12 Ways to Lower Your Auto Insurance Rates

We represent over 15 Companies…. We are happy to do the shopping for you. Call, text, or get your own quote online.

- 1. Lower Auto Insurance Rates by Shopping Around

- 2. Comparing Costs BEFORE buying a vehicle can lower auto insurance rates

- 3. Lower Your Auto Insurance Rates by Raising Your Deductibles

- 4. You Can Lower Your Auto Insurance Rates by Lowering Coverage on older Vehicles

- 5. Bundling Your Auto Insurance with Home or Renters Insurance Can Lower Auto Insurance Rates

- 6. Maintaining a low credit Score Can DRAMATICALLY lower your auto insurance rates

- 7. Lower Your Auto Insurance Rates with Discounts!

- 8. Auto pay or EFT discounts Can Lower Auto Insurance Rates Big Time!

- 9. Lower Auto Insurance Rates by Paying in Full for 6 months or a year

- 10. Enroll in SnapShot & and other Driver based rating programs

- 11. Drive Slow Drive Safe…. Violation/Accident-Free Discount is Huge Helping Lower Auto Insurance Rates

- 12. Talk to a Broker to Lower Your Auto Insurance Rates

- Frequently Asked Questions

- What are some effective ways to lower auto insurance rates?

- Are there specific discounts that can help decrease auto insurance premiums?

- Is there a contact number to inquire about auto insurance rate reductions?

- Who gives the lowest car insurance rates?

- What is the simplest way to lower your auto insurance premium?

- How can I get my insurance company to lower my rate?

- Other Related Links

- Lower Auto Insurance Rates

1. Lower Auto Insurance Rates by Shopping Around

Since prices do vary from company to company, it’s smart to shop around for the best price. Ask friends and relatives for some recommendations. Most importantly pick an insurance company that takes the time to answer all your questions.

For example, in the city of Richmond, Virginia, notice how the average liability-only rates vary depending on the company.

But this might not be the case in your city, so give us a call to check, and we could help you lower auto insurance rates in under 15 minutes

| Rank in Virginia | Auto Insurance Company | Average Liability Only Rate |

|---|---|---|

| 1 | Progressive | $88.00 |

| 2 | Dairyland (Viking) | $89.00 |

| 3 | Travelers | $104.00 |

| 4 | Mendota | $109.00 |

| 5 | The General | $113.00 |

| 6 | Bristol West | $123.00 |

| 7 | Liberty Mutual | $123.00 |

2. Comparing Costs BEFORE buying a vehicle can lower auto insurance rates

Auto insurance premiums are based on the car’s worth, the cost to replace or repair it, and safety records.

Make sure to note if the vehicle you are buying has any prior damage, theft, or title issues as those rating factors can impact your auto insurance rates.

Take a look at how the year of a vehicle can impact a monthly payment with the same insurance company, same driver, same record, and the same make and model.

| Year Make and Model | Average Progressive Rate |

|---|---|

| Full Coverage Rate on 2006 Toyota Corolla | $76 |

| Full Coverage Rate on 2022 Toyota Corolla | $116 |

3. Lower Your Auto Insurance Rates by Raising Your Deductibles

By asking for higher deductibles, your insurance premium will go down. For example, going from a $500 deductible to $1,000 could save you 40 percent or more on your auto insurance rates.

4. You Can Lower Your Auto Insurance Rates by Lowering Coverage on older Vehicles

If your car is worth less than about 10 times the total premium, full coverage might not be worth the additional cost.

Take a look at the liability-only insurance rates vs. the full coverage from Atlanta, Georgia. Liability only can help lower auto insurance rates by a nice hefty chunk each month.

See if you might be a good candidate to lower auto insurance rates by lowering your coverage.

| Rank | Insurance Company | Avg. Liability Only Rates |

|---|---|---|

| 1 | The General | $96.00 |

| 2 | Dairyland (Viking) | $97.00 |

| 3 | Travelers | $101.00 |

| 4 | Progressive | $104.00 |

| 5 | Liberty Mutual | $114.00 |

| 6 | Mendota | $122.00 |

| 7 | Bristol West | $124.00 |

| Rank | Insurance Company | Average Full Coverage Rates |

|---|---|---|

| 1 | Progressive | $119.00 |

| 2 | Bristol West | $126.00 |

| 3 | Mendota | $127.00 |

| 4 | The General | $141.00 |

| 5 | Travelers | $168.00 |

| 6 | Dairyland (Viking) | $189.00 |

| 7 | Liberty Mutual | $199.00 |

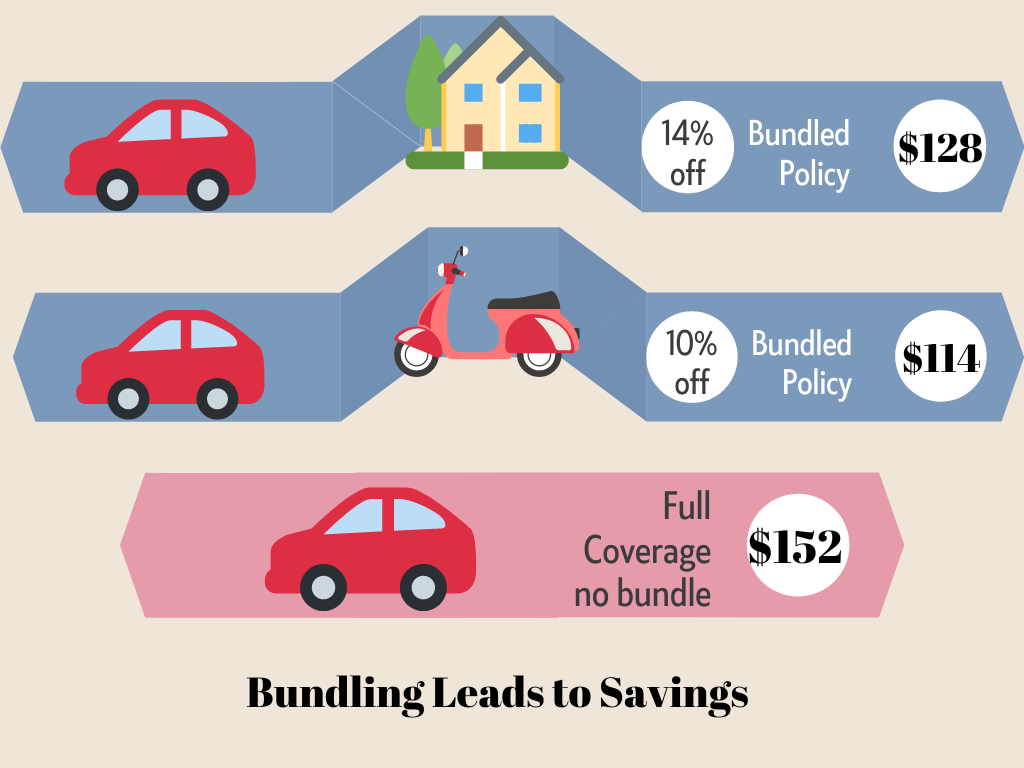

5. Bundling Your Auto Insurance with Home or Renters Insurance Can Lower Auto Insurance Rates

Consider purchasing a home or renters with the same company. Many companies offer a discount for bundling auto and home or auto and renters.

If you don’t need to add a home or renters policy, there are plenty of other products you can bundle that will help lower auto insurance rates.

6. Maintaining a low credit Score Can DRAMATICALLY lower your auto insurance rates

Since most companies use your credit information to determine your auto insurance rates, it’s important to pay bills on time and keep balances low to keep your record in good standing.

Take a look at some sample monthly rates and notice how dramatically the cost is if you have a poor credit score.

| Level of Credit | Average Car Insurance Rate |

|---|---|

| Excellent | $127.65 |

| Good | $143.84 |

| Average | $173.19 |

| Poor | $244.95 |

7. Lower Your Auto Insurance Rates with Discounts!

Don’t miss out on the car insurance discounts!

For example, on one auto policy we recently sold, the gentleman wanted to keep his wife from being a rated driver, thinking it would make his rates higher. But when we added her, a married discount was applied and lowered his monthly installments by $30 dollars. That’s $180, and a new pair of shoes!

Some companies differ in the auto discounts they offer, so it’s important to ask. For example: one company may offer a low mileage discount, and not offer a discount for a driving course.

Check out some of the auto insurance companies below and notice which discounts they might offer.

| Level of Impact on Savings (from low to high) | Insurance Discounts with Progressive |

|---|---|

| High | Advanced Quote |

| High | Paid in Full |

| High | Auto Pay |

| Mild | Multi Policy |

| Mild | Multi Vehicle |

| Mild | Married |

| High | No Accidents or Violations |

| Very High | Continuous Insurance |

| Mild | Homeowners |

| Mild | Military |

| Mild | Education Discount |

| Mild | Paperless Discount |

8. Auto pay or EFT discounts Can Lower Auto Insurance Rates Big Time!

Set up automatic payments through your company if you are paying monthly. Not doing so can mean higher auto insurance rates each month.

Not only is this something almost EVERYONE can qualify for, but it’s also one of the most impactful discounts you can add to your policy

9. Lower Auto Insurance Rates by Paying in Full for 6 months or a year

If you are able to do so, paying in full for 6 months or a year can save $100’s on your auto insurance rates versus paying monthly.

Think about all the things you can get with those savings.

| If You Saved $587.55 in a Year From Paying In Full…. | What it Looks like in Savings… |

|---|---|

| Number of Eggs you could buy | 5402 |

| Pound of bananas you could buy | 1157 |

| Pound of Potatoes you could purchase | 853 |

| Number of Candy bars you could buy | 435 |

| Months of Netflix you could afford with your savings | 43 |

| Number of Peanuts you could buy | 107568 |

10. Enroll in SnapShot & and other Driver based rating programs

Most insurance companies now offer ways that you can personalize your insurance rates based on your own good driving habits.

It is a known statistic that men will typically pay more for auto insurance than women drivers. Unfair?

Possibly! That’s why there is the option to enroll in a “drive program” like Progressive Insurance “Snapshot” or National General’s “Dynamic Drive.”

These programs can save almost up to 30% on your renewal premium. Find out more about what some of our carriers can offer you!

| AGE | Avg. Male Driver Rates | Average Female Driver Rates |

|---|---|---|

| 16-18 | $ 231.84 | $ 184.09 |

| 19-24 | $ 193.20 | $ 161.00 |

| 25-30 | $ 139.84 | $ 124.84 |

| 31-40 | $ 110.40 | $ 106.08 |

| 41-50 | $ 109.48 | $ 98.44 |

| 50-65 | $ 99.36 | $ 101.48 |

| 65+ | $ 106.08 | $ 114.08 |

11. Drive Slow Drive Safe…. Violation/Accident-Free Discount is Huge Helping Lower Auto Insurance Rates

This one seems like a no-brainer, but people are genuinely shocked when they see that one or two speeding tickets can cause insurance rates to jump up significantly.

Take your time on the road, don’t drink and drive, and make sure not to get caught without the required documents.

If you maintain a clean driving record for a number of years, your insurance company will reward you with lower auto insurance rates.

| Violation Type | Major/Minor/Non-Moving? | How Long It will Affect Your Rates |

|---|---|---|

| No Proof of insurance | Non Moving | NA* |

| Failure to Secure Load to truck/trailer | Minor | 3 Years |

| Failure to Use Turn Signal | Minor | 3 Years |

| Crossing over a Center Divider | Minor | 3 Years |

| DUI | Major | 10 Years |

| Failure to maintain Clear Distance (tailgating | Minor | 3 Years |

| Expired Tags | Non Moving | NA* |

| Failure to Use a Seat Belt | Non Moving | NA* |

| Reckless Driving | Major | 5 Years |

| At Fault Accident | Major | 5 Years |

| Parking | Non Moving | NA* |

| Failure to Yeld | Minor | 3 Years |

12. Talk to a Broker to Lower Your Auto Insurance Rates

We can’t say it enough. Talk to one of the agents with A Plus Insurance today. They are trained and licensed professionals who are here to be your advocates and will work hard to lower your car insurance rates. So give us a try, and at the very least, you will have spoken to an awesome person!

Frequently Asked Questions

What are some effective ways to lower auto insurance rates?

There are several ways to reduce auto insurance costs, such as maintaining a clean driving record, bundling insurance policies, and opting for higher deductibles.

Are there specific discounts that can help decrease auto insurance premiums?

Yes, various discounts, including good driver discounts, student discounts, and safety feature discounts, may be available to lower insurance rates.

Is there a contact number to inquire about auto insurance rate reductions?

Yes, for inquiries about reducing auto insurance rates, please call us at 1.888.445.2793.

Who gives the lowest car insurance rates?

The lowest car insurance rates can vary based on individual circumstances. Comparing quotes from multiple providers, like Progressive, Dairyland, and National General, can help identify the most competitive rates.

What is the simplest way to lower your auto insurance premium?

The simplest way to lower your auto insurance premium is to maintain a clean driving record, increase your deductible, and take advantage of discounts such as multi-policy or safe driver discounts.

How can I get my insurance company to lower my rate?

To get your insurance company to lower your rate, consider discussing your policy options, updating them about any changes in your driving habits, and asking about additional discounts for which you may be eligible.

Other Related Links

How much will you pay for Insurance

Lower Auto Insurance Rates

Learn how to lower your auto insurance rates with these tips from Learn and Serve Insurance. Saving on auto insurance has never been easier.

- Compare Insurance Rates

- Ask About Discounts

- Maintain a Good Driving Record

- Bundle Policies for Savings

For personalized guidance and a free quote, call us at 1.888.445.2793.

Last Updated on by Amanda Moss