- Need a Quote for Motorcycle Insurance?

- Quote for Motorcycle Insurance

- Motorcycle Liability Insurance: Miniumum Required by Law

- Before Getting a Quote for Motorcycle Insurance, know the basics: What The Policy Is Worth

- Motorcycle Insurance Discounts

- Quote for Motorcycle Insurance: Dairyland or Progressive?

- Progressive Motorcycle Insurance

- Dairyland Motorcycle Insurance

- Motorcycle Basics: Get Safety Prepared

- Ready for Your Quote for Motorcycle Insurance?

- What factors affect motorcycle insurance quotes?

- How can I get a quote for motorcycle insurance?

- Why should I choose your agency for motorcycle insurance?

- What is the cheapest style of motorcycle to insure?

- What We Do at A Plus Insurance

- How to Get the Best Quote for Motorcycle Insurance

Quote for Motorcycle Insurance

When getting a quote for motorcycle insurance, your agent will always ask what kind of coverage you are looking for.

Don’t get too overwhelmed! Coverages on a motorcycle insurance policy are very similar to those on an auto policy. Those coverages include:

- Liability coverage: This coverage helps pay for damages or injuries to others in the event of an accident for which the rider is at fault. It typically includes both bodily injury and property damage coverage.

- Collision: pays out minus the deductible when you “collide” with another object such as another vehicle.

- Comprehensive: pays out minus your deductible for things other than collision. For example, somebody steals your motorcycle, or a tree limb falls on it in the driveway.

- Medical payments coverage: This coverage helps pay for medical expenses for the rider and/or their passengers in the event of an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage: This coverage helps protect the rider in the event of an accident caused by another driver who either has no insurance or insufficient insurance to cover the damages.

- Personal Injury Protection or PIP: This coverage pays for medical bills due to injuries sustained in an accident by you, your passengers or pedestrians.

After your basic coverages, many companies will throw add-ons or special coverages. These are very handy coverages and usually, cost little. Extra’s you might consider adding to your motorcycle policy might be:

- Trip Interruption – Imagine you have your sweet little Sportster out on the highway whizzing along, then boom you find yourself on the side of the road hundreds of miles from home, trying to figure out how you hit the car in the lane next to you. Trip interruption coverage pays for a ride and a place to stay if your bike is disabled due to a collision.

- Custom parts and equipment coverage/Coverage for your upgrades– one of the rites of passages for any motorcycle owner is making the bike your own. There is some coverage for custom parts and accessories on your policy usually up to $3000. However, all of the chrome parts, saddlebags and personal touches you add to your bike usually cost more than that. You can purchase additional coverage for accessories and upgrades, usually up to $30,000.

- Transport trailer coverage– will cover trailers valued up to $7,500.

- Roadside assistance: Imagine that pretty little rebuild on the side of the road, this coverage helps you get that beauty back to your garage.

| Motorcycle Insurance Coverage Options |

|---|

| Safety Riding Apparel |

| Collision |

| Comprehensive |

| Roadside |

| Rental Reimbursement |

| Carried Contents |

| Transport Trailer Coverage |

| Uninsured Motorist Property Damage |

| Diminishing Deductible |

| Trip Interruption |

| Physical Damage Plus |

| Medical Payments |

| Liability |

| Roadside / Trip Interruption |

| Uninsured Motorist Bodily Injury |

| Accessory Coverage |

| Optional Equipment |

| Guest Passenger Liability |

Motorcycle Liability Insurance: Miniumum Required by Law

Not only is it a wise financial decision to carry it, but most states also require at least a minimum limits liability policy.

What is Liability insurance? It provides coverage to another party if you were to cause an accident. The limits are dollar amounts that the insurance company would pay in the event of a covered loss. Without liability insurance, you would be financially responsible for any injuries or property damage.

Minimum limits would be the lowest amount of coverage that a company offers, and are written as split limits. If you live in the state of South Carolina for example, your liability limits would look like the following:

Again, each state amount is different, so be sure to ask your agent what your state requires.

When you look at minimum limits compared to how much a typical hospital visit could be or how much cars and motorcycles cost in the area you live in, it might be a good idea to increase these limits.

You should also look into carrying uninsured/underinsured motorist coverage.

Uninsured/Underinsured coverage protects you in an accident with someone who does not have insurance. You also have coverage up to the selected limits in the event of a hit and run accident.

Before Getting a Quote for Motorcycle Insurance, know the basics: What The Policy Is Worth

Once you understand the coverages on your policy, your quote for motorcycle insurance will include your choice of monetary coverage. Familiarize yourself with how the policy will pay if your motorcycle is stolen or destroyed in an accident.

If you need additional help with these feel free to contact us with any questions. There are three valuations to choose from when the policy is taken out. They are:

Actual cash value:

After determining the replacement cost, subtract for depreciation. This the amount the policy pays after the deductible is met.

Stated amount:

The policy will pay up to the amount selected when the policy was taken out.

Agreed value:

Amount that you and the insurance company agree upon when purchasing the policy. The amount never changes, and there is no deductible at claim time. This type of valuation is ideal for those that own custom or classic bikes.

Motorcycle Insurance Discounts

Your insurance agent is your expert, and they know what discounts to looks out for. Check out the potential discount options below and see if you qualify!

| Potential Motorcycle Insurance Discounts |

|---|

| Multi Lines Discount |

| Vehicle Usage & Mileage |

| Homeownership Discount |

| Education Discount |

| PIF Discount |

| Anti Lock Brakes |

| Motorcycle Rider Group Discount |

| LoJack Device |

| EFT Discount |

| Advanced Quote |

| Prior Insurance |

| Approved Safety Course |

| Operators Safety Course |

| Multi Policy |

| Continuous Insurance Discount |

| Years of Riding Experience |

| HOG Discount |

| Responsible Driver |

| Garaged or Locked Storage |

| Association Membership |

| MC Endorsement on License |

Quote for Motorcycle Insurance: Dairyland or Progressive?

While there are multiple insurance companies that offer motorcycle insurance, at A Plus Insurance we use Progressive and Dairyland exclusively for our motorcycle needs.

Progressive Motorcycle Insurance

- Do you have a Harley Davidson with all the customized features imaginable?

- Progressive will most likely be your go to if you have a custom built motorcycle sine they provide full replacement cost coverage and original equipment manufacturer coverage.

- Progressive has is also our leader in the discount opportunities. Even if your bike is expensive to insure, it is likely you will find a discount to bring your premium down.

Dairyland Motorcycle Insurance

- Do you have a sport bike or plan on using your bike as your main mode of transportation?

- Then Dairyland might be the choice for you.

- Dairyland has excellent options for emergency roadside assistance and rental vehicle reimbursement, all of which will come in handy if you are constantly on the road with your bike.

Motorcycle Basics: Get Safety Prepared

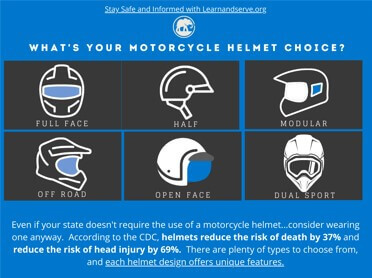

Did you know that not every state requires the use of a motorcycle helmet?

Regardless of if your state requires a helmet or not, it is still worth purchasing and wearing one. Besides a helmet, make sure you have all the required safety gear to keep you protected on the road.

Ready for Your Quote for Motorcycle Insurance?

Having proper coverage for your motorcycle is like wearing a helmet when you ride. Enjoy the freedom that motorcycles offer but be smart and have the adequate protection. Make sure you understand what your policy offers and be sure to ask about discounts. Many companies offer discounts for completed safety courses and bundling multiple policies. If you are not sure about coverages or where to start, please visit our site.

What factors affect motorcycle insurance quotes?

Motorcycle insurance quotes are influenced by a variety of factors, including the rider’s age and experience, the make and model of the motorcycle, the level of coverage selected, the motorcycle’s storage location, and the rider’s driving history.

How can I get a quote for motorcycle insurance?

Obtaining a motorcycle insurance quote is simple. You can use online tools provided by insurance companies or contact an insurance agent directly. We offer personalized quotes to suit your individual needs, easily accessible online or by phone.

Why should I choose your agency for motorcycle insurance?

Our agency stands out for its dedication to customer service, competitive rates, and extensive knowledge of motorcycle insurance options. We work with multiple carriers to offer you the best policy for your needs. Get in touch for a bespoke insurance quote today.

What is the cheapest style of motorcycle to insure?

The cost of insuring a motorcycle can vary based on factors such as the style, make, and model of the bike, as well as your personal driving history. In general, smaller and less powerful motorcycles tend to have lower insurance premiums. However, it’s essential to consult with our experienced agents to get specific quotes and guidance on finding the most affordable motorcycle insurance for your chosen style.

What We Do at A Plus Insurance

Last Updated on by Marlon Moss