About Falcon Insurance

Falcon Insurance Company is one of those insurance companies that not many people have heard of, but this does not mean they aren’t any good or have anything to offer. They are described as a non-standard insurance company, meaning they are reserved for high-risk drivers, such as teenagers, those with multiple violations, and those with bad credit.

The company only provides coverage in 7 states:

On this page, however, we will be focusing on Falcon in Oklahoma.

Like any company, Falcon Insurance has a mixture of positive and negative reviews. Some consider the company to be very helpful and friendly, while others have had a negative experience. So what are the Pro’s and Con’s?

| Pros: | Cons: |

|---|---|

| Those who have a hard time finding insurance anywhere else | They only provide Auto Insurance. Renters, Homeowners, Boat, etc. are not available. |

| Offers a bilingual staff for the Spanish-speaking community | According to the NAIC, there are many complaints |

| Affordable | Only available in 7 States |

Falcon in Oklahoma: Coverages

Coverages that are offered by Falcon Insurance in Oklahoma may vary depending upon the location within the State and type of policy. However, they offer common auto insurance coverages. Oklahoma specifically offers the following coverages for personal auto:

- Liability

- Collision

- Comprehensive

- Uninsured Motorist

- Underinsured Motorist

- Medical Payments

- Towing Reimbursement

- Non-Owners

- SR-22

Below and the Coverage Limit Options according to Falcon’s own website.

| BI Limits: | $25,000/$50,000 |

| Comp and Collision: | Must be written with Liability |

| CP & CL Deductibles: | $100, $250, $500, $750, $1,000 |

| PD Limits: | $15,000, $20,000, & $25,000 are offered |

| UM/UIMBI: | $25,000/$50,000 |

| UMPD: | Available with a $500 deductible |

| MP Limits: | $5,000 Limits available |

| Roadside Assistance (TOW) | -Optional and available on both Full Coverage and Liability-Only policies -All coverage provided on a reimbursement basis -Benefit Amounts: Max Towing Benefit: $70 per covered auto disablement Locksmith: $25 Emergency Road Service: $35 |

Falcon Insurance in Oklahoma: Discounts

A great way to save some money on car insurance is to have your agent apply discounts. Each insurance company has their own discounts available, but for Falcon in Oklahoma, the following discounts are available to you:

- EFT Discount

- Homeowners

- Paid in Full Discount

- Non-Owners

- Transfer Discount (Up to 30 day lapse in coverage)

- Multi-Car Discount

- Renewal Discount

- Advance Purchase Discount (3 days or more)

- Defensive Driver

Is Oklahoma Car Insurance Required?

Yes, car insurance is required by law in the State of Oklahoma. All drivers in Oklahoma are required by law to have state minimum liability coverage to help pay for any damages and/or injuries caused by a car accident they may be legally responsible for.

According to the Oklahoma Insurance Department, the minimum liability insurance coverage required in the state is: 25/50/25

- $25,000 for bodily injury or death of one person in an accident caused by the driver

- $50,000 for bodily injury or death of two or more people in an accident caused by the driver

- $25,000 for property damage caused by the driver

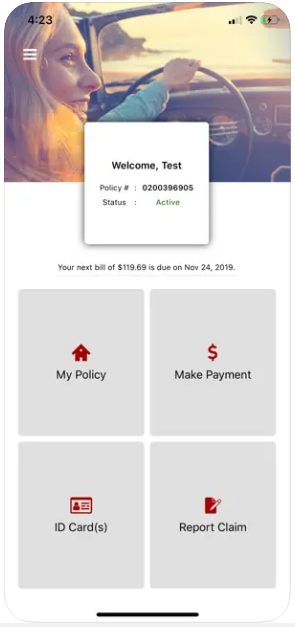

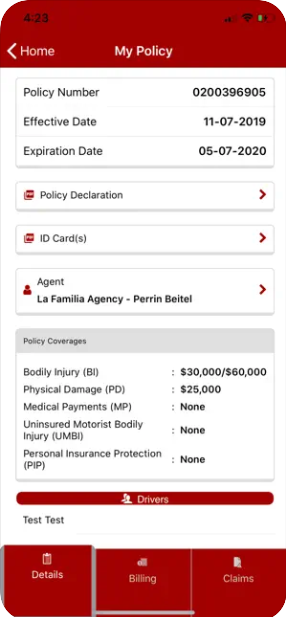

Falcon’s Mobile App

Most high-risk auto insurance companies, such as Falcon, don’t bother investing in mobile apps to help their customers. However, Falcon has a mobile app for iOS and Android – the reviews on the app are insanely good. Note below on what services the Falcon App provides:

View detailed policy information including coverages, drivers, and vehicles

View and print ID cards

Access your insurance agent’s address and phone number for quick contact

View billing details

Make payments

File a claim on the spot with photos and location details from your mobile phone

Share policy documents via email or text message

Receive policy billing notifications to remind you that a payment is due

Is Falcon Insurance Right For You?

To determine if Falcon Insurance is the right insurance company for you, take a close look at the coverage options provided by Falcon Insurance and compare them to your personal needs.

You can also get a quote from Falcon Insurance and compare it to quotes from other insurance companies to see what’s the best fit for you. The most practical way is to call an insurance broker. They have the ability to check multiple insurance companies and find the most affordable price, saving you time and money.

Another way you can see if Falcon in Oklahoma is a good fit for you is to research on their customer service. Reviews are easily available online and see if there are any major complaints or reasonable issues that stand out.

An important factor before deciding is to learn about the claims process at Falcon Insurance to make sure that your expectations line up with what is offered.

You can also do some research on Falcon Insurance’s financial strength rating to determine if the company is financially stable and able to pay out claims if necessary.

Ultimately, choosing an insurance company really comes down to finding a balance and what works for your circumstances. But be sure to consider all of these factors when deciding if Falcon Insurance is the right fit for you.

Contact Information for Falcon in Oklahoma

Claims

Email:OKclaims@falconinsgroup.com

Fax: 1(888)503-1632

+

Underwriting

Email:OKunderwriting@falconinsgroup.com

Fax: 1(888)503-2538Customer ServicePhone:800-929-3252

Falcon Insurance Company: Other Helpful Links

A Plus Insurance is proud to offer more information about Falcon Insurance in:

Frequently Asked Questions about A Plus Insurance in Oklahoma

Q1: What types of insurance does A Plus Insurance offer in Oklahoma?

A Plus Insurance in Oklahoma offers a wide range of insurance options, including auto, home, life, and business insurance.

Q2: How can I contact A Plus Insurance in Oklahoma?

You can reach us at 1.888.445.2793. Our dedicated team is available to assist you.

Q3: Can I get a custom insurance quote for my specific needs in Oklahoma?

Absolutely! A Plus Insurance in Oklahoma can provide personalized insurance quotes tailored to your specific needs. Feel free to call us at 1.888.445.2793 to discuss your requirements and get a custom quote.

Last Updated on by Marlon Moss