We Shop, You Save!

FLORIDA HOMEOWNERS INSURANCE

Sunshine, poolside, and a cool drink to make your brain freeze? Yes Please! Need Insurance to on your new Florida Crib? We’ve got you covered with a free quote, it’ll be a breeze!

- FLORIDA HOMEOWNERS INSURANCE

- Does my Florida homeowners policy cover hurricane damages?

- Florida Homeowners Insurance: Cheapest Companies by City

- Florida Homeowners Insurance Coverage Options

- Discounts Available For Florida Homeowners Insurance

- Best Homeowners Insurance By Company In Florida

- Bundling Options With Homeowners Insurance In Florida

- Laws Pertaining To Homeowners In Florida

- Which Companies Offer Homeowners In Florida?

- Florida Homeowners Insurance: Article Information

- Frequently Asked Questions About Florida Homeowners Insurance

- What does Florida homeowners insurance typically cover?

- What factors affect the cost of homeowners insurance in Florida?

- Do I need additional coverage for hurricanes in Florida?

- What is the average homeowners insurance cost in Florida?

- Additional Helpful Links

Homeowners insurance helps pay to repair or rebuild your home and replace personal property due to a covered loss. A typical policy would include loss from theft and structural damage from fire, leaks, water discharge, fallen trees, or as a result of a storm. Some exclusions to a policy will include manmade or natural disasters like war, earthquake, flood, or nuclear hazard, and building collapse caused by shifting or settling of the soil. Pollution is excluded, along with losses related to a loss of services like electricity to your home. Be sure to check with your Florida homeowners insurance provider to see what exclusions apply.

Florida Homeowners Insurance: Most Common Causes For Homeowners Loss And Claims (nationwide)

You will notice a natural disaster theme in the chart below.

Statistics show that 98.1% of losses and homeowners claims are due to property damage, with wind and hail damage making up a big chunk.

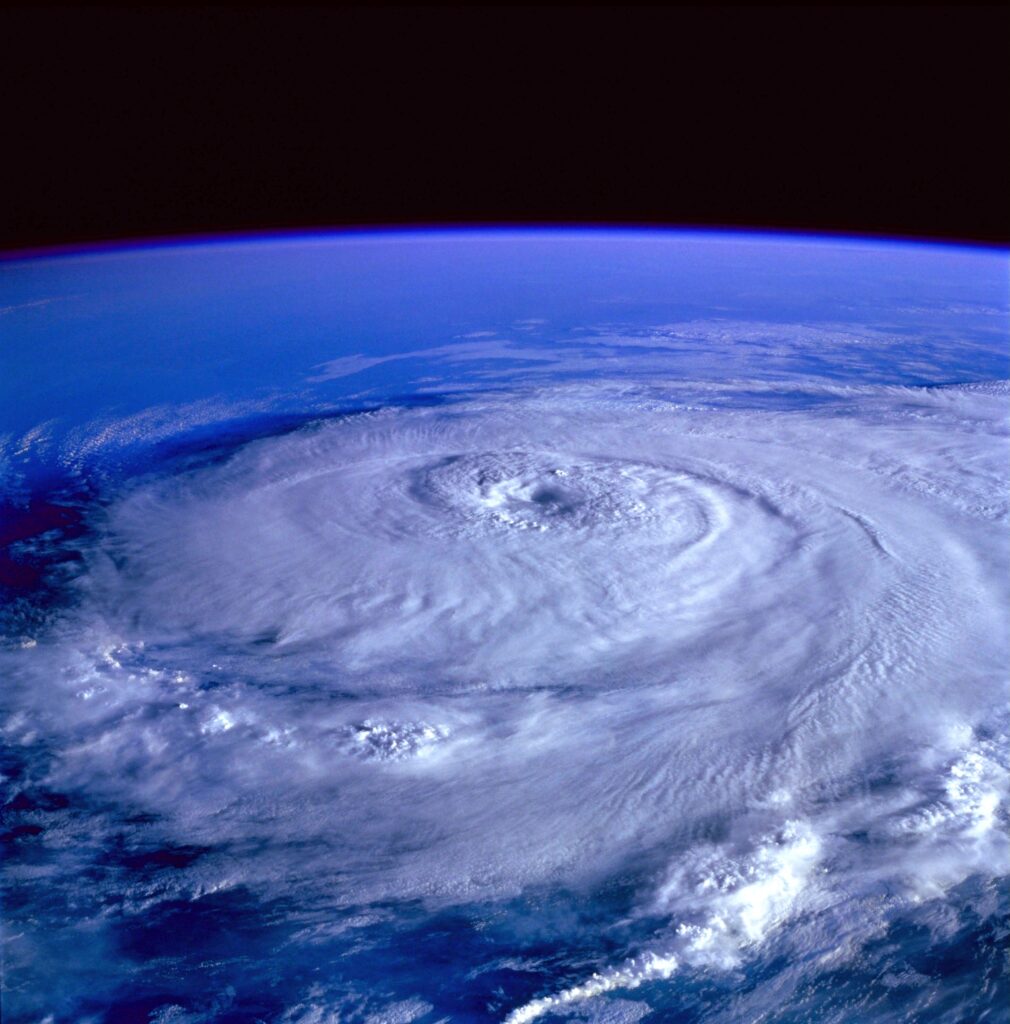

Florida is #1 countrywide for storm surges. Average claims each year are valued at about $11,000. Water damage is the second most common cause in Florida. As you might have guessed, hurricanes, and thunderstorms being so prevalent in this state, means a ton of water. This then leads to a lot of possible damage to homes. One in 50 homeowners insurance claims are due to water damage each year.

Break Ins and theft can happen anywhere honestly, not just Florida. And at times, the missing items are not the only loss. Thieves can also cause some physical damage to your home, while breaking in, and while acquiring stolen goods. But don’t rule out the small percentage of homeowners losses due to theft…it still happens!

Fire and lightning damage, while not occurring the most frequently, are sometimes the most expensive insurance claims!

The Point?

Loses can come in many different ways, the key is to get the right coverage your Florida home.

And with Hurricane season a constant yearly feature it’ll be crucial to get the coverage that won’t leave you stranded or financially upside down.

| Most Common Causes For Homeowners Loss And Claims (Nationwide) |

|---|

| Wind |

| Hail |

| Other Weather related |

| Fire |

| Water Damage |

| Power surge |

| Lightning |

| Injuries |

| Vandalism |

| Loss of Use |

| Theft |

An Attractive Nuisance

Are you a Florida homeowner with a pool?

What is an attractive nuisance? No it’s not a moniker given by your busybody neighbor to your lawn ornaments. Rather, it is an actual insurance term for something on your property that looks fun and appealing to children, but could be hazardous and be potentially harmful. Attractive nuisances are things such as pools and trampolines(forget children, a trampoline is hazardous to anyone like me over 30…just admit you’re old and please don’t try that back flip).

What does this mean for my Florida homeowners insurance policy? Unfortunately there are some homeowners companies like Progressive: ASI that won’t insure you at all if you have a trampoline or a pool that doesn’t meet very specific conditions. If an insurer does choose to cover your property, you will most likely have to pay a much higher liability amount. Don’t try to withhold this information either, because if you have to file a claim one day due to injuries caused by an attractive nuisance, they could cancel your policy and will not cover the claim.

Does my Florida homeowners policy cover hurricane damages?

Yes! The good news is your homeowners policy will cover hurricane damage in Florida. A general homeowners policy will include hurricane damage to your home. Florida law requires insurers to cover wind damage if the National Hurricane Center determines a storm to be a hurricane.

Is Homeowners Required?

The short answer is no. But, without proper coverage especially for those living close to the coastline, you are opening yourself up to paying a lot of damages out of pocket!

Flood Coverage?

Along with hurricanes, or storm surges, comes flash flooding. Even some of the best companies out there will not cover water damage from a flood. Because flooding is not covered, flood insurance is highly recommended! The National Flood Insurance Program (NFIP) can help you acquire a policy to fit your needs!

Vehicle Coverage for Autos on Property?

It is important to note with hurricane insurance, there is no vehicle coverage. You would want to ensure that you have comprehensive coverage on your auto policy to cover any damages to your car in the event of a hurricane. Finally, how much can floridians expect to pay each year for their homeowners insurance? The average Florida policy annually will cost about $1,400. Of course this will range depending on your zip code, cost of home, coverages, and other rating factors.

Florida Homeowners Insurance: Cheapest Companies by City

Insurance companies are not one size fits all.

In fact, a policy written by Progressive might be super affordable in a city like Gainesville, a city where homeowners insurance rates are considerably lower. However the same coverages and same company might have much higher rates in a city like Hialeah.

Therefore it’s crucial to shop around until you find the company that works best for the zip code you live in. You might wonder why insurance companies’ rates differ so vastly. There are several reasons for this! Some insurance companies use your credit as a rating factor, and others do not. As you may have guessed, good credit means a better premium, poor credit can mean a higher premium. Insurance companies offer different discounts as well. One company might offer a discount for good student grades while others will not. Some companies offer a defense course discount, while others do not.

We did the work for you and listed where you can find some of the cheapest homeowners coverage rates by cities in Florida. Even if your city is not listed here, we can still get you affordable rates.

| City in Florida | Cheapest Homeowners Insurance |

|---|---|

| Lehigh Acres | American Family |

| Gainesville | Farmers |

| Hollywood | Travelers |

| Cape Coral | Liberty Mutual |

| Miami Gardens | Progressive (ASI) |

| Pembroke Pines | Allstate |

| Deerfield Beach | USAA |

| Pinellas Park | Travelers |

| Clearwater | Allstate |

| Doral | Progressive (ASI) |

| Deltona | USAA |

| Jacksonville | Progressive |

| Palm Bay | USAA |

| Miramar | Travelers |

| Tamarac | Liberty Mutual |

| St. Cloud | Travelers |

| Wesley Chapel | Allstate |

| The Villages | Progressive (ASI) |

| Alafaya | Farmers |

| Town ‘n’ Country | USAA |

| Brandon | Liberty Mutual |

| Palm Coast | State Farm |

| Jupiter | Farmers |

| Miami | Allstate |

| Kendall | State Farm |

| Plantation | Amica |

| Bradenton | Progressive |

| Weston | Progressive (ASI) |

| St. Petersburg | Travelers |

| Palm Harbor | Travelers |

| Lauderhill | Allstate |

| Orlando | State Farm |

| Coconut Creek | Allstate |

| Tamiami | Travelers |

| Pine Hills | Chub |

| Lakeland | Progressive (ASI) |

| Miami Beach | NationWide |

| Boynton Beach | Allstate |

| Tallahassee | Travelers |

| Pensacola | State Farm |

| Port St. Lucie | USAA |

| West Palm Beach | Progressive |

| Fort Myers | USAA |

| Boca Raton | Progressive |

| Riverview | USAA |

| Pompano Beach | USAA |

| Spring Hill | Allstate |

| North Miami | Travelers |

| Sanford | Chub |

| Poinciana | State Farm |

Florida Homeowners Insurance Coverage Options

Homeowners insurance covers replacing your home and personal items up to certain limits, depending on your policy. While most disasters are covered, earthquakes and flooding is not. Additionally, insurance policies do not cover the normal aging of your house. Along with general wear and tear, mold, rust, rot, bird or rodent damage, and termite and insect damage would not be covered under your policy. Damage from smoke or smog from an industrial or agricultural cause would not be covered as well.

In your policy, there are several coverage types identified:

- Coverage A – Dwelling — Pays for damage or destruction to your house and any unattached structures and buildings. Examples include fences, attached garage, or patio cover.

- Coverage B – Other structures such as a garage, deck or swimming pool

- Coverage C – Personal Property — Covers the contents of your house, including furniture, clothing and appliances, if they are stolen, damaged, or destroyed.

- Coverage D – Loss of Use — Pays for additional living expenses if your home is uninhabitable due to a covered loss. Most standard Florida Homeowners Insurance policies pay 10% to 20% of the amount of your Dwelling coverage

- Coverage E – Liability — Protects you against financial loss if you are sued and found legally responsible for someone else’s injury or property damage

- Coverage F – Medical Payments — Covers medical bills for person(s) injured on your property.

Discounts Available For Florida Homeowners Insurance

If you wonder why your agent is asking you so many odd questions, or why they are asking you about your marital status, it’s simply because they are trying to maximize your discount possibilities.

And for those who are single and loving life and wonder why married people are so special…they are not…but statistically speaking they happen to file claims less.

Insurance companies in Florida are required by the state to provide discounts for efforts made to protect your home hurricane-force winds. By installing certain features you could be eligible to receive a reduced premium, and reduce your overall expenses. However, these discounts would only apply to the windstorm portion of the policy.

Roof Covering – Roof coverings like asphalt/fiberglass shingles, concrete/clay tiles, metal panels, other types of roof covering, that meet the current Florida Code standards or a reinforced concrete roof deck will qualify for this wind discount.

Roof Deck Attachment – Using particular sized nails, with specific spacing between the nails which qualify with the standards of the Florida Code could also qualify for the wind discount.

There are three different roof shapes, gable, hip and a flat roof. A hip roof which is shaped similar to a pyramid is the most wind resistant type of roof, and could qualify for a discount as well.

Here you will find some of the ways you can get discounts with your homeowners insurance. It’s always helpful to have some of these features in your home and it’s also a good way to save money on your policy.

| Florida Homeowners Insurance Available Discounts |

|---|

| Loyalty |

| Smoke Detector (Monitored) |

| Claims Free |

| Upgraded Wiring |

| Married Discount |

| New Home Discount |

| Non-Smoking Discount |

| EFT |

| Hail Resistant Roofing |

| Upgraded Roof |

| Gated Community |

| Bundling Multiple Polices |

| Auto Water Shut Off or Leak Detection |

Best Homeowners Insurance By Company In Florida

You deserve and want the best coverage and company to handle your home. Here you will find a list of the best companies for the best homeowners insurance ratings.

| Company | A.M. Best |

|---|---|

| Chubb | A |

| Allstate | A+ |

| Nationwide | A |

| State Farm | A++ |

| Progressive | A+ |

| Auto-Owners Insurance | A |

| Farmers Insurance | A |

| USAA | A++ |

| Hartford Financial | A+ |

| Liberty Mutual | A |

| American International | A- |

| American Family | A |

| MetLife | A- |

| Travelers | A++ |

Bundling Options With Homeowners Insurance In Florida

Bundling some of your other vehicles and insurances is a great way to save money. Having everything under one roof with one premium is a great way to take care all of your insurance needs.

| Florida Homeowners Insurance Bundling Options |

|---|

| RV |

| Umbrella |

| Health |

| Auto |

| Motorcycle |

| Boat |

| Life |

| Business |

| ATV |

Laws Pertaining To Homeowners In Florida

Here is a great and informative resource for Florida HOA Laws & FL Homeowners Association Resources.

Which Companies Offer Homeowners In Florida?

Having choices when it comes to your homeowners insurance provider is a great thing to have. Below you will find the companies who offer Florida homeowners insurance.

| Company | Homeowners Offered |

|---|---|

| American Family | yes |

| Nationwide | yes |

| State Farm | yes |

| American International | yes |

| Travelers | yes |

| Farmers Insurance | yes |

| Chubb | yes |

| Hartford | yes |

| Progressive | yes |

| USAA | yes |

| Allstate Corp. | yes |

| MetLife Inc. | yes |

| Liberty Mutual | yes |

| Auto-Owners | yes |

Frequently Asked Questions About Florida Homeowners Insurance

What does Florida homeowners insurance typically cover?

Florida homeowners insurance typically covers your dwelling, personal belongings, liability protection, additional living expenses, and other structures on your property. It provides financial protection against perils such as fire, theft, windstorm, and more.

What factors affect the cost of homeowners insurance in Florida?

The cost of homeowners insurance in Florida is influenced by various factors, including the location of your home, its age and construction, coverage limits, deductible, and your claims history. Factors like proximity to the coast, flood zones, and hurricane-prone areas can also impact premiums.

Do I need additional coverage for hurricanes in Florida?

In Florida, homeowners often need additional coverage for hurricanes and windstorm damage. Standard homeowners insurance may have limitations for hurricane-related damage, so it’s advisable to consider a separate windstorm or hurricane insurance policy to ensure comprehensive protection during hurricane season.

What is the average homeowners insurance cost in Florida?

The average cost of homeowners insurance in Florida varies, but reports indicate it is around $2,385 annually, or approximately $199 per month, according to varying sources

Additional Helpful Links

| Additional Florida Insurance Links |

|---|

| Auto Insurance In Florida |

| Motorcycle Insurance Florida |

| Ride Share Insurance in Florida |

| Best Florida Liability Insurance |

| Progressive Insurance in Florida |

Last Updated on by Veronica Moss