- Utah Car Insurance Quotes

- UTAH AUTO INSURANCE REQUIRMENTS

- UTAH CAR INSURANCE RATES : UNDERSTANDING FULL COVERAGE INSURANCE

- SHOULD I GET FULL COVERAGE?

- UTAH CAR INSURANCE QUOTES : HOW TO GET THE BEST UTAH CAR INSURANCE RATES

- Frequently Asked Questions

- INSURANCE SERVICES WE OFFER

- OTHER HELPFUL LINKS: SUGGESTIONS

- About This Article

- Contact Us

UTAH AUTO INSURANCE REQUIRMENTS

All insured drivers in Utah are required to have and meet the States minimum requirement for auto insurance. Utah requires insureds to have Liability, along with Personal Injury Protection on their auto policy.

Utah Requires A Minimum Liability Limit of: 25 / 65 / 15

| Bodily Injury for One Individual | Bodily Injury for More Than One Individual | Property Damage |

|---|---|---|

| $25,000 | $65,000 | $15,000 |

Utah Also Requires A Minimum P.I.P. Coverage of : $3,000

Aside from Liability coverage, drivers are able to add Full Coverage to their Auto policy from an additional Premium. If you are financing a vehicle, or purchased a new vehicle – chances are, you will want to insure the vehicle is covered by carrying full coverage insurance. We can help you find cheap full coverage Utah Car Insurance Rates today!

UTAH CAR INSURANCE RATES : UNDERSTANDING FULL COVERAGE INSURANCE

Full Coverage Auto Insurance typically consists of Comprehensive and Collision coverage added to an Insurance policy. While Full Coverage is not required by State Law, it may be required by a Lender if you are financing a vehicle. Learn more about how you can get the most affordable Utah Car Insurance Rates, while still carrying full coverage insurance.

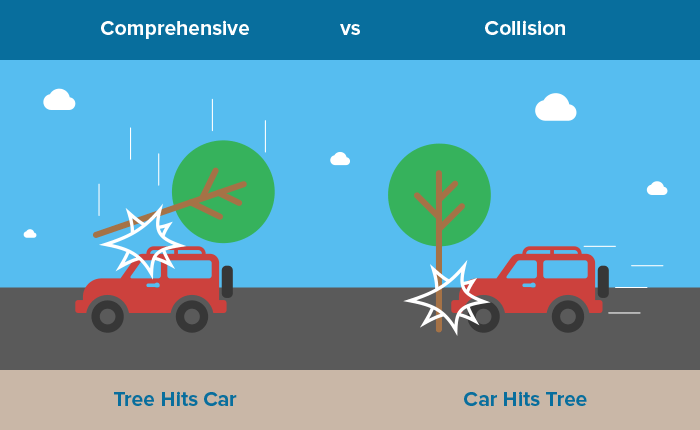

Comprehensive – Subject to a deductible of your choice, usually a $500 or $1000 deductible applies. The Insured would be responsible for paying the deductible in the event of a claim, or At Fault Accident, before the insurance company pays out. Comprehensive will cover the vehicle for things such as fire, theft, vandalism, glass breakage, hail, and an impact with an animal.

Collision – Subject to a deductible of your choice, like Comprehensive. Collision will cover for damages to the vehicle in the event of an accident with another vehicle, or object.

Additional Coverages – Other coverages may be added onto a full coverage insurance policy, which would include Roadside Assistance, Rental Reimbursement, and even Gap Insurance if you have a loan on the vehicle. These coverages can generally be added to your policy for a small additional premium.

SHOULD I GET FULL COVERAGE?

Before purchasing a vehicle, consider checking the price of full coverage on that vehicle to ensure that it is within your price range. While we do what we can to save our customers money by applying discounts, some factors go into play when determining the cost of full coverage insurance. If a vehicle has higher rates of theft, or the parts are more expensive to replace/repair, the cost of insurance will likely be higher for that vehicle.

UTAH CAR INSURANCE QUOTES : HOW TO GET THE BEST UTAH CAR INSURANCE RATES

Searching for Utah Car Insurance Quotes can seem like a lengthy, difficult process for some drivers. If you go through an Insurance Broker, like our agents at A Plus Insurance, we take the hassle away and do the shopping for you.

How can you save on your Car Insurance ? Consider the type of vehicle you are looking to insure and the coverages for that specific vehicle. If you are financing a vehicle, there are things you can do to save on your Utah Car Insurance Rates, even while carrying full coverage.

Talk with an Agent about discounts available, coverages options such as deductibles, bundling multiple products together such as auto and home insurance, and Safe Driver Discounts.

Frequently Asked Questions

How can I get car insurance quotes in Utah?

Getting car insurance quotes in Utah is easy. You can call our A Plus Insurance office at 888-445-2793 for a free quote. We also offer online quotes, allowing you to compare rates and find the best car insurance coverage for your needs.

What types of car insurance policies are available in Utah?

In Utah, you can choose from various car insurance policies, including liability insurance, full coverage, SR22 insurance, and more. A Plus Insurance can provide guidance and resources to help you understand your options and select the right policy.

How can I compare car insurance rates from different companies?

You can compare car insurance rates from different companies in Utah by reaching out to A Plus Insurance. We can assist you in obtaining quotes from multiple insurance companies, allowing you to make an informed decision and find the most affordable rates for your vehicle insurance.

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

OTHER HELPFUL LINKS: SUGGESTIONS

| Additional Utah Insurance |

|---|

| SR-22 Insurance in Utah |

| Bundle and Save on Homeowners Insurance in Utah |

About This Article

This article provides valuable information about car insurance quotes in Utah. Here’s a summary of what you can find:

- Find the best Utah car insurance rates for your vehicle.

- Compare quotes from top insurance companies in Utah.

- Get insured and protect your vehicle and family.

- Affordable car insurance for Utah residents.

- Coverage options for all types of drivers.

- Utah auto insurance made easy with Learn and Serve.

Contact Us

If you have any questions or need assistance, please feel free to call us at 1.888.445.2793. Our team of insurance experts is ready to help you.

Last Updated on by Lauren Mckenzie