- Comprehensive and Collision Coverage: What Is the Difference?

- Comprehensive Vs. Collision Vehicle Insurance: What it is NOT

- What’s the difference between comprehensive and collision insurance vs. full coverage?

- The Main Difference Comprehensive and Collision On Car Insurance:

- Collision Insurance Coverage

- Comprehensive Insurance Coverage

- Can I have Comprehensive Only On My Car Insurance Policy?

- Comprehensive Vs. Collision Deductibles

- Difference between Comprehensive and Collision and Liability

- Why Do I need Comprehensive and Collision Coverage On My Insurance Policy

- Comprehensive and Collision Cost: Average Full Coverage Rates

- Frequently Asked Questions about The Difference Between Comprehensive and Collision

- What is the main difference between comprehensive and collision coverage?

- When should I choose comprehensive coverage over collision?

- How can I get a personalized insurance quote for my needs?

- Is it better to have a $500 deductible or $1000?

- Difference Between Comprehensive and Collision

- What We Do at A Plus Insurance

Comprehensive Vs. Collision Vehicle Insurance: What it is NOT

If you recently financed a vehicle, your lienholder may have required you to have full coverage insurance.

While many people assume full coverage is an all encompassing auto insurance policy with all the coverages, that assumption is incorrect.

Full coverage insurance simply means you are adding comprehensive and collision coverage, the two kinds of coverages that cover Physical Damage to your own vehicle. You must also carry whatever your state requires.

What’s the difference between comprehensive and collision insurance vs. full coverage?

Comprehensive and collision insurance, when combined with liability coverage, are often referred to as “full coverage,” but it’s essential to understand the distinction between the terms.

Full Coverage is often used to describe the combination of both comprehensive and collision insurance.

- When someone says they have “full coverage,” it typically means they have comprehensive and collision coverage in addition to liability coverage (which covers damages to others’ vehicles/property).

- Full coverage provides more extensive protection for your vehicle, as it covers both collision and non-collision incidents.

It’s important to note that “full coverage” can vary between insurance providers and may not cover every possible scenario. Always review your policy’s terms and conditions to understand what specific protections are included in your coverage.

The Main Difference Comprehensive and Collision On Car Insurance:

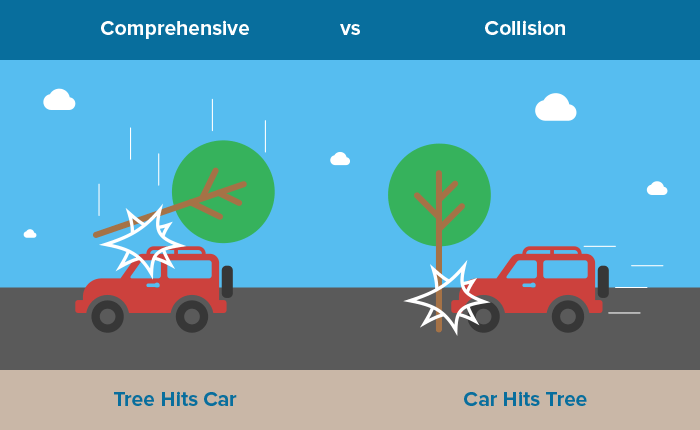

Comprehensive insurance covers non-collision damage to your vehicle, like theft or weather-related issues. On the other hand, collision insurance protects against damages caused by accidents. Choosing comprehensive and collision coverage is a wise decision for most drivers.

Collision Insurance Coverage

This auto insurance coverage pays for the damage caused to your car when you “collide” or have an accident with another vehicle, an object, a pothole, etc.

You must set a deductible when you add this to your policy. This means you must pay out of your own pocket the amount you set on your policy, before the insurance company pays for the rest of the damage.

Comprehensive Insurance Coverage

Also known as “other than collision,” this type of coverage will compensate you when your vehicle sustains damage that wasn’t caused by a typical collision accident. This might include things like theft, windstorms, floods, hail and hitting animals.

You must also set a deductible for comprehensive coverage. The lower your deductible, the higher your auto insurance rates will be.

Can I have Comprehensive Only On My Car Insurance Policy?

In certain situations, insurance companies may allow individuals to have comprehensive-only coverage (also known as garaging insurance) when the risk of collisions is minimal or when it aligns with the driver’s specific needs and circumstances.

Instances where a car insurance company might allow someone to have comprehensive-only auto insurance include:

- Older Vehicles: For older cars with lower market value, comprehensive coverage alone may be more cost-effective than full coverage.

- Low-Value Cars: When determining your insurance needs, consider the value of your car and your budget. If your car is older or has a lower value, comprehensive-only insurance is an option. However, if your vehicle is newer or valuable, comprehensive and collision coverage is recommended.

- No-Fault States: In states with no-fault insurance laws, medical expenses are typically covered separately, reducing the need for collision coverage.

- Uninsured Vehicles: If a vehicle is not actively driven or is in storage, comprehensive coverage may protect against theft, vandalism, or natural disasters.

- Personal Preference: Some drivers might opt for comprehensive-only insurance if they are comfortable covering potential collision damages out-of-pocket.

- Financial Constraints: When facing budgetary constraints, drivers might choose comprehensive coverage as a more affordable option.

Make sure to ask the specific auto insurance carrier about their policies and if comprehensive only is allowed in your situation. It’s essential to carefully assess individual circumstances and the vehicle’s value before opting for comprehensive-only insurance, as it leaves the policyholder exposed to financial risks in collision-related incidents.

Comprehensive Vs. Collision Deductibles

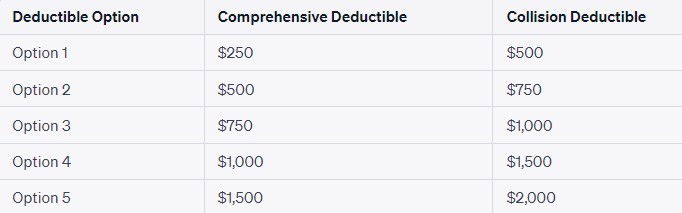

Comprehensive Deductible: The amount you would be responsible for paying before the comprehensive coverage kicks in, in the event of damage caused by incidents other than collisions (e.g., theft, vandalism, weather-related damage).

Collision Deductible: The amount you would be responsible for paying before the collision coverage takes effect, in the event of damage caused by a collision with another vehicle or object.

In this example, the deductible options vary from $250 to $1,500 for comprehensive coverage and from $500 to $2,000 for collision coverage. Keep in mind that choosing a lower deductible typically means higher premium payments, while opting for a higher deductible can result in lower premiums. The right deductible option for you will depend on your individual circumstances, risk tolerance, and budget.

Difference between Comprehensive and Collision and Liability

| Coverage Type | Coverage for Your Vehicle | Coverage for Others’ Vehicles/Property |

|---|---|---|

| Comprehensive & Collision | Yes | No |

| Liability Only | No | Yes |

What’s the difference between comprehensive and collision and liability?

Car insurance provides protection against various types of damage. Liability insurance only covers damages you cause to others. Comprehensive coverage handles incidents such as theft, vandalism, and natural disasters. Meanwhile, collision insurance addresses damages resulting from accidents with other vehicles or objects. Liability only offers no coverage for your vehicle.

Why Do I need Comprehensive and Collision Coverage On My Insurance Policy

Comprehensive and collision is not typically required by law, however, if you are financing a vehicle, your lienholder might require you to have it.

Also, if you have a newer or expensive vehicle, this offers protection and will cover repairs or the cost of replacing vehicle parts.

It’s also good to know that while their are some exceptions, many insurance companies will not allow you to add comprehensive without collision, and vice-versa.

Comprehensive and Collision Cost: Average Full Coverage Rates

The average cost of a full coverage auto insurance policy can vary widely depending on several factors.

| Auto Insurance Company | Avg. Monthly Rate in Colorado |

|---|---|

| National General | $129 |

| State Farm | $147 |

| Farmers | $149 |

| Nationwide | $150 |

| Progressive Insurance | $156 |

| The General | $156 |

| Travelers | $164 |

| Allstate | $165 |

| Bristol West | $165 |

| USAA | $166 |

| Acceptance RTR | $167 |

| Liberty Mutual | $167 |

| American Family | $168 |

| AssuranceAmerica | $170 |

These are sample rates from Colorado policies for good drivers

Insurers consider numerous variables when calculating premiums to determine the level of risk associated with each driver and their vehicle.

- Some of the main factors influencing the cost of a policy include the driver’s age, driving record, and credit history.

- Younger and less experienced drivers may face higher premiums due to perceived higher risk.

- Additionally, a history of accidents or traffic violations can increase rates.

- The type of vehicle, its make, model, and age also play a significant role; luxury and sports cars usually carry higher premiums.

- Moreover, the location where the car is primarily driven and stored affects costs, as urban areas or regions with higher accident rates may lead to more expensive coverage.

- Lastly, the level of coverage and deductibles chosen, as well as optional add-ons, can impact the overall cost of a full coverage policy.

It’s essential for drivers to compare quotes from various insurers to find the most suitable and affordable coverage for their individual needs.

Frequently Asked Questions about The Difference Between Comprehensive and Collision

What is the main difference between comprehensive and collision coverage?

When should I choose comprehensive coverage over collision?

How can I get a personalized insurance quote for my needs?

Is it better to have a $500 deductible or $1000?

Here’s What Our Clients Say About Us

A Plus Insurance

What We Do at A Plus Insurance

Last Updated on by Amanda Moss