Homeowners Insurance Greer SC: Finding the best coverage

Greer SC Home Insurance

If the Lord’s willin’ and the creek don’t rise, A Plus Insurance will find you affordable, and quality Homeowners Insurance!

- Which Insurance Company has the best rates for Greer SC Home Insurance?

- Which companies offer Greer SC Home Insurance?

- Greer SC Home Insurance Discounts You Need to Know About!

- What is the most reasonable Homeowners insurance?

- Products to bundle with Greer SC Home Insurance

- Most common Causes for Loss and claims for Greer SC Home Insurance (and nationwide)

- Why Your Policy Might be so High: Rating factors for Greer SC Home Insurance

- Greer SC Homeowners Insurance: Do You Know What Your Insurance Covers?

- What is the average cost of homeowners insurance in south carolina? Rates by company

- Greer SC Home Insurance Most Frequently Asked Questions

- Additional Helpful Links

- Questions About Homeowners Insurance In Another State?

- Other Guides to the Best Insurance Rates in Greer SC

Which Insurance Company has the best rates for Greer SC Home Insurance?

To save you some valuable time on your home insurance shopping journey, we listed the cheapest companies to choose from below!

| Company | Rank |

|---|---|

| Farmers Insurance | 1 |

| Nationwide | 2 |

| MetLife Inc. | 3 |

| Auto-Owners | 4 |

| Liberty Mutual | 5 |

| American International | 6 |

| Chubb | 7 |

| American Family | 8 |

| Progressive | 9 |

Which companies offer Greer SC Home Insurance?

Did you just purchase a home in Greer SC? We made it easy for you and listed a few companies that offer Homeowners there!

| Company | Homeowners Offered |

|---|---|

| MetLife Inc. | yes |

| USAA | yes |

| Auto-Owners | yes |

| State Farm | yes |

| Hartford | yes |

| Farmers Insurance | yes |

| Travelers | yes |

| American International | yes |

| Progressive | yes |

| American Family | yes |

| Allstate Corp. | yes |

| Chubb | yes |

| Liberty Mutual | yes |

| Nationwide | yes |

Greer SC Home Insurance Discounts You Need to Know About!

Everyone wants discounts where they can get them! Did you know that there are numerous ways you can get discounts on your homeowners insurance?

Discounts available are always different based on the company you are dealing with. Some offer more than others. Others offer much less, or maybe just a few. If you are shopping around for home insurance, be sure to ask each agent about discounts. Saving a few bucks where we can is always worth a little extra time! We have listed some below for you to check out!

| Gated Community |

| Smoke Detector (Monitored) |

| EFT |

| Non-Smoking Discount |

| Upgraded Roof |

| Upgraded Plumbing |

| Home Monitoring / Burglar |

| New Home Discount |

| Married Discount |

| Bundling Multiple Polices |

What is the most reasonable Homeowners insurance?

Progressive, Nationwide and Erie are the top least expensive Home Insurance Providers in the State of SC. Each Home Insurance provider is able to tailor the insurance coverages to the policy holder’s needs to make the coverage customized and affordable.

Products to bundle with Greer SC Home Insurance

You know bundling your home and auto can save you money! But did you know that you can bundle other things with your homeowners insurance and save?

If you are a homeowner, chances are you may own a few toys! Whether you finance or own toys like motorcycles, RV, Boat, or an ATV, rates may not be as high as one might think! Bundling your policies gives you an opportunity to save, but also peace of mind! We all breathe a bit easier with a blanket of protection. Look at some more ideas below!

| ATV |

| RV |

| Boat |

| Umbrella |

| Business |

| Motorcycle |

| Health |

| Auto |

| Life |

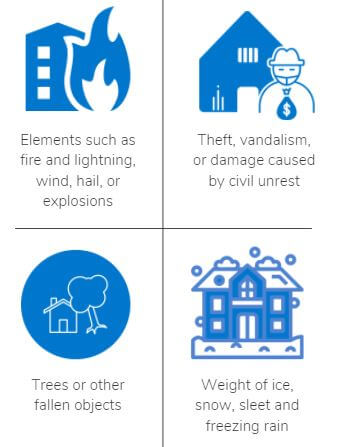

Most common Causes for Loss and claims for Greer SC Home Insurance (and nationwide)

By having homeowners insurance you are protecting yourself from the day to day unknown. Water damage is one of the most common reasons for home insurance claims.

This damage can occur by means of a loose or damaged washing machine hose, bathtub or shower edge leaks, toilet issues, refrigerator leaks, hot water heater leaks, and roof damage.

Theft is unfortunately an inevitable reality in the world we live in. A big tip to prevent theft- if you own a home with a garage avoid parking your car in the driveway with your garage opener inside. This provides a smooth opportunity for a thief to gain entrance into your home! There are so many other things that can cause a loss to your home, so it’s good to be protected!

| Injuries |

| Other Weather related |

| Theft |

| Water Damage |

| Vandalism |

| Lightning |

| Loss of Use |

| Hail |

| Fire |

| Wind |

Why Your Policy Might be so High: Rating factors for Greer SC Home Insurance

Many things go into making up homeowners insurance rates. Things that can strongly affect your odds of being denied coverage, or higher rates are: Dog breed, an unfenced swimming pool, trampoline, and proximity to the closest fire station. These things are often seen as high risk liability factors to insurers. Some of these factors are listed below for your review.

| Protection Class Proximity to fire station |

| Home liability limits |

| Upgrades to Wiring plumbing |

| Dog breed |

| Deductible |

| Swimming pool or hot tub |

| Roof condition |

| Wood-burning stoves |

| Claims |

| Insurance score |

| Credit history |

| Value of home Replacement cost |

| Age of Home |

| Home-based business |

Greer SC Homeowners Insurance: Do You Know What Your Insurance Covers?

What is the average cost of homeowners insurance in south carolina? Rates by company

Of course, homeowners insurance rates vary per each company. Why not get multiple quotes at once to compare your options? When shopping for homeowners insurance, you should consider more than just cost. A home insurance company’s financial status, company ratings, and customer reviews are a big indication of who you should trust to protect your home.

| Company | Homeowners ($250,000) |

|---|---|

| Liberty Mutual | $1,453 |

| State Farm | $1,366 |

| USAA | $1,521 |

| Hartford Financial Services | $1,265 |

| Chubb | $1,447 |

| Erie Insurance | $1,327 |

| Travelers Companies Inc. | $1,509 |

| MetLife Inc. | $1,385 |

| Progressive | $1,291 |

| Farmers Insurance Group | $1,507 |

| Auto-Owners Insurance | $1,423 |

| American Family Insurance | $1,262 |

| Nationwide Mutual | $1,370 |

| Allstate | $1,313 |

Greer SC Home Insurance Most Frequently Asked Questions

What is the average cost of homeowners insurance in Greer SC?

Greer SC yearly premium for home insurance is $1,118. The South Carolina average yearly premium is $1,269.

Is homeowners insurance required in Greer SC?

Home Insurance is not required in South Carolina. Typically, if you are financing your home, home insurance will be required by your lender.

What is the Greer SC homeowners tax credit?

A tax credit is available to homeowners who pay more than 5% of their gross income for their home insurance. There is a maximum of $1,250.

Does South Carolina require homeowners insurance?

South Carolina does not legally require homeowners insurance. However, while it’s not mandatory by state law, many mortgage lenders may require homeowners insurance as a condition of approving a mortgage loan. Lenders want to ensure that their investment in your home is protected in case of damage or loss, which is why they often make homeowners insurance a requirement.

Additional Helpful Links

Questions About Homeowners Insurance In Another State?

Other Guides to the Best Insurance Rates in Greer SC

| Best Auto Insurance in South Carolina |

| Cheapest SR22 Insurance In South Carolina |

| Cheap Car Insurance in SC: Greenville |

| Motorcycle Insurance In South Carolina: Best Rates |

Last Updated on by Lauren Mckenzie