Auto Insurance – Texas

Farmers Branch Insurance

No, we are not farmers… but we can farm up some great rates. Below are important factors that crop up in figuring your insurance rate. You can be paying as low as $82.00 a month for Liability Only with our buddies at DAIRYLAND Insurance.

- What Are The Liability Insurance Requirements In Farmers Branch?

- Farmers Branch Insurance Cheapest Liability Rates

- Average Rates For Full Coverage And Liability – Farmers Branch Insurance

- Cheapest Full Coverage Rates And Companies In Farmers Branch

- Farmers Branch Insurance

- SR22 Insurance Rates In Farmers Branch

- Additional Helpful Links

- INSURANCE SERVICES WE OFFER

- FAQs About Farmers Brand Auto Insurance at A Plus Insurance

- What types of auto insurance policies does A Plus Insurance offer with Farmers Brand?

- How can I request a free quote for Farmers Brand Auto Insurance from A Plus Insurance?

- What benefits does Farmers Brand Auto Insurance offer through A Plus Insurance?

- What is the #1 auto insurance in the US?

- Who typically has the cheapest insurance?

- Why does my insurance go up every 6 months?

- Farmers Branch Insurance Article

What Are The Liability Insurance Requirements In Farmers Branch?

Liability Insurance is a coverage that is requited in each state. The liability limits can differ from state to state. This is insurance that will cover injuries and property damage done to another party in an accident. Here below, you can see that the liability requirements for Texas is 30/60/25.

| State | Minimum Coverage Requirements | Average Cost for Minimum Liability Coverage |

|---|---|---|

| Texas | 30/60/25 | $578 |

This is a place to start when searching for insurance, as this is the bare minimum needed to be able to legally drive in the state of Texas. It is important to note that this doesn’t have to be the liability limits you stick with, you can opt for greater limits fully covering you in the case of an accident.

Farmers Branch Insurance Cheapest Liability Rates

Now that we went over what liability is, you are going to of course want to know what it is going to cost you. If you look below, we have listed 7 different companies in Farmers Branch and how they rank according to their average rates for liability.

| Rank | Company | Average Price |

|---|---|---|

| 1 | Dairyland (Viking) | $82.00 |

| 2 | Progressive | $94.00 |

| 3 | Bristol West | $95.00 |

| 4 | Liberty Mutual | $112.00 |

| 5 | The General | $118.00 |

| 6 | Travelers | $120.00 |

| 7 | Mendota | $124.00 |

Most opt for Liability Only for the cheaper rate, but springing for Full Coverage doesn’t have to break the bank. In fact it can protect you from being left with the repairs for you OWN auto in the case of an incident. Small cost upfront for big protection down the road. Literally!

Average Rates For Full Coverage And Liability – Farmers Branch Insurance

Coverage options when shopping for auto insurance, you can choose to do just liability, or you can do Full Coverage. Full Coverage is going to have more coverage, because it also covers your injuries and damages done in the event of an accident. Above you can see the pricing for both broke down for rates in Farmers Branch and the average rates in Texas.

| Liability Insurance Rates in Farmers Branch | Liability State Average |

|---|---|

| $712.96 | $510.15 |

| Full Coverage Insurance in Farmers Branch | Full Coverage TX average |

|---|---|

| $1,306.14 | $934.59 |

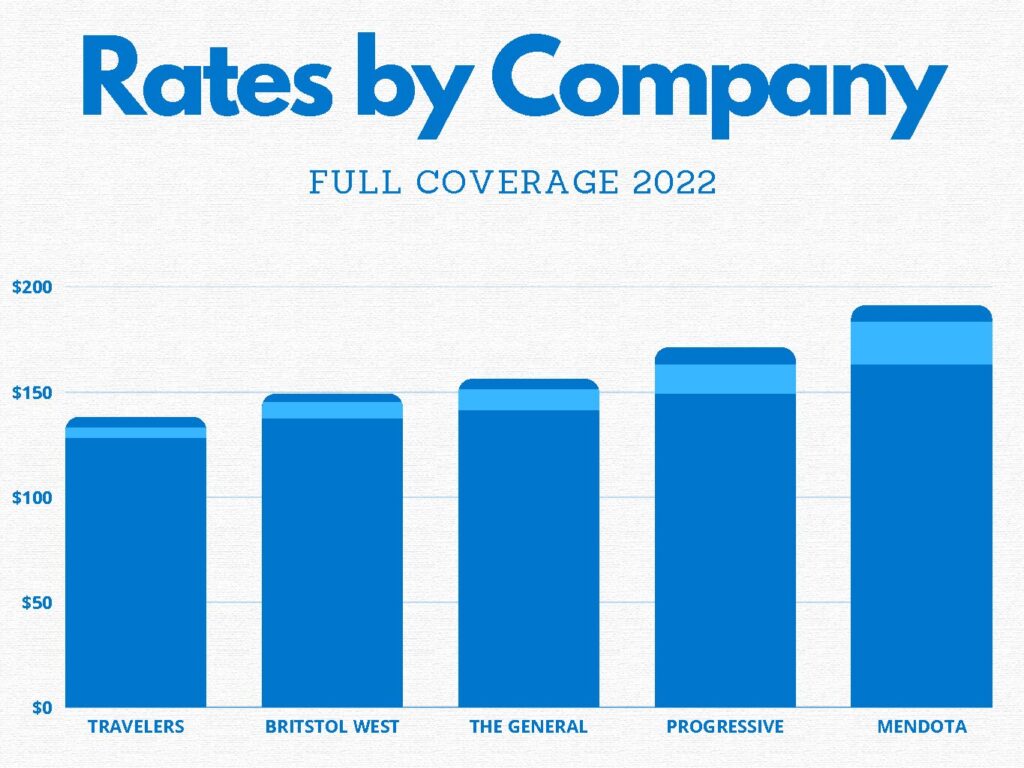

Cheapest Full Coverage Rates And Companies In Farmers Branch

Above are the rates for the top 5 full coverage policies by rate for your Farmers Branch Insurance. In most cases it is $35.00-$45.00 more a month.

Full Coverage is simply adding Comprehensive and Collision to your policy. Comprehensive is coverage on non-collision related unforeseen situations, like theft or damage due to weather. While Collision is damage due to…well… collisions.

When Would I Need Full Coverage?

Your Lienholder requires you to have full coverage for a vehicle you are making payments on or other circumstances due to the great quality of the auto. Yet, you might reject full coverage in the case of owning a jalopy. Why?

Well, when getting full coverage you have to decide how much skin your getting in the game. To that end an insured, you, will choose the deductible amount. $500 or higher, this number affects your monthly premium. So if your vehicle does get damaged you’ll be the deductible amount then the insurance kicks in for the rest. Now… what if the car is worth $500… then this insurance may be wasted on the jalopy… as sentimental as one may feel toward it.

| Rank | Company | Average Price |

|---|---|---|

| 1 | Travelers | $128.00 |

| 2 | Bristol West | $137.00 |

| 3 | The General | $141.00 |

| 4 | Progressive | $149.00 |

| 5 | Mendota | $163.00 |

| 6 | Liberty Mutual | $188.00 |

| 7 | Dairyland (Viking) | $191.00 |

Above we listed what the liability rates are and the companies that have the cheapest rates in Farmers Branch. Now, lets look at the same thing but for Full Coverage. Same thing here, look above at the chart and you will see 7 companies that rank from the cheapest rates to the highest. In this case, Travelers has the number one spot!

Farmers Branch Insurance

These rating factors help insurers assess the risk associated with insuring a particular driver and vehicle. While the specific weighting of these factors may vary between insurance companies, common rating factors used in Texas include:

- Driving Record: Your driving history is a significant factor in determining your auto insurance rates. Insurance companies typically consider factors such as accidents, traffic violations, DUI convictions, and the length of your driving experience.

- Age, Gender, and Marital Status: Statistically, younger and less experienced drivers tend to have higher accident rates, so age is often a significant factor in determining premiums. Additionally, gender and marital status can also impact rates, with married individuals and women often receiving lower premiums.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its safety features and value, can influence your insurance rates. Additionally, how you use your vehicle (e.g., commuting, pleasure, business) can also affect premiums.

- Location: Where you live and where your vehicle is primarily parked can impact your insurance rates. Urban areas with higher population densities and higher rates of accidents or vehicle thefts may result in higher premiums compared to rural areas.

- Credit History: In many states, including Texas, insurance companies may use credit-based insurance scores to determine premiums. Maintaining a good credit score can help lower your insurance rates, as individuals with higher credit scores are perceived as lower-risk policyholders.

- Coverage and Deductibles: The types and amounts of coverage you choose, as well as the deductibles you select, can impact your insurance premiums. Opting for higher coverage limits and lower deductibles typically results in higher premiums, while lower coverage limits and higher deductibles can lead to lower premiums.

- Prior Insurance Coverage: Insurance companies may consider whether you have had continuous coverage in the past and any gaps in your insurance history when calculating premiums. Maintaining continuous coverage without lapses can sometimes result in lower rates.

- Driving Habits and Mileage: How much you drive and your driving habits can also influence your insurance rates. Drivers who have lower annual mileage or who use their vehicles primarily for pleasure may qualify for lower premiums compared to those who commute long distances or have high-mileage vehicles.

- Discounts and Loyalty Programs: Many insurance companies offer discounts for various factors, such as bundling multiple policies, completing defensive driving courses, having certain safety features installed in your vehicle, and maintaining a clean driving record. Taking advantage of available discounts can help reduce your insurance costs.

It’s important to note that each insurance company uses its own proprietary algorithms and underwriting criteria to determine premiums, so rates can vary significantly between insurers. Additionally, some factors, such as age and location, may have a more substantial impact on premiums than others.

SR22 Insurance Rates In Farmers Branch

Another quote we can give you for you Farmers Branch Insurance is for an SR22 if needed. Some carriers do not file with it but listed below we have a few options that do.

On the chart, we have listed the company on the left and on the right side you will see the SR22 fee to file and if the company even files with it. Feel free to give us a call and we can help you!

Below is amount the amounts company adds to the premium to file the SR22 with the state.

| Company | Average (SR22 Fee) |

|---|---|

| Assurance America | $25 |

| Bristol West | $35 |

| Dairyland | Free |

| Gains Co | $25 |

| Mendota | $25 |

| Progressive | 5% (average) |

| State Farm | SR22 Not available |

| The General | $25 |

| Travelers | SR22 Not available |

Farmers Branch is home to the Coca-Cola Enterprises Offices and is a champion of diversity, education, and innovative commercial development.

This has led it to becoming a booming family town, this can lead to a huge discount for your Farmers Branch insurance if you are a family with multiple vehicles!

We Serve many different cities in the State of Texas, and we have saved new customers in Texas $562.00 on a new policy! Find your City belwo or START HERE to get a quote now!

Additional Helpful Links

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

FAQs About Farmers Brand Auto Insurance at A Plus Insurance

What types of auto insurance policies does A Plus Insurance offer with Farmers Brand?

A Plus Insurance offers various auto insurance policies in partnership with Farmers Brand. Our coverage includes liability insurance, full coverage, and more. If you’re interested in a specific policy, contact our office at 888-445-2793 for details.

How can I request a free quote for Farmers Brand Auto Insurance from A Plus Insurance?

Getting a free quote for Farmers Brand Auto Insurance is easy. Simply call our office at 888-445-2793, and our experienced agents will assist you in obtaining a personalized insurance quote tailored to your needs.

What benefits does Farmers Brand Auto Insurance offer through A Plus Insurance?

Farmers Brand Auto Insurance, offered through A Plus Insurance, provides benefits such as competitive rates, comprehensive coverage options, and access to a network of trusted agents. To learn more, contact our office at 888-445-2793.

What is the #1 auto insurance in the US?

The #1 auto insurance in the US is often considered to be State Farm, known for its extensive coverage options and nationwide availability. However, the best choice can vary based on individual needs and state regulations.

Who typically has the cheapest insurance?

Typically, drivers with a clean driving record and good credit history can find the cheapest insurance rates. Companies like Progressive, Geico, and State Farm often offer competitive rates, but it’s important to compare quotes to find the best deal for your specific situation.

Why does my insurance go up every 6 months?

Insurance rates can increase every 6 months due to factors like inflation, changes in your driving record, or adjustments in your credit score. Insurance companies also periodically reassess risk factors, which can lead to rate changes.

Farmers Branch Insurance Article

Headline: Farmers Branch Insurance

Description: Discover the Best Insurance Options in Farmers Branch, Texas

Author: Learn and Serve Insurance

Publisher: Learn and Serve Insurance

Main Entity URL: https://learnandserve.org/insurance-texas/farmers-branch-insurance/

Article Body:

- Our team at Learn and Serve Insurance is here to provide you with comprehensive insurance options in Farmers Branch, Texas. We offer a wide range of insurance types, including car insurance, home insurance, motorcycle insurance, and more. With competitive rates and excellent customer service, we’re your trusted insurance partner in Farmers Branch.

- For more information about our insurance policies and to get a free quote, please call us at 1.888.445.2793.

- Here’s what you can expect from our Farmers Branch Insurance services:

- Competitive insurance rates

- Expert guidance on choosing the right policy

- Resources to help you compare insurance companies

- Special discounts for American military personnel

- Quick and easy quotes, online or by phone

- Convenient access to ID cards and proof of insurance

- Coverage options for high-risk drivers and more.

- Contact us today to secure your peace of mind with the best insurance coverage in Farmers Branch!

Last Updated on by Marlon Moss