- Motorcycle Insurance in Maryland: State Requirements

- Is motorcycle insurance required in Maryland?

- Motorcycle Insurance in Maryland: How do You Get a Motorcycle License?

- Motorcycle Insurance in Maryland: Most Affordable Full Coverage Rates

- Motorcycle Insurance in Maryland: Ask Your Agent About Discounts!

- Motorcycle Insurance In Maryland: Safety Tips

- Cheapest Rates by City – Motorcycle Insurance in Maryland

- RATING FACTORS FOR MOTORCYCLE INSURANCE IN MARYLAND

- Motorcycle Insurance in Maryland: Coverage Options

- Liability Only Rates – Motorcycle Insurance in Maryland

- Motorcycle Insurance in Maryland: Who should I Call?

- What types of motorcycle insurance plans do you offer in Maryland?

- How can I contact you to learn more about motorcycle insurance in Maryland?

- What factors affect motorcycle insurance rates in Maryland?

- INSURANCE SERVICES WE OFFER

Motorcycle Insurance in Maryland: State Requirements

| State | Liability Required | Personal Injury Protection |

|---|---|---|

| Maryland | 30/60/15 | $2,500 |

The Minimum Liability limits required in Maryland are $30,000 per person for Bodily Injury, up to $60,000 per accident, and $15,000 for property damage.

Uninsured Motorist Bodily Injury protection is required at $30,000 per person, $60,000 per accident, and $15,000 for property damage.

Personal Injury Protection is also required of at least $2,500 minimum. These are the limits and coverages that drivers are required to carry by law, in Maryland. You can adjust these coverages higher if desired.

Not sure what you need for liability limits to ensure you are properly covered? Speak with one of our professionals to make sure you understand your coverages and have the proper limits for your protection.

Is motorcycle insurance required in Maryland?

Yes, [motorcycle insurance in Maryland] is mandatory for all riders. State law mandates that motorcyclists carry liability insurance to cover bodily injury and property damage in the event of an accident. The minimum coverage requirements include liability limits of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $15,000 for property damage per accident.

Maryland Motorcycle Insurance Requirements:

- Liability coverage for bodily injury and property damage

- Minimum coverage limits mandated by state law

- Additional coverage options available for enhanced protection

Ensuring compliance with Maryland’s motorcycle insurance laws not only avoids legal penalties but also provides financial protection in case of accidents. Explore coverage options from reputable insurers like [Progressive], [Allstate], and [National General], comparing rates and benefits to find the best policy for your motorcycle.

Motorcycle Insurance in Maryland: How do You Get a Motorcycle License?

In Maryland, you must either obtain a learners permit and take a knowledge test or written skills test if you have no Motorcycle experience and/or are under the age of 18.

If you are over the age of 18 and/or have driving experience, you only need to take a knowledge test or skills test to add the Class M to your current Maryland Drivers License.

Motorcycle Safety Programs are encouraged for all drivers in Maryland when obtaining a Motorcycle license, but are not required for all drivers.

Check with your local DMV if you are interested in scheduling one of these tests/classes.

Check with your DMV to make sure you have all documentation and fees that you may need at the time of your appointment.

Motorcycle Insurance in Maryland: Most Affordable Full Coverage Rates

The cost for full coverage Motorcycle Insurance in Maryland is much cheaper than some may expect.

This is because the cost of Motorcycles are less than Automobiles, and cost less to replace or repair in the event of an accident, so the insurance prices are generally cheaper.

Full coverage rates will vary depending upon the type of Motorcycle you are looking to insure, and the different full coverage options.

The driver’s experience and driving history will also affect the Insurance premium as well.

Full coverage consists of Comprehensive and Collision coverage, but you can add additional coverages such as Roadside/Trip Interruption, Accessory Coverage, and others.

Check below for the average cost of full coverage in Maryland.

| City in Maryland | Full Coverage Rates |

|---|---|

| Glen Burnie | $218 |

| Fairland | $223 |

| Lake Shore | $224 |

| Severna Park | $231 |

| Ellicott City | $196 |

| Carney | $177 |

| Arnold | $185 |

| North Laurel | $240 |

| Columbia | $237 |

| Pasadena | $181 |

| Ilchester | $219 |

| Hyattsville | $228 |

| Annapolis | $183 |

| Cockeysville | $216 |

| Rockville | $212 |

| Beltsville | $181 |

| Elkridge | $223 |

| Wheaton | $185 |

| South Laurel | $215 |

| Camp Springs | $183 |

| Milford Mill | $211 |

| Woodlawn | $218 |

| Baltimore | $187 |

| Laurel | $177 |

| Waldorf | $222 |

| Lochearn | $222 |

| Reisterstown | $215 |

| Bel Air North | $198 |

| North Potomac | $206 |

| Middle River | $208 |

| Montgomery Village | $220 |

| Arbutus | $210 |

| Chillum | $185 |

| Owings Mills | $214 |

| Potomac | $222 |

| Crofton | $193 |

| Oxon Hill | $183 |

| Odenton | $204 |

| Ballenger Creek | $192 |

| Bethesda | $221 |

| Eldersburg | $204 |

| Aspen Hill | $175 |

| Essex | $198 |

| Landover | $185 |

| Rosedale | $238 |

| Greenbelt | $216 |

| Perry Hall | $237 |

| Severn | $195 |

| Frederick | $200 |

| Clarksburg | $191 |

| Gaithersburg | $209 |

| Seabrook | $224 |

| Towson | $227 |

| Fort Washington | $234 |

Motorcycle Insurance in Maryland: Ask Your Agent About Discounts!

Many Insurance companies offer a variety of discounts, and what’s not to love about saving money and keeping your Motorcycle Insurance premiums low?

Some common discounts may include: Paperless discount, EFT or Auto pay discount, Married discount, and Safe driving discount.

You may also be eligible for a discount if you’ve completed a certified Motorcycle Safety Driving Course, recognized by the DMV.

Also, if you are affiliated with a known Motorcycle group, you can save extra on your Insurance rates. Drivers who are affiliated with a group of other riders are more likely to uphold the law and maintain safe driving habits.

Check with your insurance provider to see what discounts may be available to you.

| Motorcycle Discounts |

|---|

| vehicle usage & Mileage |

| prior insurance |

| association membership |

| Anti lock brakes |

| Operators Safety Course |

| Responsible driver |

| LoJack device |

| Years of riding experience |

| paperless |

| approved safety course |

| advanced quote |

| HOG Discount |

| PIF Discount |

| Garaged or locked storage |

| Motorcycle Rider Group Discount |

| Married discount |

| EFT Discount |

| Homeownership Discount |

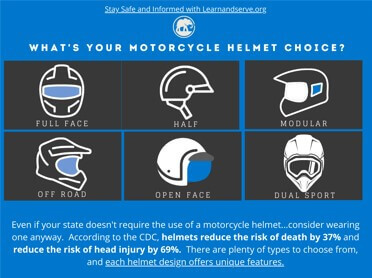

Motorcycle Insurance In Maryland: Safety Tips

Some things happen unexpectedly, and accidents may be unavoidable. However, there are always ways to help keep yourself and others safe while on the road:

- It is always important to check your bike before taking off on a trip.

- Make sure to check your tires, blinkers and headlights before hitting the pavement.

- Always practice proper driving etiquette by safely passing, using turn signals, and leaving at least 3 car lengths between you and the other driver on the road.

- Make sure to carry the proper Information with you, such as Registration, License and Insurance documents in the event you get pulled over.

- We recommend you wear your Motorcycle gear such as boots, leather jacket, and safety gloves.

Cheapest Rates by City – Motorcycle Insurance in Maryland

Why does location matter when determining insurance premiums?

Simply, the more drivers on the road statistically leads to more accidents/claims paid out by Insurance companies. The fewer accidents an area has, the lower the cost for Insurance will be for everyone.

Keep your Insurance rates low by always practicing safe driving.

Don’t want to waste time calling insurance company after insurance company? We listed the cheapest insurance companies for motorcycles in each city.

| City in Maryland | Insurance Company with Best Rate |

|---|---|

| Milford Mill | Progressive |

| Beltsville | Progressive |

| Rosedale | Geico |

| Owings Mills | Progressive |

| Annapolis | Geico |

| Bel Air North | Dairyland |

| Frederick | Dairyland |

| Wheaton | The General |

| Aspen Hill | Farmers |

| Towson | The General |

| Hagerstown | Progressive |

| Pikesville | The General |

| Glen Burnie | Progressive |

| Dundalk | Progressive |

| Bel Air South | Geico |

| Randallstown | Progressive |

| Eldersburg | Geico |

| Reisterstown | Geico |

| Hyattsville | Geico |

| Fairland | Progressive |

| Salisbury | Progressive |

| Chillum | The General |

| Ballenger Creek | Progressive |

| Landover | Farmers |

| Lake Shore | Progressive |

| Cumberland | Progressive |

| Waldorf | Progressive |

| College Park | Progressive |

| Germantown | The General |

| North Laurel | Progressive |

| Ellicott City | Progressive |

| Severna Park | Geico |

| Pasadena | Progressive |

| Baltimore | Progressive |

| Fort Washington | The General |

| Lochearn | The General |

| Parkville | The General |

| Montgomery Village | Progressive |

| Westminster | Progressive |

| Seabrook | Progressive |

| Olney | Dairyland |

| Severn | Geico |

| Oxon Hill | Geico |

| Langley Park | Progressive |

| Perry Hall | The General |

| Gaithersburg | Progressive |

| North Bethesda | Geico |

| Greenbelt | Progressive |

| Woodlawn | Geico |

| Crofton | Dairyland |

| Rockville | Progressive |

| Laurel | The General |

RATING FACTORS FOR MOTORCYCLE INSURANCE IN MARYLAND

What is a rating factor?

Rating factors are used to determine a risk, or even who they will insure, by Insurance companies. Insurance companies need to determine if the customer they are going to be insuring will be low risk (more favorable) and higher risk

Common motorcycle rating factors include:

- Gender

- Age

- Location

- Driving Experience/History

- Coverages

- occupation

- credit history

- type of bike

- riding frequency

- education level

While some factors are out of your control and can cause Insurance premiums to go up…if you are an experienced driver, with no driving violations your cost for Insurance will likely be very cheap!

Motorcycle Insurance in Maryland: Coverage Options

Motorcycle coverages are very customizable.

You can opt for the most basic coverage, which would be liability only.

Additional coverages may be added on for a small price (some companies include these for no additional cost) which include Roadside/Trip Interruption, and Safety Riding Apparel. This will cover you if you are stranded more than a certain amount of miles from your residence, and if you were to damage any of your riding apparel in an accident, such as Helmet, Goggles, Leather Jacket, etc.

You can also opt to carry full coverage, which consists of Comprehensive and Collision coverage. Comprehensive will cover for things like fire, theft, vandalism and Collision covers an impact with another vehicle or object.

| Coverage Options for Motorcycle Insurance in Maryland |

|---|

| Roadside/Trip Interruption |

| Diminishing Deductible |

| Collision |

| Comprehensive |

| Medical Payments |

| Accessory Coverage |

| Liability |

| Guest Passenger Liability |

| Optional Equipment |

| Transport Trailer coverage |

| Roadside |

| Uninsured Motorist Property damage |

| Rental Reimbursement |

| Trip Interruption |

| Physical Damage Plus |

| Uninsured Motorist Bodily Injury |

| Safety riding apparel |

Liability Only Rates – Motorcycle Insurance in Maryland

Liability insurance is the Minimum Required coverage to make you legal on the road.

The average cost for liability only, on a Motorcycle is cheap, great news for you!

Some Insurance companies only charge the minimum they can for the motorcycle, which means you may be able to get full coverage on your bike for the same exact cost as liability.

This may sound confusing, but we promise, it is true. Progressive and Dairyland Insurance often do this.

Liability will vary depending upon your location, the bike and the drivers history, but the average cost can be as little as $10/month.

Make sure to call our Insurance agents for a free Motorcycle quote, as we can shop several Insurance providers to find you the best coverage, for the best price.

| City in Maryland | Best Liability Rates |

|---|---|

| Middle River | $111.00 |

| Reisterstown | $96.00 |

| Cumberland | $134.00 |

| Bel Air North | $96.00 |

| White Oak | $122.00 |

| Ilchester | $109.00 |

| Langley Park | $127.00 |

| Elkridge | $101.00 |

| Lochearn | $97.00 |

| Camp Springs | $102.00 |

| Laurel | $103.00 |

| Carney | $121.00 |

| Fort Washington | $126.00 |

| Owings Mills | $98.00 |

| Columbia | $133.00 |

| Eldersburg | $130.00 |

| Ballenger Creek | $135.00 |

| Fairland | $111.00 |

| Essex | $103.00 |

| Pasadena | $123.00 |

| Towson | $112.00 |

| Edgewood | $134.00 |

| Annapolis | $108.00 |

| Pikesville | $98.00 |

| South Laurel | $113.00 |

| Milford Mill | $129.00 |

| Rosedale | $128.00 |

| Germantown | $135.00 |

| Frederick | $115.00 |

| Greenbelt | $97.00 |

| Hyattsville | $132.00 |

| Gaithersburg | $132.00 |

| North Laurel | $116.00 |

| Wheaton | $96.00 |

| Westminster | $96.00 |

| Salisbury | $128.00 |

| Cockeysville | $125.00 |

| Beltsville | $125.00 |

| Ellicott City | $99.00 |

| Catonsville | $106.00 |

| Odenton | $100.00 |

| Suitland | $124.00 |

| Severna Park | $103.00 |

| Arnold | $108.00 |

| North Bethesda | $112.00 |

| Potomac | $125.00 |

| Rockville | $96.00 |

| Oxon Hill | $111.00 |

| Perry Hall | $119.00 |

| Bethesda | $113.00 |

| Landover | $132.00 |

| Bel Air South | $112.00 |

Motorcycle Insurance in Maryland: Who should I Call?

Not all companies offer Motorcycle Insurance, and not all companies have the best service in terms of claims process and customer service.

It is important to do your research on a company before purchasing a policy. Sometimes the cheapest option is not always the best.

We have our customers’ best interest at heart, so we want to make sure we place you with the best insurance company.

Check below to see which companies offer Motorcycle Insurance. You may even be able to bundle your other products, like home and auto for instant savings.

| Best Companies for Motorcycle Insurance |

|---|

| Progressive Insurance |

| Dairyland |

| Geico |

What types of motorcycle insurance plans do you offer in Maryland?

We provide a range of motorcycle insurance plans tailored to Maryland riders, including liability coverage, comprehensive insurance, collision coverage, uninsured/underinsured motorist protection, and more.

How can I contact you to learn more about motorcycle insurance in Maryland?

For more information or to discuss your specific motorcycle insurance needs in Maryland, please call us at 1.888.445.2793.

What factors affect motorcycle insurance rates in Maryland?

Various factors influence motorcycle insurance rates in Maryland, such as riding experience, the type of bike, coverage limits, location within the state, and more. We’ll help you navigate these factors to find the most suitable and cost-effective insurance plan for your motorcycle.

We hope this information was helpful…if any of your questions were not answered…just give us a call and we are happy to get you on the road…safely and legally!

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

| Other Maryland Insurance Guides |

|---|

| SR22 Insurance in Maryland |

| Maryland Homeowners Insurance |

| General Maryland Auto Insurance Guide |

| Auto Insurance Virginia |

| Why Use an Insurance Broker? |

Last Updated on by Camron Moss