- Insurance Salida

- Salida Insurance Rates

- Insurance Salida: Cheapest full coverage rates with a great record and good credit.

- Insurance Salida: Bundling Leads to Savings

- Auto Insurance Salida: How age and gender affect your Insurance rates

- "We save our client in Salida an average of $598.55"

- Non-Owners Insurance Salida

- Insurance Salida SR22

- Frequently Asked Questions About Auto Insurance Salida, CO

- What factors influence auto insurance rates in Salida, Colorado?

- How can I obtain affordable auto insurance rates in Salida, Colorado?

- Where can I get more information or assistance with auto insurance in Salida, Colorado?

- What is full coverage insurance in Colorado?

- INSURANCE SERVICES WE OFFER

Salida Insurance Rates

What if you need more coverage than just Liability-Only? When should you purchase full coverage and how do you know if you just need liability only? The answers to these questions depend on a few different variables. If you own the vehicle outright chances are you might just need the state minimum liability required in Salida, Colorado.

If you are making payments on a vehicle you will need full coverage including comprehensive and collision coverage.

Some insurance carriers do allow you to carry comprehensive coverage without collision. Ask your agent for multiple quotes to compare your options. Springing for Full Coverage does add to your monthly premium, but in the case of an accident you’ll be happy you have it.

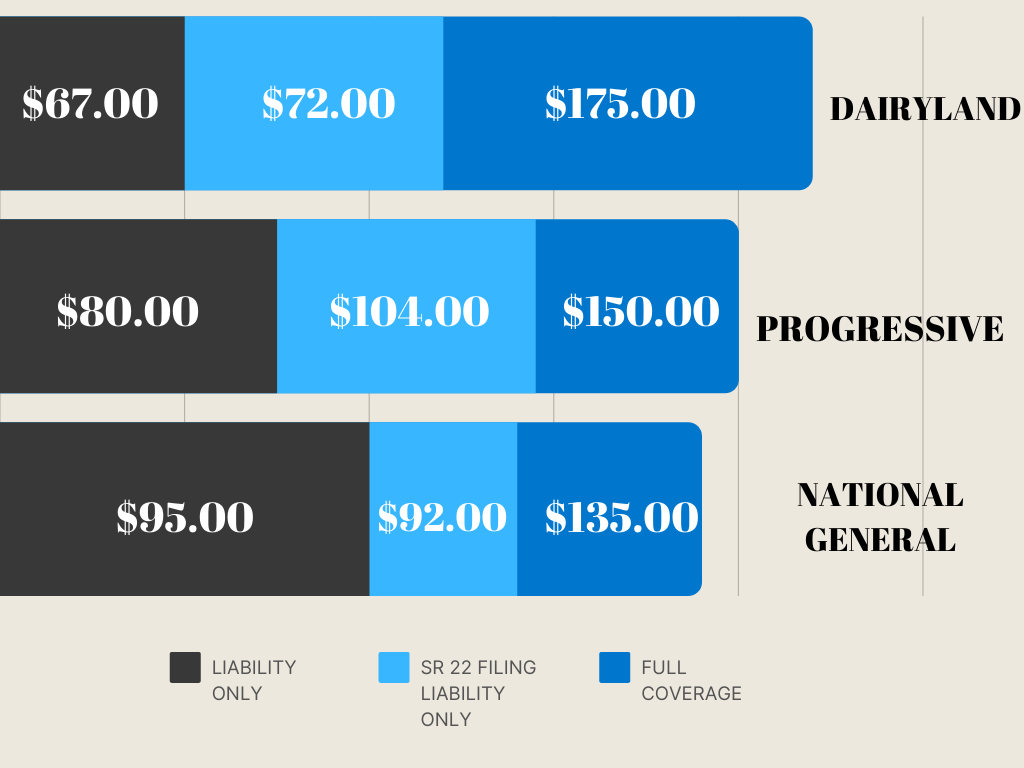

SR22 is a filing required by the state for an individual with multiple moving violations or a serious offense like a DUI. The violations are the cause for higher rates, not the filing itself. Let your Agent know you need SR22 on your insurance and they will add this to your policy. After the policy has been bound, or paid for and applications signed, the insurance carrier will upload your SR22 with the State of Colorado and voila! You are legally able to drive again!

Insurance Salida: Cheapest full coverage rates with a great record and good credit.

Driving without Auto insurance is illegal, but you are not required to have Full Coverage.

When leasing or paying on your vehicle however, full coverage is also a must have. Below is a list of insurance carriers and what their rates look like for full coverage in Salida, CO.

| Rank | Company | Average Price |

|---|---|---|

| 1 | Progressive | $120.00 |

| 2 | Bristol West | $125.00 |

| 3 | Mendota | $125.00 |

| 4 | The General | $141.00 |

| 5 | Travelers | $163.00 |

| 6 | Liberty Mutual | $188.00 |

| 7 | Dairyland (Viking) | $208.00 |

COMPREHENSIVE: Covers damages when in an accident that is NOT a collision. FOR EXAMPLE: Theft, weather, animals.

COLLISION: Covers damages when in an accident that is a collision. FOR EXAMPLE: Hitting another car, tree, building, fence.

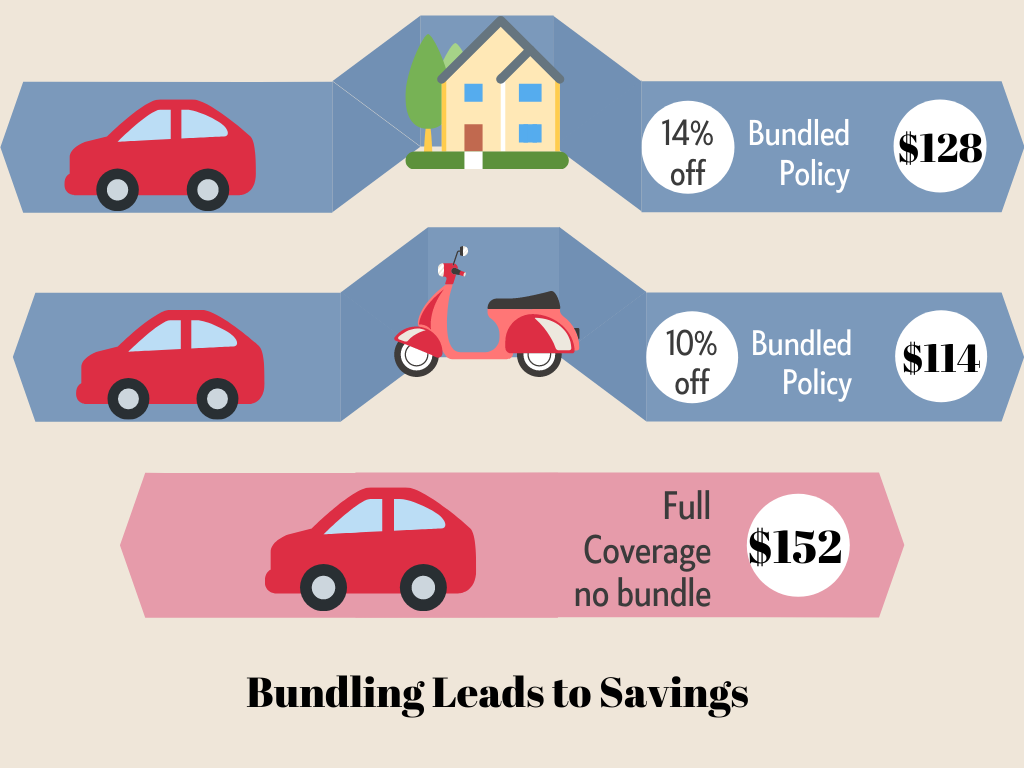

Insurance Salida: Bundling Leads to Savings

It is not just a gimmick, bundling policies of auto, home, motorcycle truly does save you big time! It is a signal to the insurance companies that you are responsible, which is rewarded. Also, the chances of you maintaining your insurance is higher with the bundle, which is rewarded. Plus, it is multiple lines of business for the insurance company encourages them to incentivize you, that being…Savings!

What are the rewards? Serious Savings! Compare below which is home and auto!

| Carrier | Price |

|---|---|

| Dairyland | $128 |

| Acceptance RTR | $138 |

| Geico | $140 |

| Progressive Insurance | $148 |

| National General | $150 |

| GAINSCO | $152 |

| Nationwide | $153 |

| Mendota Ins. Company | $155 |

| The General | $155 |

| Assurance America | $158 |

| State Farm | $158 |

| American Family | $164 |

| 21st Century | $166 |

| Bristol West | $167 |

| Allstate | $171 |

Auto Insurance Salida: How age and gender affect your Insurance rates

Age and gender makes a huge difference in rating the cost and premiums for your car insurance.

This may not be fair, but it isn’t about gender roles. It is simply statistics.

The numbers show that male drivers between 16 and 18 typically find themselves in more collisions than their female counterparts. While a female tends to be much more cautious at younger stages of driving. In fact, the numbers continue in the favor of the females until we get to our 50s.

| Age | Male | Female |

|---|---|---|

| 16-18 | $ 231.84 | $ 184.09 |

| 19-24 | $ 193.20 | $ 161.00 |

| 25-30 | $ 139.84 | $ 124.84 |

| 31-40 | $ 110.40 | $ 106.08 |

| 41-50 | $ 109.48 | $ 98.44 |

| 50-65 | $ 99.36 | $ 101.48 |

| 65+ | $ 106.08 | $ 114.08 |

“We save our client in Salida an average of $598.55”

Purchasing insurance can be tricky and down right frustrating. That is why it is great to use a brokerage to let us do the shopping for you. We have access to the rates of multiple companies and comparing coverages until we get the right fit for your family.

Simply ask how can they save on their car insurance in Salida! A Plus Insurance has saved the citizens of Salida on average $598.55 annually on auto insurance. Think of all the goodies you can buy, debt you can pay off, candy bars you could consume. (Please Snack responsibly.)

| New Customers in Salida, Colorado Save on Average | $598.55 |

| Number of Candy bars you could buy | 435 |

| Months of Netflix you could buy | 43 |

| Number of Peanuts you could buy | 107568 |

Non-Owners Insurance Salida

We’ve talked a lot about insuring your vehicle if you live in Salida Colorado. But what if you do not have a vehicle? It is still important to be insured, especially if you frequently utilize a friends vehicle.

That is why there is what is known as a Non-Owners Insurance. We here at A Plus lean on one of our trusted carriers Dairyland for this type of insurance and sell the ‘Broadform Policy’.

Non-Owners is a Liability-Only policy that covers damages you may cause while operating a vehicle. Non-owners policy holders typically don’t have their own vehicle, but may have regular access to other vehicles.

Below is a chart for non-owners policy for insurance Salida.

| Carrier | Price |

|---|---|

| Dairyland | $92 |

| Progressive Insurance | $97 |

| The General | $110 |

| Bristol West | $137 |

| Mendota Ins. Company | $161 |

Insurance Salida SR22

If you’re looking for information on SR-22 insurance in Salida, it’s essential to understand what an SR-22 is, who needs it, and how to obtain it efficiently and affordably. An SR-22 is not insurance but a certificate your insurance company files with your state to prove that you have the minimum required auto insurance coverage. Here are some tips and tricks for dealing with SR-22 requirements in Salida:

1. Understand the SR-22

- Not a Type of Insurance: SR-22 is a certificate of financial responsibility required by the state to verify that an individual is maintaining auto insurance liability coverage.

- Who Needs It: It’s typically required for drivers who’ve had a DUI/DWI, been caught driving without insurance, had too many at-fault accidents, or accumulated too many traffic violation points.

2. Shop Around for the Best Rates

- Compare Insurance Companies: After an SR-22 requirement, your current insurance rates may rise, or your policy might even be canceled. It’s crucial to shop around and compare rates from different insurers who accept drivers requiring an SR-22.

- Specialty Providers: Some insurance companies specialize in high-risk insurance policies, including providing SR-22 certificates. These companies might offer better rates for individuals in your situation.

3. Minimize Costs

- Higher Premiums: Expect higher premiums with an SR-22 requirement. To minimize costs, inquire about discounts you may still be eligible for, such as for safe driving (if applicable), multi-policy bundles, or completing a defensive driving course.

- Budget Wisely: Adjust your coverage to what’s essential, considering your state’s minimum requirements and your personal needs, but don’t underinsure to save money short term, as this could cost more in the long run.

4. Maintain Continuous Insurance Coverage

- Avoid Lapses: Ensure you do not have any gaps in your insurance coverage. A lapse can lead to the revocation of your SR-22 and potentially result in license suspension.

- Duration: Typically, an SR-22 is required for about three years, but this can vary depending on the reason for the SR-22 and state laws.

5. Fulfill the SR-22 Period

- Stay Informed: Keep track of how long you need to carry the SR-22. Once you’ve fulfilled the required period without any insurance lapses or major traffic violations, you may be eligible to have the SR-22 requirement removed.

- Verify with DMV: Once the SR-22 period is over, check with the Salida DMV or your state’s DMV to confirm that the SR-22 requirement has been lifted from your record.

6. Improve Your Driving Record

- Safe Driving: The best way to lower your insurance rates and eventually get out of the SR-22 requirement is to maintain a clean driving record moving forward.

- Education Courses: Consider taking defensive driving courses not only to potentially lower your insurance rates but also to improve your driving habits.

7. Stay Informed and Compliant

- Understand State Requirements: Insurance laws and requirements, including those for SR-22, vary by state. Stay informed about the specifics in Salida and comply with all state regulations and timelines.

8. Legal and Financial Responsibilities

- Legal Advice: In some cases, consulting with a legal expert who specializes in traffic law might provide avenues to reduce the duration of the SR-22 requirement or offer advice on handling your situation more effectively.

- Financial Planning: Adjust your budget to account for the increased insurance costs. Being financially prepared can ease the strain of higher premiums.

Frequently Asked Questions About Auto Insurance Salida, CO

What factors influence auto insurance rates in Salida, Colorado?

Auto insurance rates in Salida, Colorado can be affected by various factors, including driving history, age, vehicle type, coverage options, and the geographic area’s zip code.

How can I obtain affordable auto insurance rates in Salida, Colorado?

To find inexpensive auto insurance rates in Salida, Colorado, consider comparing quotes from multiple insurers. Factors such as bundling policies and maintaining a good driving record can help reduce insurance costs.

Where can I get more information or assistance with auto insurance in Salida, Colorado?

For additional information about auto insurance in Salida, Colorado or to explore options for cheap rates, please call us at 1.888.445.2793. Our experienced agents are ready to assist you with your insurance inquiries.

What is full coverage insurance in Colorado?

Full coverage insurance in Colorado typically includes liability coverage, collision coverage, comprehensive coverage, and sometimes uninsured/underinsured motorist coverage. It provides a broader range of protection for your vehicle and other parties involved in accidents.

| Additional Colorado |

|---|

| Car Insurance Aurora |

| Auto Insurance Castle Rock |

| Insurance Colorado |

| Car Insurance Fort Collins |

For expert guidance on insurance in Salida, call us at 1.888.445.2793.

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

Last Updated on by Marlon Moss