- Homeowners Insurance Bluffton SC

- Homeowners Insurance Bluffton SC – Which companies have the best rates?

- Homeowners Insurance Bluffton SC: Which Companies offer coverage

- Homeowners Insurance Bluffton Sc Discounts You Need to Know About!

- Homeowners Insurance Bluffton Sc: Products to bundle

- Most common Causes for Loss and claims for Bluffton Homeowners Insurance

- Why Your Policy Might be so High: Rating factors for Bluffton Homeowners Insurance

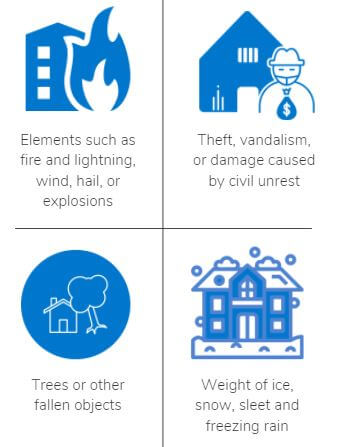

- Bluffton, South Carolina Homeowners Insurance: What Does It Cover?

- Average Cost of Homeowners Insurance Bluffton Sc (by city)

- Homeowners Insurance Bluffton Sc Rates by company

- Frequently Asked Questions about Homeowners Insurance Bluffton SC

- Q1: What does Homeowners Insurance cover in Bluffton, SC?

- Q2: How can I get a quote?

- Q3: Can I customize my Homeowners Insurance policy?

- Q4: How much is the average homeowners insurance in SC?

- Q5: Do you need hurricane insurance in South Carolina?

- Q6: Which homeowners insurance has the highest customer satisfaction?

- What We Do at A Plus Insurance

Homeowners Insurance Bluffton SC – Which companies have the best rates?

It is important to keep in mind, that not all home insurance providers offer the same insurance prices. It is best to get multiple home insurance quotes before making a decision to insure that you are getting the best coverage, for the best price.

Check below to see the companies in your area that are top contenders for the most affordable home insurance rates.

| Company | Rank |

|---|---|

| Hartford | 1 |

| American International | 2 |

| Travelers | 3 |

| State Farm | 4 |

| Progressive | 5 |

| MetLife Inc. | 6 |

| Nationwide | 7 |

| USAA | 8 |

| Chubb | 9 |

Homeowners Insurance Bluffton SC: Which Companies offer coverage

Did you just purchase a home in Bluffton South Carolina? We made it easy for you and listed a few companies that offer Homeowners there!

If you do not want to do the work yourself, call one of our agents today for a free, fast home insurance quote. Our agents are knowledgeable and able to find you the coverage you need, for the price you want by comparing multiple insurance companies for you.

| Company | Homeowners Offered |

|---|---|

| Progressive | yes |

| Nationwide | yes |

| USAA | yes |

| MetLife Inc. | yes |

| Hartford | yes |

| Farmers Insurance | yes |

| Travelers | yes |

| American International | yes |

| Auto-Owners | yes |

| American Family | yes |

| Allstate Corp. | yes |

| Chubb | yes |

| Liberty Mutual | yes |

| Statefarm | yes |

Homeowners Insurance Bluffton Sc Discounts You Need to Know About!

Everyone wants discounts where they can get them! Did you know that there are numerous ways you can get discounts on your homeowners insurance? We have listed some below for you to check out!

Some of the discounts available have to do with home safety features to avoid accidents, such as smoke alarm, fire extinguisher, and home security system.

Other discounts include a Pay in full discount, where the insured pays the entire premium for the year up front, leading to hundreds of dollars in savings.

Other great money saving discounts include the bundling discount. Did you know you can bundle you auto, home, RV, and motorcycle all together to save money?

| Gated community |

| Smoke detector (monitored) |

| EFT |

| Non-smoking discount |

| Upgraded roof |

| Upgraded plumbing |

| Home monitoring / Burglar |

| New home discount |

| Married discount |

| Bundling Multiple Polices |

Homeowners Insurance Bluffton Sc: Products to bundle

You know bundling your home and auto can save you money! But did you know that you can bundle other things with your homeowners insurance and save? Look at some ideas below!

Whether you just purchased an RV or Motorhome to take out camping, or you have an old ATV sitting in the garage, you can bundle your insurance with your home policy to save.

Most homeowners save 10% on each insurance policy just by bundling with the same insurance provider.

| ATV |

| RV |

| Boat |

| Umbrella |

| Business |

| Motorcycle |

| Health |

| Auto |

| Life |

Most common Causes for Loss and claims for Bluffton Homeowners Insurance

Purchasing a home is a big deal, and one of the largest investments you will make in a lifetime. It is just as important to properly protect your home, in the event of the unknown.

There are several things which could result in a home insurance claim, so having the best insurance policy is important for homeowners. Check below for a list of the most common reasons for home insurance claims near Bluffton SC.

| Other Weather Related |

| Power Surge |

| Lightning |

| Vandalism |

| Wind |

| Water Damage |

| Fire |

| Hail |

| Injuries |

| Theft |

Why Your Policy Might be so High: Rating factors for Bluffton Homeowners Insurance

Many things go into making up homeowners insurance rates. Some of the most commonly known factors, which even determine eligibility in some cases, are whether you have a pool or hot tub on the property, or even a trampoline.

Other factors that may determine your home insurance premium in Bluffton is the location of the home, age of the home, and age of the roof.

Keep these things in mind when looking at purchasing a new home in Bluffton.

| Roof Condition |

| Swimming pool or hot tub |

| Location |

| Claims |

| Wood-burning stoves |

| Credit history |

| Home liability limits |

| Dog breed |

| Protection Class Proximity to fire station |

| Upgrades to Wiring and Plumbing |

| Age of home |

| Value of home Replacement cost |

| Marital Status |

| Home-based business |

Bluffton, South Carolina Homeowners Insurance: What Does It Cover?

Average Cost of Homeowners Insurance Bluffton Sc (by city)

Homeowners rates can be different by city, state and company.

Here are some companies with great AM ratings, meaning they have scored high in every rating category such as customer service, price, and claims process.

Remember, when purchasing home insurance, the cheapest company is not always the best fit.

By doing your due diligence, you can insure that your home insurance company will be there for you in the time that you may need them, instead of hassling over an insurance claim for months.

| City | Carrier |

|---|---|

| Greenwood | Allstate |

| Burton | NationWide |

| North Charleston | State Farm |

| Rock Hill | American Family |

| Wade Hampton | USAA |

| Summerville | Chub |

| Georgetown | Liberty Mutual |

| Port Royal | Progressive (ASI) |

| Beaufort | NationWide |

| Lake Wylie | Progressive (ASI) |

| Moncks Corner | Progressive (ASI) |

| West Columbia | Progressive |

| Columbia | American Family |

| Little River | Travelers |

| Sangaree | Progressive (ASI) |

| Sans Souci | USAA |

| Clinton | Allstate |

| Laurens | Progressive |

| Anderson | Progressive (ASI) |

| Myrtle Beach | Liberty Mutual |

Homeowners Insurance Bluffton Sc Rates by company

Since home insurance rates vary by each company, consider getting multiple insurance quotes through an insurance broker.

Agents, or brokers are able to shop several insurance providers to make sure you are getting the best coverage, for the most affordable price.

Below is a list of several home insurance companies and their average cost in Bluffton, SC.

| Company | Homeowners ($250,000) |

|---|---|

| Erie Insurance | $1,360 |

| Liberty Mutual | $1,284 |

| Auto-Owners Insurance | $1,370 |

| Chubb | $1,318 |

| Nationwide Mutual | $1,367 |

| State Farm | $1,425 |

| Farmers Insurance Group | $1,466 |

| Allstate | $1,520 |

| Hartford Financial Services | $1,472 |

| Travelers Companies Inc. | $1,492 |

| Progressive | $1,431 |

| USAA | $1,296 |

| MetLife Inc | $1,267 |

| American International | $1,402 |

Frequently Asked Questions about Homeowners Insurance Bluffton SC

Q1: What does Homeowners Insurance cover in Bluffton, SC?

Homeowners Insurance in Bluffton, SC typically covers the structure of your home, personal belongings, liability protection, and additional living expenses in case of covered perils.

Q2: How can I get a quote?

To get a quote, you can visit our website or call us at 1.888.445.2793 to speak with one of our representatives.

Q3: Can I customize my Homeowners Insurance policy?

Yes, you can customize your Homeowners Insurance policy in Bluffton, SC to meet your specific needs. We offer options for additional coverage and policy adjustments.

Q4: How much is the average homeowners insurance in SC?

The average cost of homeowners insurance in South Carolina varies, but it generally ranges from $1,200 to $1,500 per year. Prices can fluctuate based on factors like location, home value, and coverage options.

Q5: Do you need hurricane insurance in South Carolina?

In South Carolina, especially in coastal areas, it is highly recommended to have hurricane insurance as part of your homeowners policy due to the high risk of hurricanes and tropical storms.

Q6: Which homeowners insurance has the highest customer satisfaction?

Customer satisfaction can vary, but insurance companies like USAA, Amica Mutual, and State Farm often rank highly in terms of customer satisfaction for homeowners insurance.

Here’s What Our Clients Say About Us

A Plus Insurance

What We Do at A Plus Insurance

Last Updated on by Amanda Moss