Piedmont Insurance Cost!

When it comes to Piedmont insurance costs, there are several key factors to consider. Your premium can depend on the size and location of your home, the age of the property, the materials used in construction, and even your credit score. On average, homeowners in the Piedmont region can expect to pay between $800 and $1,500 annually for comprehensive coverage. However, rates may vary based on individual circumstances and the specific coverage options chosen. To ensure you’re getting the best value for your insurance dollar, it’s essential to compare quotes from multiple carriers. Here are some tips to help you find affordable Piedmont insurance for your Home:

- Shop around and compare quotes from different insurance companies.

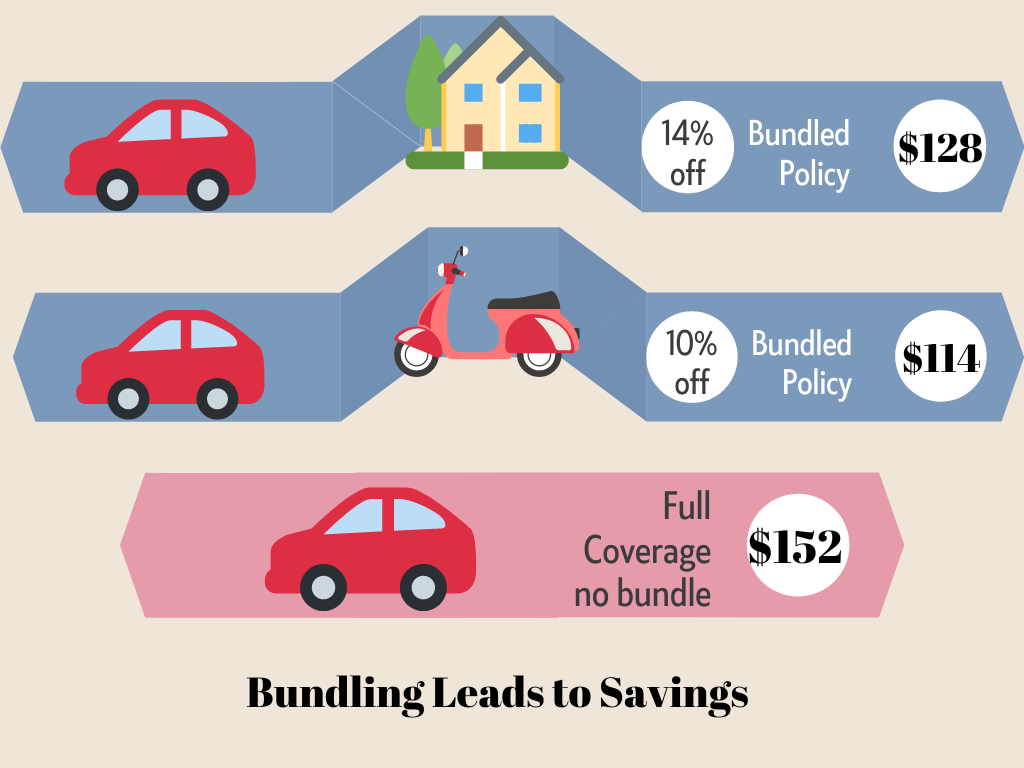

- Consider bundling your home and auto insurance policies for potential discounts.

- Maintain a good credit score to qualify for lower premiums.

By taking these steps, you can secure the coverage you need to protect your home without breaking the bank.

South Carolina Insurance Rates

You may think that rates should be the same across all carriers, but this is rarely the case. Why?

It boils down to Rating Factors.

The Rating Factors they use are statistics and data they calculate to decide your rate. So if you have previous claims on past homeowners policies, then likely you’ll have a higher rate. If your home has designer upgrades, then likely you’ll have a higher rate. But, safety features like Water Leak shutoffs and being in a secured sub-division are rating factors that improve the rate!

| Company | Homeowner’s ($250,000) |

|---|---|

| American International | $1,350 |

| American Family Insurance | $1,357 |

| Auto-Owners Insurance | $1,382 |

| Chubb | $1,481 |

| Progressive | $1,490 |

| Erie Insurance | $1,375 |

| Farmers Insurance Group | $1,529 |

| Allstate | $1,348 |

| USAA | $1,260 |

| Hartford Financial Services | $1,527 |

| State Farm | $1,273 |

| Nationwide Mutual | $1,514 |

| MetLife Inc. | $1,487 |

| Liberty Mutual | $1,399 |

| Travelers Companies Inc. | $1,497 |

Piedmont Insurance Homeowners Coverage Options and Cost!

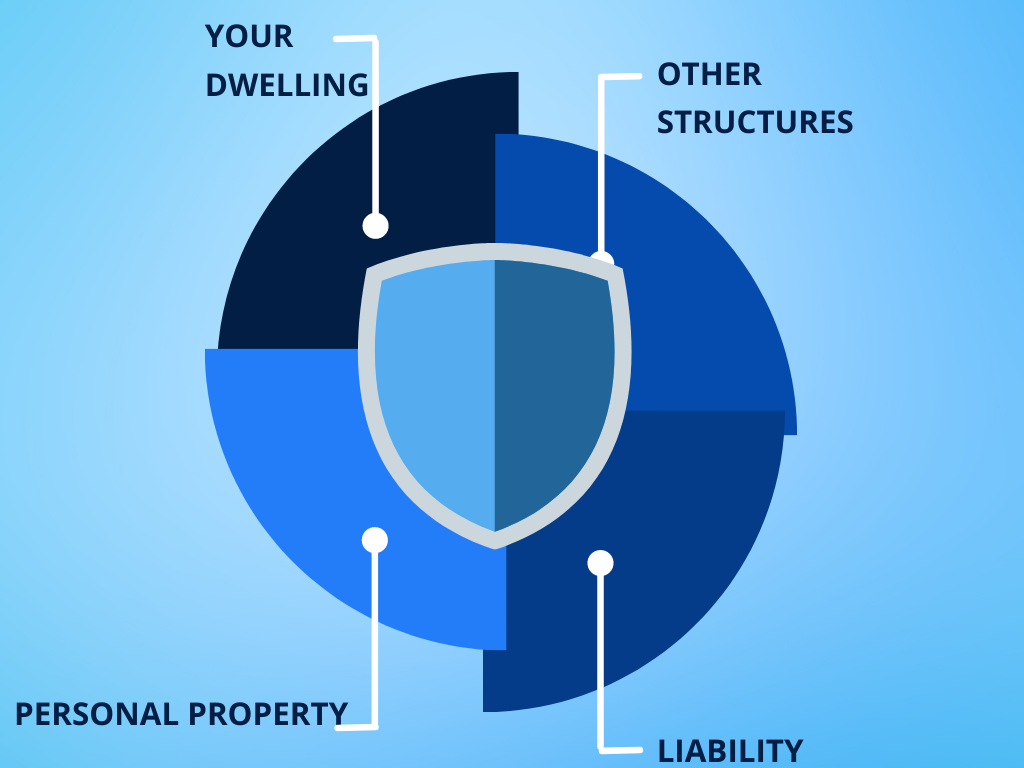

Homeowners insurance can be broken up into four different coverage options making it one of the most comprehensive insurance programs out there. Because it isn’t just property, it is your Home.

Coverage Types

First is DWELLING PROTECTION

This is the SLICED bread! The basic coverage needed. Your home! The roof, the walls, the foundation. This coverage insures that you do not have to bare the burden of a total loss. The Insurance Company will help you shoulder it.

So throw us your worst mother nature! We are covered with Piedmont Insurance!

Please don’t throw anything at us mother-nature, we got carried away..

DWELLING COVERAGE

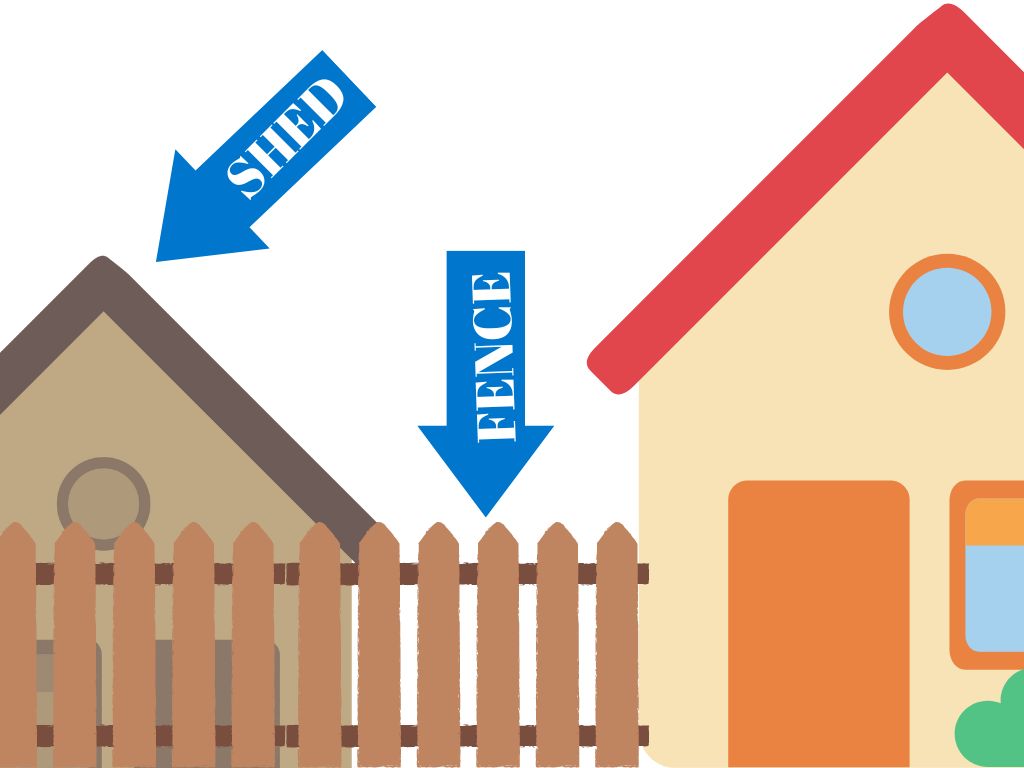

Second is OTHER STRUCTURES PROTECTION

If Dwelling Coverage is the Bread, well OTHER STRUCTURES PROTECTION is the Butter! This is the Fence that keeps Lassie safe, or the shed you hide in because your wife kicked you out of the house again… so you hide in the He-Shed with your pocket wifi and your laptop typing about homeowners insurance… *sigh*

Essentially these are structures on your property but

S-E-P-E-R-A-T-E

from your house.

OTHER STRUCTURES COVERAGE

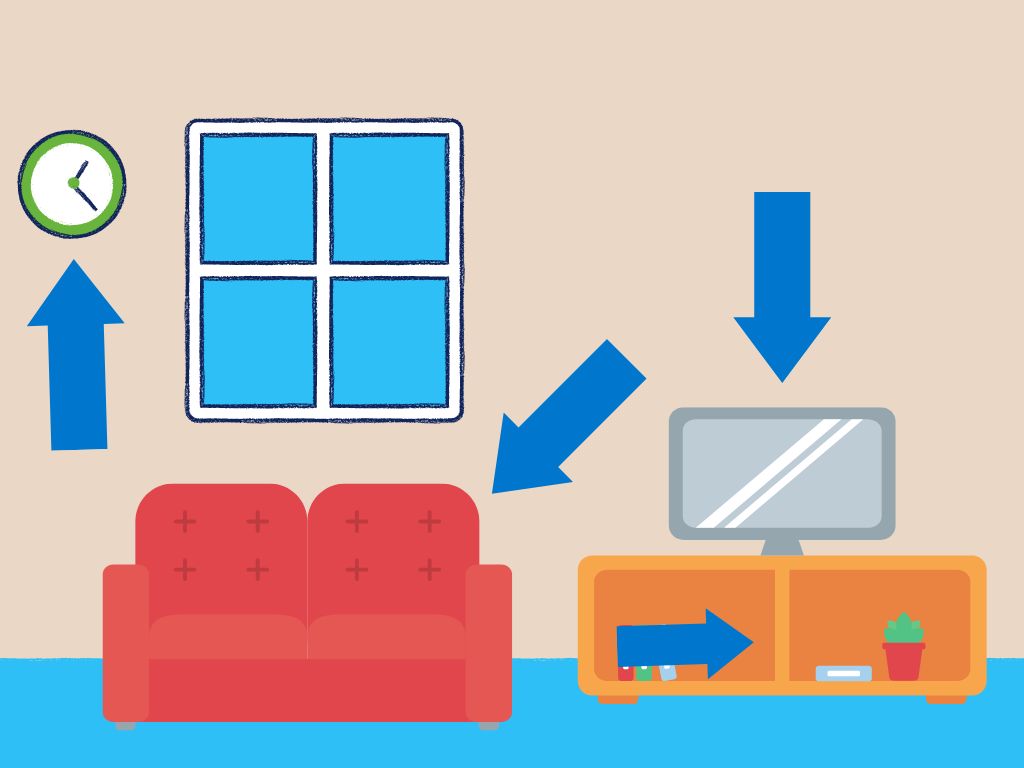

Third is PERSONAL PROPERTY PROTECTION

Your home isn’t just the structure, its also all the items you’ve furnished it with. Your belongings. What you’ve chosen to spend your hard earned cash on and stare at until its eventual trip to the Goodwill. Which there are many in Piedmont South Carolina.

Many…

This is the TV you watch, the couch you’re sitting on while you’re watching it… the rug your feet hug while your sitting on the Ikea couch watching the show on the TV that is all covered under your Homeowners Insurance in Piedmont South Carolina. Now there is an SEO packed paragraph. Love me Google!

PERSONAL PROPERTY PROTECTION

Fourth there is Liability Protection

In the unlikely event of an injury on the part of an individual visiting your property there are coverages to protect you from paying for their medical bills for the next 10 years! Get to work Millennials!

Liability Protection

Piedmont South Carolina Home Insurance

A Companies claims experience can impact how much their rates are in a certain area or their cost of doing business.

That being said the below rankings is based on a few crucial pieces of information that you should weigh when choosing your Homeowners Insurance policy in Piedmont South Carolina.

Financial Stability of the insurance carrier, Affordability of the rates, and Customer Experience.

| Company | Rank |

|---|---|

| Travelers | 1 |

| State Farm | 2 |

| American Family | 3 |

| American International | 4 |

| Chubb | 5 |

| MetLife Inc. | 6 |

| Liberty Mutual | 7 |

| Progressive | 8 |

| Nationwide | 9 |

What Carriers Do We Sell For Piedmont Insurance?

TRAVELERS Insurance is a fantastic Insurance Company, in fact according to Time.com they are the Best for Homeowners Insurance. Why is that?

Well, not only is there financial status stable, which means your claims will be met.. but also their customer service ratings are through the roof. We couldn’t be more thrilled with the way they treat our customers, it truly has been wonderful partnering with Travelers Insurance.

It is important to note that although they are among the best, this doesn’t mean you will be paying a crazy premium. They often are extremely competitive with their rates. We attribute this to the discounts you can stack with Travelers especially the Homeowners Discounts!

Travelers Discounts for South Carolina Home Insurance

- BUNDLING AUTO AND HOME Saves 13% right off the top.

- Homeownership saves an automatic 5% off Auto policies even if you DON’T get your Homeowners Insurance through Travelers.

- If you’ve had continuous insurance with NO GAPS you can save another 15%.

PROGRESSIVE Insurance is the other Homeowners Insurance Carrier that we LOVE! Who doesn’t love Progressive? WalletHub.com does! They gave Progressive a 4.3 out of 5 due to its competitive rates, its HUGE discount list, and Client Satisfaction that consistently out beats others in the space.

In fact, Progressive Homeowners Insurance tends to be 7% cheaper than the National Average!

“WAIT A MINUTE PROGRESSIVE DOESN’T HAVE A HOMEOWNERS BRANCH!“

On April 1, 2015 ASI or AMERICAN STRATEGIC INSURANCE was acquired by The Progressive Corporation by majority. That was no April Fools! ASI is one of the 10 largest homeowners companies in the USA and they are not losing steam!

So when you call us looking for Homeowners Insurance in Piedmont South Carolina you can be confident that your home will be covered by the very best.

Average Cost for South Carolina Piedmont Home Insurance

| City | Price |

|---|---|

| Aiken | $1,276.00 |

| Fort Mill | $1,232.00 |

| Taylors | $1,302.00 |

| Garden City | $1,122.00 |

| Lugoff | $1,229.00 |

| Greenwood | $1,112.00 |

| Red Hill | $1,391.00 |

| Ladson | $1,350.00 |

| Moncks Corner | $1,263.00 |

| Bennettsville | $1,411.00 |

| Powdersville | $1,132.00 |

| Anderson | $1,422.00 |

| Boiling Springs | $1,329.00 |

| Gantt | $1,148.00 |

| Sangaree | $1,233.00 |

| Myrtle Beach | $1,114.00 |

| Florence | $1,199.00 |

| Beaufort | $1,186.00 |

| Seneca | $1,169.00 |

| Cayce | $1,135.00 |

| Clinton | $1,166.00 |

| Hanahan | $1,308.00 |

| Laurens | $1,269.00 |

| Port Royal | $1,114.00 |

| Lake Wylie | $1,172.00 |

| Sans Souci | $1,125.00 |

| Little River | $1,157.00 |

| West Columbia | $1,186.00 |

| Berea | $1,226.00 |

| Hilton Head Island | $1,394.00 |

| Socastee | $1,392.00 |

| Union | $1,372.00 |

| Woodfield | $1,246.00 |

| Summerville | $1,245.00 |

| North Augusta | $1,287.00 |

| Lexington | $1,177.00 |

| Red Bank | $1,304.00 |

| Simpsonville | $1,226.00 |

| Sumter | $1,220.00 |

| Dentsville | $1,249.00 |

| Orangeburg | $1,311.00 |

| Burton | $1,161.00 |

| Lancaster | $1,386.00 |

| James Island | $1,223.00 |

| Greenville | $1,240.00 |

| Welcome | $1,132.00 |

| Easley | $1,211.00 |

| Mauldin | $1,380.00 |

| Fountain Inn | $1,214.00 |

| Columbia | $1,388.00 |

| Five Forks | $1,167.00 |

| Irmo | $1,395.00 |

| North Charleston | $1,324.00 |

| Georgetown | $1,108.00 |

| Hartsville | $1,201.00 |

| Newberry | $1,408.00 |

| Mount Pleasant | $1,313.00 |

| Clemson | $1,182.00 |

| Oak Grove | $1,417.00 |

| North Myrtle Beach | $1,375.00 |

| Spartanburg | $1,422.00 |

| Greer | $1,283.00 |

| Tega Cay and Forest Acres | $1,184.00 |

| Parker | $1,326.00 |

| Charleston | $1,309.00 |

| Seven Oaks | $1,231.00 |

| Conway | $1,280.00 |

| Wade Hampton | $1,262.00 |

Piedmont Insurance

Most Common Causes for Homeowners Loss and Claims

Weather Related

Winds, Hail, Thunder, Wildfire, and other weather related incidents are one of the most common losses leading to claims.

Other Losses

Theft, Power Surge causing loss of use, Water Leak, and Injuries in the home are a close follow up to the reason many claims are filed. That is why it is good to get covered.

Life happens, but they don’t have to leave you to shoulder the full financial burden.

Why Should I go with a Brokerage to purchase my South Carolina Home Insurance?

South Carolina Insurance Rates. What goes into deciding your final rate?

| Homeowners Rating Factors |

|---|

| Location |

| Marital Status |

| Age of Home |

| Credit History |

| Wood-Burning Stoves |

| Roof Condition |

| Claims |

| Value of Home Replacement Cost |

| Protection Class Proximity to Fire Station |

| Deductible |

| Home-Based Business |

Best Homeowners insurance by company in South Carolina

AM BEST rates the credit strength of insurance companies worldwide. So if AM Best gives a company a positive rating for Piedmont Insurance, then you can be sure that they are… the Best.

Below are the top companies in South Carolina that sell insurance in the upstate where Piedmont is tucked. Here at A Plus Insurance we sell both PROGRESSIVE Homeowner Policies and TRAVELERS Homeowner Policies. Not to mention auto policies.

| Company | A.M. Best |

|---|---|

| Nationwide | A |

| Hartford Financial | A+ |

| American Family | A |

| Progressive | A+ |

| Liberty Mutual | A |

| State Farm | A++ |

| Farmers Insurance | A |

| American International | A- |

| Allstate | A+ |

| Auto-Owners Insurance | A |

| Chubb | A |

| USAA | A++ |

| Travelers | A++ |

Bundling Options with Homeowners insurance in South Carolina

Bring all of your belongings under one roof!

Since you are in the market for homeowners insurance in Piedmont South Carolina, likely you own other personal property that requires the financial security that insurance provides.

Think about your vehicle! Migrate your auto insurance into the same carrier. This leads to savings!

Let’s say you have a Single Family Home, you own a 2021 Ford Maverick LX and use it to pull a Travel Trailer. Oh! And on Sundays you ride on your Motorcycle. Bring all four under the same roof. Companies like Progressive reward this with stacked savings.

| Bundling Options |

|---|

| Umbrella |

| Boat |

| RV |

| ATV |

| Health |

| Business |

| Motorcycle |

| Life |

| Auto |

Contact us today for personalized car insurance. Call us at 1.888.445.2793.

Frequently Asked Questions About Piedmont Insurance

Q1: What types of insurance products does Piedmont Insurance offer?

A1: Piedmont Insurance offers a range of insurance products, including home insurance, auto insurance, life insurance, commercial insurance, and more. Our goal is to provide comprehensive coverage to meet our clients’ needs.

Q2: How can I get a quote for insurance from Piedmont Insurance?

A2: Getting a quote from Piedmont Insurance is easy. You can request a quote online through our website or give us a call to speak with one of our experienced agents. We’ll gather the necessary information to provide you with a competitive insurance quote.

Q3: What sets Piedmont Insurance apart from other insurance agencies?

A3: Piedmont Insurance stands out due to our commitment to personalized service, competitive rates, and a wide range of insurance options. Our team of experienced agents is dedicated to finding the right coverage for our clients, whether it’s for their home, business, or personal needs.

Q4: How much is the average home insurance in South Carolina?

A4: The average cost of home insurance in South Carolina can vary depending on several factors, including the location of your home, the value of your property, the level of coverage you choose, and your personal circumstances. To get an accurate quote for home insurance in South Carolina, please contact us at 1.888.445.2793 to speak with one of our agents.

Last Updated on by Camron Moss