AUTO – COLORADO

Grand Junction Insurance

START HERE with Liability only and potentially get insured for $80.00! This is the required insurance amount to drive legally in Colorado.

The Colorado required minimum liability limits are 25/50/15 which stands for $25,000 per person for bodily injury up to $50,000 per accident for Bodily injury (if multiple people are involved) and up to $15,000 for Property Damage.

Additional Coverages Offered for Grand Junction Insurance

Drivers may choose to add coverages in additional to the required Liability Limits. Coverages that are optional for a small additional premium are Uninsured/Underinsured Motorist Bodily Injury Protection & Property Damage. Medical Payments, Roadside Assistance, Rental Reimbursement, and Full coverage (Comprehensive and Collision)

| Carriers | Average Price |

|---|---|

| National General | $80 |

| Bristol West | $94 |

| The General | $100 |

| Geico | $103 |

| Mendota Ins. Company | $103 |

| Progressive Insurance | $103 |

| Dairyland | $106 |

| American Family | $110 |

| AssuranceAmerica | $110 |

| Farmers | $116 |

| Liberty Mutual | $117 |

| State Farm | $118 |

| USAA | $133 |

| Safeco | $134 |

| GAINSCO | $135 |

What Are The Minimum Liability Limits I Need For Auto Insurance In Colorado?

Who Has The Cheapest Rates For Grand Junction Insurance – Auto Insurance?

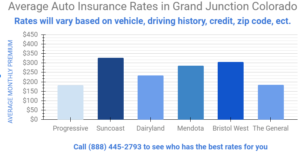

Traditionally, we have found that Progressive, Dairyland, Bristol West and Mendota have all had competitive rates in Grand Junction Colorado for auto insurance.

Grand Junction Insurance prices will vary based upon the Insurance provider, the driver, location and the vehicle. Drivers should do their part by comparing several insurance companies to ensure they are getting the best coverage, for the best price. Drivers may also consider using an agent/broker like us at A Plus Insurance to shop multiple companies.

Grand Junctions Insurance Nearby Cities And Neighborhoods

Grand Junction Colorado is a wonderful place. What many do not realize is how close it is to so many towns and cities. If you look on a map it does seem like Grand Junction Colorado is in the middle of nowhere. In reality though it is close to so many cities and neighborhoods such as Glade Park, Mack, Mesa, Loma And Clifton. Folks in this area know that driving is super important. Having the right insurance coverage means the complete difference between getting to point A or point B.

| Neighborhoods in Grand Junction, Colorado | Cities Near Grand Junction | Zip Codes in Grand Junction |

|---|---|---|

| Appleton | Mesa, CO | 81501 |

| Redlands | Mack, CO | |

| Easter Hill | Clifton, CO | |

| Rosevale | Glade Park, CO | |

| Loma, CO |

How Do Violations Affect your Grand Junction Insurance Rates?

What’s interesting about Grand Junction, Colorado is that violations and car insurance do you make a huge difference and how much you pay each and every year in premiums. Simply put the more violations that you have on your motor vehicle report the more you are going pay for car insurance. And if you pay less for car insurance that means you simply have less violations on your motor vehicle report in the state of Colorado.

That’s why it’s super important if you live in Grand Junction Colorado to make sure that you drive to the best of your abilities. Talk to your local Agent to see how long violations will stay on your record and how much extra you will pay for that amount of time. See the data below to see which violations apply in your area.

| Violation Name | Major, Minor, or Non Moving | How Long it Will Affect Your Insurance Rates |

|---|---|---|

| Non-At-Fault Accident | Minor | NA* |

| Speeding | Minor | 3 Years |

| Failure to Secure Load to truck/trailer | Minor | 3 Years |

| Using a Cell Phone with Driving | Minor | 3 Years |

| Failure to Use a Seat Belt | Non Moving | NA* |

| Improper Lane use | Minor | 3 Years |

| Failure to maintain Clear Distance (tailgating | Minor | 3 Years |

| Failure to Use Turn Signal | Minor | 3 Years |

| Failure to Yeld | Minor | 3 Years |

| Failure to Stop for a Pedestrian Side walk | Minor | 3 Years |

| Running a Traffic Light or Stop Sign | Minor | 3 Years |

| Reckless Driving | Major | 5 Years |

Grand Junction Insurance Discounts From Each Company

So many companies offer so many discounts in Grand Junction Colorado. Each and every company offers different discounts. For instance Progressive will offer a snapshot discount while Allstate will offer you accident forgiveness discounts.

There are so many discounts out there that can save you so much money and the smart thing to do is to talk to your agent and see how much you can really save depending on how many discounts you can qualify for.

See the chart below to see how Progressive and Dairyland compare.

Paperless Discount – An Agreement to receive notifications/Documents via email for a savings on average $50/year.

Auto Pay Discount – Sign up for reoccurring monthly payments on your Grand Junction Insurance policy for a discount. Most companies can save $100+ each year with auto pay.

Advanced Quote – Companies will give insured’s discount for shopping in advance at least a week out. Check with your Insurance agent to see if you quality for an advanced quote discount. On average this discount can save $5-10 a month!

Paid In Full Discount – If you pay for the entire premium at once (either a 6 month term or a 12 month term) you should see instant savings of $150-$200 on average. You will save because you will skip monthly installment fees, and the Insurance companies will give you a big difference for paying the entire premium in full.

Progressive | Dairyland |

|---|---|

| Advanced Quote | Married |

| Paid in Full | Paid in Full |

| Continuous Insurance | No Accidents or Violations |

| Homeowners | Continuous Insurance |

| Paperless Discount | Homeowners |

| Auto Pay | Multi Vehicle |

| Military | Multi Policy |

| Multi Policy | Auto Pay |

| Education Discount | Military |

| Married | |

| No Accidents or Violations | |

| Multi Vehicle |

Grand Junction Insurance Services we offer

Here at A Plus Insurance we offer more products besides auto insurance for your convenience! Some of our most competitive products are home, condo, renters, motorcycle, and RV insurance. These products are also available to bundle with some of our carriers. We also offer business liability insurance, and umbrella policies as well! See the date below for more products we offer in Grand Junction.

When Drivers Bundle other Insurance products, that can lead to savings of 10% off each additional insurance policy. Weather you own a Motorcycle, RV, ATV or Scooter – We can bundle for you!

| Type of Coverage | Our Top Companies |

|---|---|

| Commercial Auto Insurance | Progressive |

| Home Insurance | Travelers, ASI, Foremost Star |

| Car Insurance | Progressive, Dairyland, |

| Boat Insurance | Travelers, Progressive |

| RV Insurance | Progressive, Travelers |

| Motorcycle Insurance | Dairyland, Progressive |

| Business Insurance | BTIS, Hiscox |

Grand Junction Insurance Premiums

Graph entails different insurance rates by carriers for Grand Junction Colorado

After decades of serving millions of customers across the United States, auto insurance companies, and the policies they sell still pose a mystery to potential clients. A variety of factors goes into determining the premium that one must pay and the coverage that they receive.

Grand Junction is home to a number of different insurance companies. The following tips will help you choose the best agent that sells insurance in Grand Junction:

Recommendations

One of the best ways to find auto insurance in Grand Junction is to get recommendations from friends, families and local businesses. In a city like Grand Junction CO, advertising for auto insurance agencies is often done by word-of-mouth by customers, so finding good and bad reviews for most of the agencies shouldn’t be a problem. One of our companies we write insurance through is The General.

Local businesses such as auto shops and car dealerships have likely dealt with many of the agencies in town. Ask them about the level of service they receive and how quickly claims are processed. This will give you a good idea of the type of customer service you’ll receive if you do business with them.

Additional Coverage and Policy Extras

Many of the agents that offer auto insurance Grand Junction work with nationally-recognized companies while others own independent franchises. This factor may determine the type of coverage provided, which extras are available as part of the policy you purchase and the price you pay.

Call various auto insurance agencies in Grand Junction to see what types of policies they offer and if they include any extras at no additional cost. Should you do quite a bit of traveling, you might look into getting a policy that includes complimentary emergency services such as towing and rental cars. If you know you qualify for certain discounts, let us know. But don’t worry our agents are good at finding all of the discounts available to you.

Above All Else: Grand Junction insurance Customer Service

When looking for grand junction insurance, customer service should be the primary factor in deciding which agent you choose. Someone from their office should be available to answer questions and respond to your calls should you be involved in an accident. For information on SR22 insurance click here.

Protect Yourself With The Right Amount Of Car Insurance And Take To The Road With Confidence!

Give us a Call

Phone: (970) 812-4118

| Other Helpful Links |

| Insurance Clifton |

| Rifle, Colorado Insurance |

| Homeowner’s Insurance Colorado |

| Black Forest Car Insurance |

| Colorado Auto Liability Insurance |

| Cheap Auto Insurance Fort Carson |

Grand Junction Insurance FAQs

Grand Junction Insurance FAQs

Frequently Asked Questions

What is Grand Junction Insurance?

Grand Junction Insurance is a provider of various insurance services in Grand Junction. We offer coverage for a range of needs, including auto, home, and more.

How can I contact Grand Junction Insurance?

You can contact Grand Junction Insurance by calling us at 1.888.445.2793. Our team is here to assist you with your insurance inquiries.

What types of insurance services do you offer in Grand Junction?

We offer a wide range of insurance services in Grand Junction, including auto insurance, home insurance, business insurance, and more. Contact us for details on the services that suit your needs.

Edit Article Information

Here you can edit the information about Grand Junction Insurance.

- Grand Junction Insurance offers insurance solutions for residents in Colorado.

- We provide a range of insurance types, including home insurance and auto insurance.

- For more information or to get a quote, call us at 1.888.445.2793.

Last Updated on by Camron Moss