Top Home Insurance Companies [2023]

Homeowners Insurance is an important step in Homeownership. While Homeowners Insurance is often required by lenders, even if it is not required, it is strongly recommended to carry which could save homeowners from financial ruin.

Purchasing a home is a big investment, and often one of the greatest investments a person will make. Protecting your Investment is as equally important as the initial purchase.

Homeowners Insurance will cover to cost to rebuild the structure of the home, replace personal belongings, provides coverages for incidents you may be liable for, and additional expenses if you were unable to occupy your home due to a covered claim.

Choosing the best Home Insurance provider will be an important step Homeowners should take. Stick around for the TOP RATED Home Insurance Companies, average prices, coverages, and more!

- Top Home Insurance Companies [2023]

- Top Rated Home Insurance Companies

- Average Cost for our highly rated Home Insurance Companies

- Understanding Home Insurance Coverages

- How to Select the Best Home Insurance Policy

- Types of Homeowners Insurance Policies

- Common Discounts Home Insurance Companies Offer

- Bundle and Save with Home Insurance Companies

- How to Narrow down the Best Home Insurance Companies for you

Top Rated Home Insurance Companies

Home Insurance companies will all have different ratings based on their customer service, claims, price, real reviews, and more. Choosing the best home insurance company will provide you with peace of mind that you and your family will be protected from theft, and other natural disasters. There is no price set on peace of mind!

Since Home Insurance companies all vary as far as prices, coverages they offer, customer service and areas they provide coverage in, homeowners should check out a few companies to see which would be the right fit for them. At A Plus Insurance, we work with several Home Insurance companies throughout the U.S., and we are able to shop, and compare prices for YOU. Call us today for a free Home Insurance quote, and stop wasting your time searching for the best price.

| Progressive (ASI) – Best company for discounts |

| State Farm – Best company for auto/home bundle |

| Amica Mutual – Best for Claims Satisfaction |

| Travelers – Best for Additional Endorsements |

| USAA – Best for Military and Veterans |

Average Cost for our highly rated Home Insurance Companies

Which States have the highest homeowners insurance premiums in the United States?

| Oklahoma | $5,300 / Annually |

| Kansas | $4,900 / Annually |

| Nebraska | $4,800 / Annually |

| Arkansas | $4,200 /Annually |

| Texas | $4,100 / Annually |

Which States have the lowest Homeowners Insurance premiums in the United States?

| Hawaii | $580 / Annually |

| California | $1,280 / Annually |

| Alaska | $1,540 / Annually |

| Washington | $1,520 / Annually |

| Vermont | $1,510 / Annually |

Understanding Home Insurance Coverages

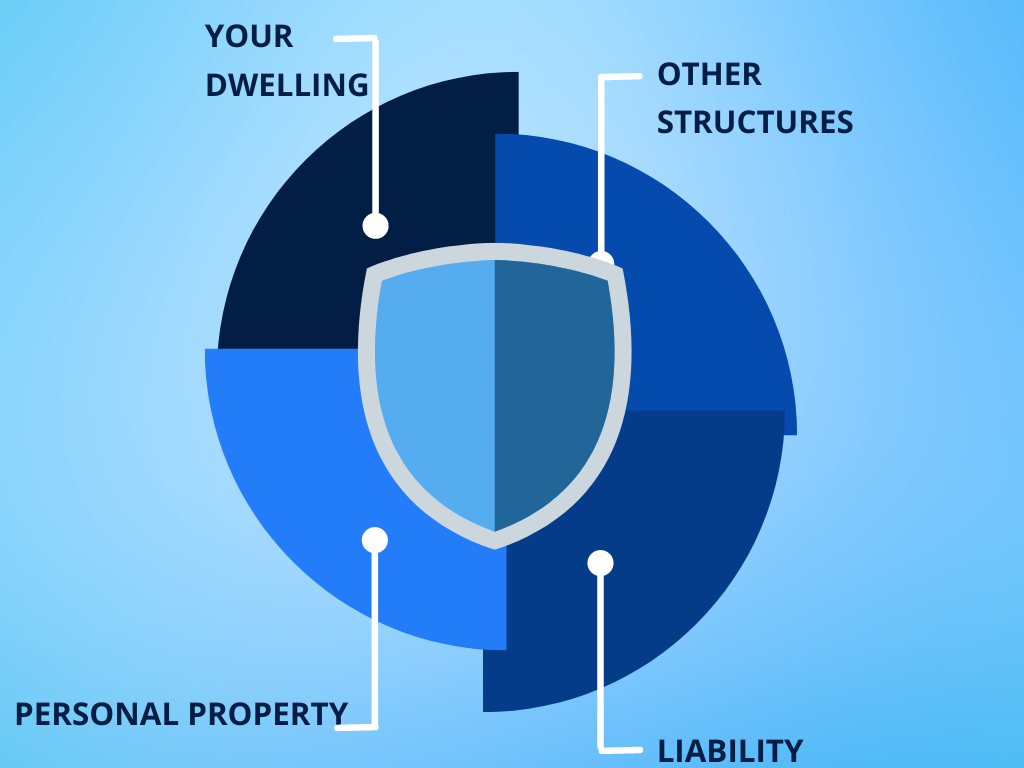

Homeowners Insurance is just as important of an investment than the purchase of the home. It is important to protect your home from any unforeseen events, and protect yourself from financial disaster, as well as understand your home insurance coverages. Most standard Insurance policies will cover the following:

Dwelling : This will pay for damages to the house and any attached structures, such as a garage. Other coverages that may be included will be damage done to plumbing, electrical/wiring, heating, and air conditioning systems. The dwelling coverage should be the amount in which the home were to cost to replace, same condition, without the land included.

Other Structures : This will cover any buildings, such as a car port, shed, etc., that is not permanently attached to the home, as well as a fence, mailbox, etc.

Personal Property : This coverage is usually a percentage of the dwelling coverage, which will cover your personal items if they are lost, damaged or stolen (subject to a deductible. Most common items include electronics, furniture, appliances, and clothing. Think about if you were to flip your home upside down – what would fall out of it? Some higher valued items such as antiques/collectables, guns may need to be listed individually.

Additional Living Expenses : Say, your home were to burn down and you need a place to stay while it is being rebuilt, where will you go? This coverage is intended to help the Insured maintain the same condition of living by providing money for a place to stay (hotel, rental, etc.) as well as transportation, and food while the home is being repaired/rebuilt.

Liability : This will pay for any legal fees if you happen to be sued, or if someone sustained any injuries or damages while on your property.

Medical Payments : This coverage is intended for guests, or friends injured on your property or by your pets (unless excluded in the policy). This will provide coverage up to a set amount for hospital bills.

Endorsements : Most Home Insurance Companies will offer additional endorsements that may be added onto a home policy for additional coverage. There are several different types of endorsements offered.

How to Select the Best Home Insurance Policy

When choosing a Home Insurance Company, it is important for you to do a little bit of research in order to find the best policy that will fit your coverage needs, and financial needs. When you a call a Home Insurance company, make sure to know the value of your home so that you can inform the agent what you would like for your dwelling coverage. You may need to have an inspector come through and tell you the value of the home, in order to get this number.

Understand your coverages, and additional endorsements available. While it may seem easier to let the Insurance provider do the work and choose the coverages for you, Insured’s should at least know what coverages mean and what are available to them. Knowledge is power. Find our top tips for choosing the Best Home Insurance Companies below.

| Company | AM Best |

|---|---|

| Allstate | A+ |

| Hartford Financial | A+ |

| American Family | A |

| American International | A- |

| Farmers Insurance | A |

| Travelers | A++ |

| USAA | A++ |

| Auto-Owners Insurance | A |

| MetLife | A- |

| Nationwide | A |

| Chubb | A |

| Progressive | A+ |

Choose a Reputable Company – Homeowners should do their due dillengence and find a company that has high ratings. You can find a list of high rated companies on BBB, and Consumer Affairs which will rank all home insurance companies by claims, customer service, price, etc. You can read real ratings on each company to find out their strengths and weakness’s before making a decision on who you should trust to insure your home.

Compare Costs – All Home Insurance companies will vary in price so it is important to get at least 3 home insurance quotes before pulling the trigger. Insurance companies premiums will differ with location, fire score, age of home/roof, credit score, and many other rating factors. Where one Home Insurance provider may be sky rocket high, others may be lower.

Find Coverage for Natural Disasters – If you live in an area where you are pron to Earthquakes, Fire, Flooding, or other Natural Disasters – your home insurance policy will likely NOT cover you. It is important to seek this coverage elsewhere if you can not add this to your Home policy.

Be Honest with Home Insurance Companies – Insurance companies have a series of Underwriting questions they ask in able to determine if you are an eligible risk, and to ensure they are insuring your home properly. Are you renting your home out for Air B&B? Make sure to let your agent know this so they can insure the home properly, if it is not disclosed, in the event of a claim it may not be paid out. Do you own a dangerous animal that has injured someone previously? Your Insurance company will need to know this in order to prevent cancellation, non renewal, or non payout in a claim.

Understand your Policy Coverage – Determine how much coverage your home will need in order to properly rebuild the home in the same condition, as well as the value of your personal property, and the liability limit needed based on your assets. Home Owners will need to do a little bit of the leg work in order to let their insurance provider know what amounts they need. While an agent can give suggestions, they generally do not know how much stuff you have in your home, or what the value of your belongings are.

Types of Homeowners Insurance Policies

There are several different types of Home Insurance policies depending upon the type of home you own. Your Agent will be able to determine the correct form to write your Homeowners Insurance policy on when shopping for a quote.

HO-1 Basic Form

This is the most limited Homeowners Insurance form available. This policy will cover your property on a Named Peril basis, meaning most common perils such as fire, or flood will not be covered on this policy. The Named Perils typically covered in this policy are :

| Damage from Aircraft |

| Damage from Vehicles |

| Explosions |

| Fire or Lightening |

| Hail and Windstorm |

| Smoke |

| Riots and Civil Commotion |

| Vandalism or Malicious Mischief |

| Theft |

| Volcanic Eruptions |

HO-2 – Broad Form

The HO-2 Broad form is similar to the HO-1 Basic Form. This policy covers your property on a Named Peril basic, like the Basic Form, but with additional perils covered:

| Weight of ice, snow or sleet |

| Sudden and accidental tearing apart, cracking, burning or bulging of a steam or hot water heating system, air conditioner or sprinkler system |

| Sudden and accidental damage from an artificially generated electrical current |

| Freezing of a household appliance or plumbing, heating, air conditioner or sprinkler system |

| Falling objects |

| Accidental discharge of water or steam from a household appliance or a plumbing, heating, air conditioning or sprinkler system |

HO-3 Special Form

The HO-3 is the most common type of Homeowners policy written. This policy type offers the best coverage that most homeowners will require, or want to have on their home in order to insure that their investment is properly covered. Instead of perils being covered on a Named Peril basis, this policy covers perils (loses) on an Open Peril basic. Open Peril Basis means that all perils are covered, unless they are excluded in the policy which most commonly would be natural disasters such as flooding, or earthquakes. Many times, homeowners will need to purchase a separate policy which would cover Earthquake or Flood if they are in a high risk area for these types of disasters.

HO-4 Tenant’s Form

The HO-4 Tenant’s form, is also known as a Renters Insurance policy. If you are not quite a Homeowner, and you are renting a home, apartment, condo, etc., you are able to purchase a HO-4 policy to cover your personal belongings. This policy will cover the Named Insured’s personal property, Medical payments up to a set limit, and damages in which the renters is found liable for. Some property management companies or landlords require Tenants to carry Renter’s Insurance, while others it is optional to have. The cost for Renter’s Insurance is generally very inexpensive.

HO-5 Comprehensive Form

The Comprehensive form is similar to the standard HO-3 form, which most Homeowners will have. The H0-5 has all of the same policy coverages as the HO-3, except the personal property is covered on an Open perils Basis meaning the insured’s belongings are covered regardless of the type or cost, unless excluded in the policy coverages. Also, the way in which the personal property is paid out in the event of a claim is by Actual Cost, meaning the depreciation of goods is not factored into the cost to replace the item. On the HO-3 policy, the personal property is paid by Replacement cost value.

HO-6 Condominium/ Unit Owners Form

An HO-6 Condo policy is for Homeowners who own a Condo, and need coverage for ‘Walls in’. Most Condo’s are apart of a Homeowners Association which will cover the damage of the Structure and Exterior. This policy will cover all of the contents inside the home, as well as floors and ceilings. The condo association would likely have their own policy which would cover the entire Condo.

HO-7 Mobile Home Form

Homeowners who have purchased a Mobile Home will need an HO-7 policy. This policy will protect the structure of the home, and personal property on a Named Peril basis.

HO-8 Older Home Form

This is a special type of policy used for older, historical homes. Since the architectural design and materials are ever changing, homeowners need an option for older homes that can be restored the same condition as they were instead of using today’s building materials. This will cover on an Actual Cash Value basis, which will be the value minus depreciation.

Common Discounts Home Insurance Companies Offer

Homeowners Insurance Companies offer a wide variety of discounts for home policies which can lead to extra savings. It is important when shopping for good home coverage, you check which discounts you may be eligible for. Most Insurance agents will ask these questions, and discuss discounts available to you, but it never hurts to double check with the agent to make sure all discounts were applied. Also, when shopping for a home insurance policy, Homeowners should check several companies and see which companies offer the best discounts for maximized savings.

Claims Free Discount – Many Home Insurance companies will apply this discount automatically, if you have not filed a claim within a certain time period (typically within 3 years), on the current property or previously owned properties.

Hail Resistant Roofing – This discount will save a percentage on your home insurance policy if you have had a hail resistant roof installed, which will prevent future damage and the roof will last longer.

New Construction – New builds are typically build better (sturdy and safe), versus older homes which will lower your cost for home insurance. The Home must be built by an accredited builder for this discount to apply.

Gated Community– Homeowners living in a gated community which requires either a key, or passkey to enter or is manned by 24/7 armed security, will receive a discount. Homes in a gated community have lower risk to crime such as vandalism and theft.

| Bundling Multiple Polices |

| Claims Free |

| Loyalty |

| Home monitoring / Burglar Protection |

| Smoke detector (monitored) |

| Hail resistant roofing |

| Upgraded Wiring |

| Gated community |

| Married discount |

| New home discount |

| Non-smoking discount |

| Upgraded plumbing |

| Upgraded roof |

| Auto water shut off or leak detection |

| Paid in full |

| EFT (Auto Pay) |

Bundle and Save with Home Insurance Companies

Many Home Insurance companies offer other products, which home owners are able to bundle multiple products for maximized savings. On average, homeowners can save %10-%15 off of each policy they bundle with the same Home Insurance company. Check below for a list of the most common products to bundle with your home insurance in order to save big!

| Auto Insurance |

| Motorcycle |

| Boat |

| RV / Motorhome |

| ATV (Dirt Bike/4-Wheeler) |

| Umbrella Policy |

| Business Owners Policy |

| Commercial Auto |

| Life/Heath Insurance |

How to Narrow down the Best Home Insurance Companies for you

We’ve said this before- all Insurance companies are different as far as coverages they are able to offer, price, eligibility, service, etc. Choosing the right company to insure your home will be down to the insured if you want the best company to insure your home. Only you know what is best for you, we can only make suggestions. How to find the best coverage-

Do you own an Older Home? Homeowners with older homes may have a harder time finding an insurance provider that will cover the home. This is because things may be outdated such as the roof, electrical, plumbing, and the wear and tear has only grown over the years. Find an Insurance company that is okay with the outdated systems, and will be able to offer you an affordable premium. Companies may charge more for older homes, so if you can not find a doable price, consider investing money into your home to improve the conditional and make small updates. You may have better luck when searching for Home insurance.

Do you have Valuable Items Needing Covered? If you have valuable items such as collectors, or antiques, consider looking for a company that will specialize in this. Other companies may charge an arm and a leg for these items, or they may not insure them at all. Most companies offer additional policy endorsements which will cover these items.

Do you own a Dog? We all love dogs! However, for safety reasons and claims some companies will not be able to insure your home if you own certain breeds of dogs. It is unfortunate- but there are companies that offer Animal Liability Exclusions, as well as companies that will not restrict certain breeds. Find an Insurance company that will work with you if you own a restricted dog breed, or exotic pet.

Purchasing a Home in a High Risk Area? High risk area could be an area that is prone to natural disasters such as Earthquake, Flooding, fire, or hurricanes. Insurance prices in these areas will be higher because the risk is greater. Find an Insurance company that will not charge you extra for a higher risk location.

| Other Helpful Links |

| Understanding Homeowners Policy Coverages |

| Buyers Guide for Homeowners Insurance |

| Home Inspection Checklist |

| Understanding Umbrella Insurance |

| Home Insurance Coverages Explained |