- Youthful & Young Drivers

- Finding The Best Rate For Our Young Drivers

- Young Drivers Car Insurance Guide

- What Is A Youthful or Young Drivers Exactly?

- Best Insurance For Young Drivers

- What are three common risks for young drivers?

- Do I Need Insurance as Young Drivers?

- Q1: Who are considered young drivers?

- Q2: How can young drivers save on insurance premiums?

- Q3: Why is it important for young drivers to have insurance coverage?

- INSURANCE SERVICES WE OFFER

Young Drivers Car Insurance Guide

You couldn’t wait for the day when Mom and Dad handed over the keys to your first car. A vehicle symbolizes freedom, of being one step closer to becoming an adult and it also means being financially responsible for your actions while driving a car. Wait, what? Pump the breaks, being responsible for what?

Financial responsibility or insurance, you know it’s that little piece of paper in your glove box that says you are covered in the event of an accident. Well, somebody has to pay to have that coverage, and now you are in the driver’s seat, and that somebody just might be you. So here is a little cheat sheet to help you understand auto insurance just a little bit better!

What Is A Youthful or Young Drivers Exactly?

Alas, one of the few times in life when youth is not necessarily a plus. You see insurance companies view drivers between the ages of 16-25 (sometimes higher depending on the company) as inexperienced and charge significantly higher rates for it.

Young Drivers tend to rack up speeding tickets twice as fast as more experienced drivers. Don’t be despaired, although you can’t convince the insurers to lower their premiums because you promise to be a safe driver; many will offer discounts for being a responsible automobile owner.

Best Insurance For Young Drivers

Young Drivers have your auto policy or are still with your parents, these five pro tips will help with the premiums.

- Pick a car that insurers deem safe or cheap to insure. Every year the insurance institute comes out with its “safest” cars list.

- Drivers with no tickets or accidents will have a lower premium, every year that your record is clean; your premiums will get better.

- Hit the books. Many companies will offer a good student discount if you are still in school.

- Companies like Progressive will offer a safe driver discount for no accidents or tickets in the last three years.

- Pay your bills on time. Don’t let your insurance lapse; look for paid-in-full discounts or automatic withdrawal discounts.

For more about other factors that go into your auto premiums, check our article about factors that determine your insurance rates

What are three common risks for young drivers?

Firstly, one prevalent risk for young drivers is inexperience. Novice drivers often lack the practical skills and judgment needed to navigate various driving situations safely. This inexperience can lead to errors in judgment, difficulty in reacting to unexpected events, and an increased likelihood of accidents. Secondly, distracted driving poses a significant threat to young drivers. With the prevalence of smartphones and other electronic devices, many young drivers succumb to the temptation of texting, browsing social media, or engaging in other distractions while behind the wheel. These distractions divert attention away from the road, impairing reaction times and increasing the risk of collisions. Lastly, peer pressure can influence young drivers to engage in reckless behaviors such as speeding, street racing, or driving under the influence of alcohol or drugs. The desire to impress friends or fit in with peers can override sensible decision-making, putting both the driver and others on the road at risk.

To mitigate these risks, it’s crucial for young drivers to prioritize safety and responsible driving habits. Seeking out additional driver training programs can help improve skills and confidence on the road, while avoiding distractions and staying focused while driving is essential for maintaining awareness of surroundings and potential hazards. Furthermore, resisting peer pressure and making informed decisions about when it’s safe to drive can significantly reduce the likelihood of accidents and injuries. As an auto insurance brokerage, we’re committed to helping young drivers understand these risks and find the coverage that meets their needs, providing peace of mind on the road ahead.

Do I Need Insurance as Young Drivers?

You absolutely need insurance. Now, whether you need your own policy or if you need to be added to your parent’s policy will depend on a few things.

- If you have a car and it is on your parent’s policy because it is titled to them, you will be added to their policy.

- Young Drivers, you don’t have a car but have a license you should be added to your parent’s policy.

- If you are still considered a young driver but purchased the vehicle yourself, you can be on your own policy.

Our auto insurance buyer’s guide will educate you on the coverages and limits offered on auto insurance policies.

If you are still a bit fuzzy on the ins and outs of auto insurance, we here at A Plus Insurance are happy to help.

Q1: Who are considered young drivers?

Young drivers are typically individuals between the ages of 16 and 25 who are relatively new to driving and may have less experience on the road.

Q2: How can young drivers save on insurance premiums?

To save on insurance premiums, young drivers can consider taking defensive driving courses, maintaining a clean driving record, and comparing quotes from different insurers. Call us at 1.888.445.2793 for personalized advice.

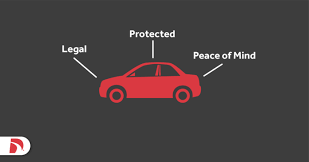

Q3: Why is it important for young drivers to have insurance coverage?

It is important for young drivers to have insurance coverage to protect themselves and others in the event of accidents, as well as to comply with legal requirements. Insurance provides financial security and peace of mind.

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

Last Updated on by Alexis Karapiperis