- Alabama Homeowners Insurance

- Bundling Options for Alabama Homeowners Insurance

- Why is Alabama home insurance so high?

- Discounts for Huge Savings on Alabama Homeowners Insurance!

- Alabama Homeowners Insurance: Average Cost (By City)

- What are the Alabama Homeowners Insurance Rating Factors?

- Alabama Homeowners Insurance: Rates by Company

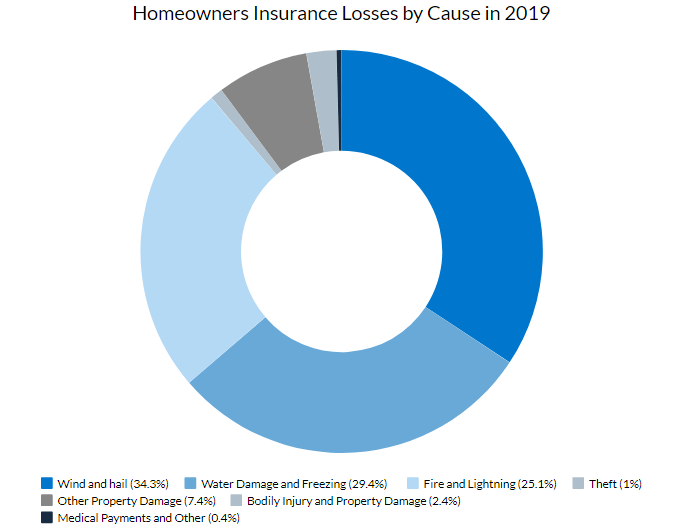

- Most Common Causes for Loss and Claims Nationwide

- Which Insurance Company has the Best Alabama Homeowners Insurance Rates?

- Cheapest Alabama Homeowners Insurance Company (By City)

- Frequently Asked Questions about Alabama Home Insurance

- What does Alabama Homeowners Insurance cover?

- How can I lower my Alabama Homeowners Insurance premiums?

- What sets A Plus Insurance apart in providing Alabama Homeowners Insurance?

- What We Do at A Plus Insurance

Bundling Options for Alabama Homeowners Insurance

Here are some great bundling options with homeowners insurance in Alabama. Bundling will save you money in most cases and provide coverage for all your needs.

When you bundle multiple insurance policies with one company, you will see instant savings on each insurance policy you have through that company. Most customers save $300-$400, sometimes more, just by bundling.

If you own a small business and need business insurance we have you covered. If you are purchasing a new boat, or ATV, we can do that too! Check with our insurance agents to see how much money you can save with our great bundle deals.

| Alabama Bundling Options With Homeowners |

|---|

| RV |

| Boat |

| Health |

| ATV |

| Business |

| Auto |

| Motorcycle |

| Umbrella |

Why is Alabama home insurance so high?

Alabama home insurance rates can be elevated due to various factors. Firstly, the state’s geographic location exposes it to natural disasters like hurricanes, tornadoes, and floods, increasing the risk for insurers. Additionally, high property crime rates in certain areas may contribute to higher premiums. Insurers also consider the age and condition of homes, construction costs, and local building codes when determining rates. Moreover, Alabama’s susceptibility to severe weather events often results in increased claims payouts, which can drive up insurance costs further.

Table: Average Annual Home Insurance Rates in Alabama

| Insurance Company | Average Rate (per year) |

|---|---|

| Progressive | $1,200 |

| Travelers | $1,350 |

| Dairyland | $1,400 |

| Assurance | $1,500 |

| National General | $1,550 |

Note: Rates are estimates based on typical coverage for a single-family home and may vary based on factors such as location, home value, and coverage limits.

Discounts for Huge Savings on Alabama Homeowners Insurance!

Most Insurance companies offer a wide array of discounts to help save potential customers additional money on their home insurance policies. Safety devices such as burglar protection, smoke detectors, and automatic water shut off/leak detection can save you!

If you live in a gated community which requires a code, or has armed security, that reduces the amount of theft in the area which will lead to cheaper prices, and better discounts for everyone.

Speak with our agents today to see what discounts we can offer you on your home insurance, and get you the best bang for your buck!

See how you may qualify for discounts with homeowners insurance by having one of the following:

| Discounts available for Homeowners insurance |

|---|

| EFT |

| Home monitoring / Burglar |

| Upgraded plumbing |

| Gated comunity |

| Auto water shut off or leak detection |

| Non-smoking discount |

| Hail resistant roofing |

| Married discount |

| Claims Free |

| Upgraded roof |

| Loyalty |

| Smoke detector (monitored) |

| Upgraded Wiring |

Alabama Homeowners Insurance: Average Cost (By City)

Depending on the city you live in, the insurance prices will vary. This is because, a larger city with a larger amount of drivers on the road, generally leads to more accidents and claims in that area.

If you live in a less populated area, there are fewer accidents, and fewer uninsured motorists on the road which will help keep your insurance prices low.

You can do your part to keep the prices affordable by always carrying insurance, and always driving safe to avoid accidents.

Here we have an average cost breakdown for homeowners insurance by city in Alabama. Don’t worry if your city isn’t listed, we still have you covered.

| City in Alabama | Average Cost |

|---|---|

| Helena | $1,100.00 |

| Prichard | $1,293.00 |

| Gardendale | $1,163.00 |

| Oxford | $1,251.00 |

| Fultondale | $1,108.00 |

| Jacksonville | $1,424.00 |

| Hueytown | $1,261.00 |

| Pell City | $1,162.00 |

| Tillmans Corner | $1,180.00 |

| Troy | $1,102.00 |

| Talladega | $1,317.00 |

| Homewood | $1,398.00 |

| Florence | $1,425.00 |

| Chelsea | $1,135.00 |

| Bessemer | $1,148.00 |

| Madison | $1,293.00 |

| Decatur | $1,284.00 |

| Selma | $1,397.00 |

| Huntsville | $1,159.00 |

| Vestavia Hills | $1,410.00 |

| Leeds | $1,277.00 |

| Albertville | $1,420.00 |

| Dothan | $1,418.00 |

| Gadsden | $1,379.00 |

| Fairhope | $1,223.00 |

| Athens | $1,300.00 |

| Trussville | $1,411.00 |

| Anniston | $1,156.00 |

| Clay | $1,227.00 |

| Birmingham | $1,148.00 |

| Sylacauga | $1,127.00 |

| Jasper | $1,175.00 |

| Auburn | $1,406.00 |

| Atmore | $1,118.00 |

| Ozark | $1,395.00 |

| Meadowbrook | $1,217.00 |

| Bay Minette | $1,264.00 |

| Pleasant Grove | $1,410.00 |

| Alabaster | $1,394.00 |

| Forestdale | $1,148.00 |

| Northport | $1,179.00 |

| Valley | $1,416.00 |

| Rainbow City | $1,164.00 |

| Cullman | $1,389.00 |

| Foley | $1,165.00 |

| Alexander City | $1,223.00 |

| Irondale | $1,115.00 |

| Saks | $1,408.00 |

| Tuscaloosa | $1,299.00 |

| Center Point | $1,160.00 |

| Hoover | $1,246.00 |

| Muscle Shoals | $1,301.00 |

| Fort Payne | $1,398.00 |

| Sheffield | $1,360.00 |

| Mountain Brook | $1,250.00 |

| Pike Road | $1,240.00 |

What are the Alabama Homeowners Insurance Rating Factors?

Homeowners Insurance rates are not one size fit all.

There are various factors such as credit history, your roof condition, even what kind of dog you have that can affect how much you pay for homeowners insurance.

| Alabama Home Owners Insurance: Knowing The Rating Factors |

|---|

| Credit history |

| Swimming pool or hot tub |

| Deductible |

| Dog breed |

| Value of home Replacement cost |

| Roof condition |

| Home-based business |

| Insurance score |

| Wood-burning stoves |

| Home liability limits |

| Claims |

| Protection Class Proximity to fire station |

Alabama Homeowners Insurance: Rates by Company

The average annual rates for homeowners insurance in Alabama will vary based on the coverage limits you choose for the dwelling. While the chart below lists the average for $250,000 dwelling coverage, it varies:

- $100,000 Dwelling Coverage…$1075

- $200,000 Dwelling Coverage…$1710

- $250,000 Dwelling Coverage…$1965

- $400,000 Dwelling Coverage…$2800

It’s important to talk to one of our agents to understand the type of homeowners coverage each Insurance company offers.

While one Insurance company might appear to have the cheapest homeowners rates, make sure they offer the specific coverage you are looking for.

| Homeowners Insurance Company | Average Annual Homeowners Cost ($250,000) |

|---|---|

| Erie Insurance | $1,459 |

| American International | $1,378 |

| MetLife Inc. | $1,357 |

| Hartford Financial Services | $1,322 |

| Travelers Companies Inc. | $1,272 |

| USAA | $1,519 |

| Chubb | $1,482 |

| Farmers Insurance Group | $1,391 |

| Allstate | $1,370 |

| Auto-Owners Insurance | $1,266 |

| Liberty Mutual | $1,409 |

| State Farm | $1,482 |

| Nationwide Mutual | $1,298 |

| American Family Insurance | $1,409 |

| Progressive | $1,305 |

Most Common Causes for Loss and Claims Nationwide

Statistics show that 98.1% of losses and homeowners claims are due to property damage, with wind and hail damage making up a big chunk. This is true for Alabama homeowners insurance as well.

But don’t rule out the small percentage of homeowners losses due to theft…it still happens!

| Most Common Causes for Homeowners Losses and Claims |

|---|

| Lightning |

| Wind |

| Loss of Use |

| Fire |

| Vandalism |

| Power surge |

| Injuries |

| Water Damage |

| Theft |

| Hail |

Which Insurance Company has the Best Alabama Homeowners Insurance Rates?

Home insurance costs will be different for each insurance company.

The prices are calculated based on several factors such as the location of the home, how far away the home is from the nearest fire department, the brushfire score, age of the home, age of the roof, and characteristics of the home.

Some companies are able to offer affordable prices, while other companies may be very expensive for the same home. Its best to always shop around and compare different quotes to find the best coverage, for the best price.

At A Plus Insurance, our agents are able to save you time and hassle by shopping multiple companies to find you the best price for your Alabama homeowners insurance. Call us today for a free, quick and friendly insurance quote.

Having the best rates for budgets are very important with home owners insurance. Here you can see which companies offer the lowest rates for homeowners insurance.

| Homeowners Insurance Company | Ranking for Rate Affordability |

|---|---|

| MetLife Inc. | 1 |

| American International | 2 |

| Allstate Corp. | 3 |

| American Family | 4 |

| Auto-Owners | 5 |

| Farmers Insurance | 6 |

| Travelers | 7 |

| Chubb | 8 |

| Hartford | 9 |

Cheapest Alabama Homeowners Insurance Company (By City)

Since insurance prices vary depending upon your city, as well as several other factors, we have compiled a list of the cheapest companies in each city.

This may not be the cheapest price guaranteed, but it would not hurt to check these companies first when shopping for home insurance. Be sure to ask about potential discounts to get the best savings.

Here you will find some of the cheapest homeowners coverage rates by cities in Alabama. Even if your city is not listed here, we can still get you affordable rates.

| City In Alabama | Insurance Company |

|---|---|

| Prattville | USAA |

| Decatur | Allstate |

| Alexander City | Travelers |

| Rainbow City | State Farm |

| Fort Payne | Progressive (ASI) |

| Alabaster | Farmers |

| Gadsden | Travelers |

| Forestdale | Progressive (ASI) |

| Troy | Progressive (ASI) |

| Homewood | Travelers |

| Tuscaloosa | Progressive (ASI) |

| Saks | Allstate |

| Jacksonville | Liberty Mutual |

| Anniston | Liberty Mutual |

| Montgomery | Farmers |

| Phenix City | American Family |

| Irondale | Allstate |

| Valley | Liberty Mutual |

| Florence | Chub |

| Sheffield | Liberty Mutual |

| Chelsea | State Farm |

| Talladega | Progressive |

| Jasper | Farmers |

| Scottsboro | Progressive (ASI) |

| Albertville | Allstate |

| Tillmans Corner | Progressive |

| Moody | State Farm |

| Helena | USAA |

| Madison | Travelers |

| Auburn | Chub |

| Oxford | Travelers |

| Hartselle | Progressive (ASI) |

| Millbrook | State Farm |

| Dothan | Travelers |

| Clay | Liberty Mutual |

| Hoover | Allstate |

| Prichard | Farmers |

| Atmore | Travelers |

| Ozark | Progressive (ASI) |

| Pike Road | Farmers |

| Calera | State Farm |

| Muscle Shoals | USAA |

| Center Point | Allstate |

| Gardendale | Farmers |

| Pelham | Farmers |

| Bessemer | Travelers |

| Bay Minette | Farmers |

Frequently Asked Questions about Alabama Home Insurance

What does Alabama Homeowners Insurance cover?

Alabama Homeowners Insurance typically covers damage to your home, personal property, and liability protection. Specific coverages may vary, so it’s essential to review your policy. If you have questions or need assistance in understanding your coverage, call A Plus Insurance at 1.888.445.2793.

How can I lower my Alabama Homeowners Insurance premiums?

There are several ways to lower Alabama Homeowners Insurance premiums, such as bundling policies, installing security features, and maintaining a good credit score. A Plus Insurance can help you explore cost-saving options. Contact us at 1.888.445.2793 for personalized advice.

What sets A Plus Insurance apart in providing Alabama Homeowners Insurance?

A Plus Insurance stands out in providing Alabama Homeowners Insurance by offering personalized service, shopping multiple carriers, and finding the best rates for our clients. Call us at 1.888.445.2793 to experience the A Plus Insurance difference.

What We Do at A Plus Insurance

Here’s What Our Clients Say About Us

A Plus Insurance

For personalized assistance, call us at 1.888.445.2793.

Last Updated on by Veronica Moss