you have

03.

Quote

We will process your information and present you with a customized insurance quote, outlining coverage options and prices tailored to your needs.

04.

Decision

Review the provided quote at your leisure. If you decide to proceed, you can finalize the policy, setting up payment and coverage start dates.

SR22 Insurance Process

01.

Consultation

We gather detailed information, ensuring you have all the facts before making a decision.

02.

Quote

Receive your SR22 insurance quote, customized to your unique needs and credit profile

03.

Filing

We work closely with the insurance carrier to ensure that the sr22 is filed with the state

04.

Policy Management

Our policy service doesn’t end once the documents are signed. We’re here for you, month to month.

Frequently Asked Questions about [keyword]

Why did my insurance rate go up?

Insurance rates can go up for various reasons, including changes in your driving record, claims history, or adjustments in our underwriting criteria. To get personalized assistance and understand the specific factors affecting your rate, please call us at 1.888.445.2793.

How can A Plus Insurance help me find the best rates?

At A Plus Insurance, we shop multiple carriers to find the best rates for you. Our experienced team compares quotes from various insurance providers, ensuring you get the coverage you need at the most competitive price.

What factors should I consider when shopping for insurance?

When shopping for insurance, consider factors such as coverage limits, deductibles, the reputation of the insurance company, and any available discounts. Our team at A Plus Insurance can guide you through these considerations to help you make an informed decision.

Here’s What Our Clients Say About Us

A Plus Insurance

replace links below with relevant links!!

Last Updated on by Camron Moss