- SR22 Insurance Indiana

- Best Full Coverage SR-22 Insurance Rates in Indiana by Company

- How Do a DUI and SR22 Impact Insurance Rates in Indiana?

- Which Company Offers the Lowest SR-22 Rates by City in Indiana?

- Indiana SR-22 Filing Laws: What You Need to Know

- Which Companies Offer SR-22 Insurance in Indiana?

- How to Get SR-22 Insurance in Indiana Without Owning a Car

- SR22 Insurance Costs by City in Indiana: Full Coverage Rates

- Why do I need an SR-22 in Indiana?

- How do I get rid of an SR-22 in Indiana?

- Additional Reasons you may be required to carry SR22 Insurance Indiana

- State Insurance Requirements in Indiana

- Frequently Asked Questions about SR22 Insurance in Indiana

- What is SR22 Insurance in Indiana?

- How long do I need to carry SR22 Insurance in Indiana?

- What happens if my SR22 Insurance lapses in Indiana?

- Can I get SR22 Insurance if I don't own a vehicle in Indiana?

- Is there a difference between SR22 Insurance and regular auto insurance in Indiana?

- SR22 Insurance in Indiana: Article Information

- What We Do at A Plus Insurance

Best Full Coverage SR-22 Insurance Rates in Indiana by Company

The best full coverage SR-22 insurance rates in Indiana vary significantly by company, so it’s important to compare options. When searching for SR-22 insurance in Indiana, providers like Progressive, GEICO, and State Farm offer different premiums based on factors such as driving history, age, and coverage level. Comparing quotes can help you find competitive rates and the best deal to meet Indiana’s financial responsibility requirements. Here are some estimated rates for full coverage SR-22 insurance from top providers to guide your search.

| Company | SR22 Full Coverage (Average) |

|---|---|

| Safeco | N/A |

| Allstate | N/A |

| Progressive Insurance | $182.00 |

| Dairyland | $184.00 |

| Assurance America | $190.00 |

| Acceptance RTR | $187.00 |

| Mendota Ins. Company | $179.00 |

| National General | $186.00 |

| Bristol West | $213.00 |

| GAINSCO | $204.00 |

| American Family | N/A |

| Travelers | N/A |

| Farmers | $179.00 |

| USAA | N/A |

| Liberty Mutual | $184.00 |

| State Farm | N/A |

| 21st Century | N/A |

Some companies above do not offer SR22 insurance at all. You can still obtain the SR22 you need from another company.

How Do a DUI and SR22 Impact Insurance Rates in Indiana?

DUI convictions in Indiana often lead to the requirement of filing an SR22 insurance certificate. This filing serves as proof of financial responsibility, showing that you carry the state-mandated minimum insurance coverage. After a DUI, insurance premiums can skyrocket, reflecting the increased risk you pose to insurers. It’s essential to shop around for SR22 insurance options that cater to drivers with DUIs on their records, as some companies specialize in high-risk insurance, potentially offering more reasonable rates to meet your needs and legal obligations.

In Indiana, you must carry an SR22 for 3 consecutive years from the end of your suspension as a result of a DUI. If the insurance policy lapses at any time in the 3 years, the time will restart and your license will be re-suspended.

Which Company Offers the Lowest SR-22 Rates by City in Indiana?

Finding the lowest price on SR-22 insurance in Indiana can vary significantly from city to city. Urban areas like Indianapolis and Fort Wayne might see higher rates due to increased traffic and risk of accidents, while smaller towns could offer more affordable options. Companies like Dairyland, The General, and SafeAuto are known for providing competitive SR-22 rates across different cities. Local insurance agents can also offer personalized quotes tailored to your specific situation, helping you find the most cost-effective SR-22 insurance in your area.

| City | Carrier |

|---|---|

| Seymour | National General |

| Vincennes | Farmers |

| Bloomington | Progressive |

| Fort Wayne | Bristol West |

| Goshen | The General |

| Washington | Farmers |

| Michigan City | Bristol West |

| Greensburg | Progressive |

| Valparaiso | Progressive |

| Marion | Bristol West |

| Carmel | Progressive |

| South Bend | Progressive |

| Fishers | Liberty Mutual |

| Zionsville | Liberty Mutual |

| Portage | Geico |

| Evansville | Progressive |

| Chesterton | Dairyland* |

| East Chicago | Progressive |

| Crawfordsville | Progressive |

| Richmond | Farmers |

| Warsaw | The General |

| Crown Point | Geico |

| Noblesville | Progressive |

| La Porte | Progressive |

| Mishawaka | The General |

| Jasper | Geico |

| Brownsburg | The General |

| Merrillville | Bristol West |

| Schererville | Dairyland* |

Indiana SR-22 Filing Laws: What You Need to Know

Indiana’s laws mandate SR-22 filings for drivers who’ve committed serious traffic violations, such as DUIs, reckless driving, or operating a vehicle without insurance. The SR-22 certificate must be filed with the state by your insurance provider, confirming that your policy meets the minimum liability coverage requirements. This filing is typically required for a period of three to five years, depending on the severity of the offense. Failure to maintain continuous SR-22 coverage can result in license suspension and further legal penalties.

In Indiana, the time required to carry an SR22 will vary depending on the type of offense, and the number of offenses. Your SR22 must remain in force for your required amount of time, if it cancels for any reason the time will start over and you may be required to pay new reinstatement fees for your license.

Which Companies Offer SR-22 Insurance in Indiana?

In Indiana, several insurance companies offer SR-22 filings for drivers needing to prove financial responsibility. Notable providers include Progressive, GEICO, State Farm, and Allstate, among others. Each company has its criteria for SR-22 insurance, with varying rates based on the individual’s driving record and the required coverage. It’s advisable to contact multiple insurers for quotes to ensure you’re getting a policy that not only meets Indiana’s SR-22 requirements but also fits within your budget.

| Company | SR22 Offered |

|---|---|

| Liberty Mutual | YES |

| Nationwide | NO |

| Bristol West | YES |

| Assurance America | YES |

| The General | YES |

| Progressive Insurance | YES |

| Dairyland | YES |

| USAA | NO |

| Travelers | NO |

Companies that do not offer SR22 Insurance tend to shy away from higher-risk drivers. These companies are listed above for your review.

How to Get SR-22 Insurance in Indiana Without Owning a Car

I

To get SR-22 insurance in Indiana without owning a car, you can obtain a non-owner SR-22 insurance policy. This type of policy provides liability coverage for drivers who do not own a vehicle but are required to file an SR-22 due to traffic violations. Non-owner SR-22 insurance ensures you meet Indiana’s financial responsibility requirements and covers you when driving vehicles you do not own. Providers like Progressive, GEICO, and State Farm offer non-owner SR-22 policies, so it’s important to compare quotes to find the best rates. This way, you can stay compliant with state laws without needing to own a car.

Key Points to Remember:

- Non-owner SR-22 insurance is available for those without a car.

- Ensures compliance with Indiana’s financial responsibility requirements.

- Compare quotes from Progressive, GEICO, and State Farm for the best rates.

SR22 Insurance Costs by City in Indiana: Full Coverage Rates

The cost of SR22 insurance with full coverage in Indiana varies by city, and understanding these differences can help you find the best rates. Major cities like Indianapolis, Fort Wayne, and Evansville may have different premium rates due to factors like traffic density and local insurance regulations. It’s important to compare quotes from top providers such as Progressive, GEICO, and State Farm to get the most competitive rates for SR22 insurance. Full coverage SR22 insurance typically includes liability, comprehensive, and collision coverage, ensuring you meet all state requirements while protecting your vehicle.

| City | Price |

|---|---|

| Munster | $165 |

| Avon | $147 |

| St. John | $181 |

| Granger | $168 |

| Beech Grove | $153 |

| Griffith | $159 |

| Gary | $172 |

| Michigan City | $146 |

| New Haven | $148 |

| Hobart | $162 |

| Frankfort | $165 |

| East Chicago | $147 |

| Schererville | $150 |

| Crawfordsville | $159 |

| Seymour | $173 |

| Carmel | $146 |

| Yorktown | $155 |

| New Castle | $151 |

| Connersville | $163 |

| South Bend | $170 |

| Martinsville | $175 |

| Lawrence | $151 |

| Bloomington | $149 |

| Dyer | $157 |

| Portage | $152 |

| Richmond | $178 |

| Highland | $162 |

| Evansville | $170 |

| Fort Wayne | $165 |

| Cedar Lake | $158 |

| Zionsville | $153 |

| Goshen | $178 |

| Chesterton | $180 |

| Bedford | $148 |

| Warsaw | $163 |

| Brownsburg | $161 |

| Greensburg | $160 |

| Clarksville | $159 |

| Valparaiso | $164 |

| Marion | $153 |

| Lafayette | $153 |

| Terre Haute | $172 |

| Elkhart | $166 |

| La Porte | $168 |

| Shelbyville | $159 |

| Auburn | $177 |

| Greenwood | $154 |

| Jeffersonville | $168 |

| Fishers | $152 |

| Greenfield | $171 |

| Speedway | $148 |

| Crown Point | $160 |

| Westfield | $155 |

| Hammond | $159 |

| New Albany | $157 |

| Vincennes | $179 |

| Indianapolis | $165 |

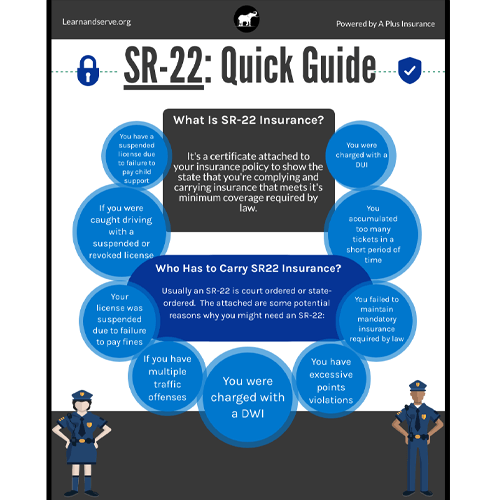

Why do I need an SR-22 in Indiana?

An SR-22 in Indiana is a vital document for individuals who’ve had their driving privileges revoked or suspended due to serious traffic violations. It’s not actually an insurance policy but rather a certificate proving that you have the minimum liability coverage required by the state. But why the need for an SR-22? In Indiana, this document acts as a form of insurance verification for high-risk drivers. Factors such as DUI convictions, multiple traffic offenses, or driving without insurance could lead to the requirement of an SR-22. It’s crucial to note that an SR-22 doesn’t automatically reinstate your driving privileges; it’s a necessary step towards reinstatement, helping you prove your financial responsibility to the state.

To secure an SR-22 in Indiana, it’s essential to have an active auto insurance policy meeting the state’s minimum liability requirements. The SR-22 itself is usually filed by your insurance provider directly with the Indiana Bureau of Motor Vehicles (BMV) on your behalf. Once submitted, it’s imperative to maintain continuous coverage for the mandated period, typically three years. Any lapse or cancellation in this coverage might result in the BMV being notified, potentially extending the required SR-22 period. Understanding why and how an SR-22 is needed in Indiana is crucial to navigate the process effectively and regain your driving privileges promptly.

How do I get rid of an SR-22 in Indiana?

To get rid of an SR-22 in Indiana, you must first ensure that you have fulfilled the SR-22 filing requirement, which typically lasts for three years. Once you have maintained continuous coverage for the required period, you can contact your insurance company to remove the SR-22 from your policy. It’s essential to keep your insurance policy active and avoid any lapses in coverage during this period to ensure the successful removal of the SR-22.

Here are some estimated costs for SR22 insurance in Indiana from various providers, which can help you understand the financial commitment while you work towards removing the SR-22 requirement.

Estimated SR-22 Insurance Rates in Indiana

| Insurance Company | Monthly Rate Estimate | Annual Rate Estimate |

|---|---|---|

| Progressive | $130 | $1,560 |

| Dairyland | $125 | $1,500 |

| Travelers | $135 | $1,620 |

| Gainsco | $140 | $1,680 |

| Assurance | $128 | $1,536 |

| National General | $132 | $1,584 |

| Bristol West | $129 | $1,548 |

| Mendota | $127 | $1,524 |

| The General | $131 | $1,572 |

| Suncoast | $133 | $1,596 |

Key Points to Remember:

- Fulfill the SR-22 requirement duration (usually three years).

- Maintain continuous insurance coverage without lapses.

- Contact your insurance provider to remove the SR-22 after meeting the requirements.

Additional Reasons you may be required to carry SR22 Insurance Indiana

Beyond DUIs and serious traffic offenses, there are other circumstances in Indiana where an SR-22 may be required. These include failing to pay court-ordered child support, repeated offenses of driving without insurance, and violations involving uninsured accidents. The SR-22 certificate serves as a pledge to the state that you’re maintaining the necessary insurance coverage, adhering to Indiana’s efforts to keep uninsured drivers off the road.

| At Fault accident with no insurance |

| Suspension of license due to child support |

| Failure to maintain mandatory insurance coverage required by state law |

| DUI (Driving under the influence of Drugs or Alcohol) |

| License suspension for failure to pay fines |

| Excessive points violations |

| Driving while Suspended/revocation |

| Too many tickets in a short period of time |

| Previous incarceration |

State Insurance Requirements in Indiana

The minimum liability requirements in Indiana are $25,000 per person for Bodily Injury and up to $50,000 for each accident, and $25,000 for property damage. This will cover expenses up to these limits in the event of an At Fault Accident.

| State | State Minimum | PIP? |

|---|---|---|

| Indiana | 25/50/25 | N/A |

An SR-22 is a certificate proving you have the required liability coverage, often mandated after serious driving offenses. Reasons for needing one include DUI convictions, multiple traffic violations, or driving without insurance.

Frequently Asked Questions about SR22 Insurance in Indiana

What is SR22 Insurance in Indiana?

SR22 Insurance in Indiana is a certificate of financial responsibility required for individuals who have committed certain driving violations. It provides proof of insurance to the state and is often necessary to reinstate a suspended driver’s license.

How long do I need to carry SR22 Insurance in Indiana?

In Indiana, individuals are generally required to carry SR22 Insurance for a period of three years from the date their driving privileges are reinstated. However, the exact duration may vary depending on the severity of the violation and any additional requirements from the court or the Indiana Bureau of Motor Vehicles.

What happens if my SR22 Insurance lapses in Indiana?

If your SR22 Insurance lapses or is cancelled in Indiana, your insurance provider is required to notify the state. This may result in the suspension of your driving privileges. To avoid this, it’s crucial to maintain continuous insurance coverage for the duration you’re required to have the SR22 certificate.

Can I get SR22 Insurance if I don’t own a vehicle in Indiana?

Yes, in Indiana, you can obtain a non-owner SR22 Insurance policy if you do not own a vehicle. This type of policy provides the necessary liability coverage to meet the state’s SR22 requirements, allowing you to reinstate your driving privileges without owning a vehicle.

Is there a difference between SR22 Insurance and regular auto insurance in Indiana?

Yes, the primary difference between SR22 Insurance and regular auto insurance in Indiana is that SR22 is not an insurance policy itself but a certification attached to an auto insurance policy. It certifies that you carry the minimum insurance coverage required by law, following a serious driving violation. Regular auto insurance doesn’t include this certification.

What We Do at A Plus Insurance

Here’s What Our Clients Say About Us

A Plus Insurance

Last Updated on by Veronica Moss